A) $3,750

B) $14,650

C) $14,750

D) $18,750

E) None of the above

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jed spends 32 hours a week, 50 weeks a year, operating a bicycle rental store that he owns at a resort community. He also owns a music store in another city that is operated by a full-time employee. He elects not to group them together as a single activity under the "appropriate economic unit" standard. Jed spends 40 hours per year working at the music store.

A) Neither store is a passive activity.

B) Both stores are passive activities.

C) Only the bicycle rental store is a passive activity.

D) Only the music store is a passive activity.

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

James is in the business of debt collection. He purchased a $20,000 account receivable from Green Corporation for $15,000. During the year, James collected $17,000 in final settlement of the account. James can take a $2,000 bad debt deduction in the current year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The amount of loss for partial destruction of business property is the decline in fair market value of the business property.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jim had a car accident in 2016 in which his car was completely destroyed. At the time of the accident, the car had a fair market value of $30,000 and an adjusted basis of $40,000. Jim used the car 100% of the time for business use. Jim received an insurance recovery of 70% of the value of the car at the time of the accident. If Jim's AGI for the year is $60,000, determine his deductible loss on the car.

A) $900

B) $2,900

C) $3,000

D) $9,000

E) None of the above

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mary incurred a $20,000 nonbusiness bad debt last year. She also had an $8,000 long-term capital gain last year. Her taxable income for last year was an NOL of $15,000. During the current year, she unexpectedly collected $12,000 on the debt. How should Mary account for the collection?

A) $0 income

B) $8,000 income

C) $11,000 income

D) $12,000 income

E) None of the above

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A nonbusiness bad debt deduction can be taken any year after the debt becomes totally worthless.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A theft loss is taken in the year of the theft.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 2, 2015, Fred's TV Sales sold Mark a large HD TV, on account, for $12,000. Fred's TV Sales uses the accrual method. In 2016, when the balance on the account was $8,000, Mark filed for bankruptcy. Fred was notified that he could not expect to receive any of the amount owed to him. In 2017, final settlement was made and Fred received $1,000. How much bad debt loss can Fred deduct in 2017?

A) $0

B) $7,000

C) $8,000

D) $12,000

E) None of the above

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maria, who owns a 50% interest in a restaurant, has been a material participant in the restaurant activity for the last 20 years. She retired from the restaurant at the end of last year and will not participate in the restaurant activity in the future. However, she continues to be a material participant in a retail store in which she is a 50% partner. The restaurant operations produce a loss for the current year, and Maria's share of the loss is $80,000. Her share of the income from the retail store is $150,000. She does not own interests in any other activities.

A) Maria cannot deduct the $80,000 loss from the restaurant because she is not a material participant.

B) Maria can offset the $80,000 loss against the $150,000 of income from the retail store.

C) Maria will not be able to deduct any losses from the restaurant until she has been retired for at least three years.

D) Assuming Maria continues to hold the interest in the restaurant, she will always treat the losses as active.

E) None of the above.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Linda owns investments that produce portfolio income and Activity A that produces losses. From a tax perspective, Linda will be better off if Activity A is not passive.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Joyce owns an activity (not real estate) in which she participates for 100 hours a year; her husband participates for 450 hours. Joyce qualifies as a material participant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If an owner participates for more than 500 hours in a bicycle rental activity located at a beach resort, any loss from that activity is treated as an active loss that can offset active income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jed is an electrician. Jed and his wife are accrual basis taxpayers and file a joint return. Jed wired a new house for Alison and billed her $15,000. Alison paid Jed $10,000 and refused to pay the remainder of the bill, claiming the fee to be exorbitant. Jed took Alison to Small Claims Court for the unpaid amount and was awarded a $2,000 judgement. Jed was able to collect the judgement but not the remainder of the bill from Alison. What amount of loss may Jed deduct in the current year?

A) $0

B) $2,000

C) $3,000

D) $5,000

E) None of the above

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Lucy owns and actively participates in the operations of an apartment complex that produces a $50,000 loss during the year. Her modified AGI is $125,000 from an active business. Disregarding any at-risk amount limitation, she may deduct $25,000 of the loss, and the remaining $25,000 is a suspended passive loss.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

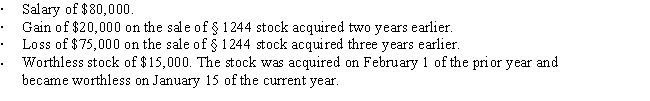

Bruce, who is single, had the following items for the current year:

Determine Bruce's AGI for the current year.

A) $27,000

B) $38,000

C) $42,000

D) $47,000

E) None of the above

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Sherri owns an interest in a business that is not a passive activity and in which she has $20,000 at risk. If the business incurs a loss from operations during the year and her share of the loss is $32,000, this loss will be fully deductible.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Taxpayer's home was destroyed by a storm in the current year and the area was declared a disaster area. If the taxpayer elects to treat the loss as having occurred in the prior year, it will be subject to the 10%-of-AGI reduction based on the AGI of the current year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Josie, an unmarried taxpayer, has $155,000 in salary, $10,000 in income from a limited partnership, and a $26,000 passive loss from a real estate rental activity in which she actively participates. If her modified adjusted gross income is $155,000, how much of the $26,000 loss is deductible?

A) $0

B) $10,000

C) $25,000

D) $26,000

E) None of the above

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Tom participates for 300 hours in Activity A and 250 hours in Activity B, both of which are nonrental businesses. Both activities are active.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 143

Related Exams