A) increases, making the change in aggregate demand larger.

B) increases, making the change in aggregate demand smaller

C) decreases, making the change in aggregate demand larger.

D) decreases, making the change in aggregate demand smaller.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If money demand shifted to the right and the Federal Reserve desired to return the interest rate to its original value, it could

A) buy bonds to increase the money supply.

B) buy bonds to decrease the money supply.

C) sell bonds to increase the money supply.

D) sell bonds to decrease the money supply.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The government increases both its expenditures and taxes by $400 billion. There is no crowding out and no accelerator effect. Aggregate demand shifts by $400 billion. Which of the following is consistent with how far aggregate demand shifts?

A) MPC = 1/2, and the effects of the increase in taxes is 1/2 as strong as the change in government expenditures.

B) MPC = 2/3, and the effects of the increase in taxes is 2/3 as strong as the change in government expenditures

C) MPC = 3/4, and the effects of the increase in taxes is 3/4 as strong as the change in government expenditures

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Congress increases taxes to balance the federal budget, then to prevent unemployment and a recession the Fed will

A) reduce interest rates by increasing the money supply.

B) increase interest rates by decreasing the money supply.

C) increase interest rates by increasing the money supply.

D) reduce interest rates by decreasing the money supply.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Critics of stabilization policy argue that

A) "animal spirits" must be offset by active monetary policy.

B) active monetary policy is necessary for steady economic growth.

C) the lag problem ends up being a cause of economic fluctuations.

D) active fiscal policy is required for steady economic growth.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

To offset increased pessimism by households, the government may _____ government spending and/or _____ taxes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Keynes used the term "animal spirits" to refer to

A) policy makers harming the economy in the pursuit of self interest.

B) arbitrary changes in attitudes of household and firms.

C) mean-spirited economists who believed in the classical dichotomy.

D) firms' relentless efforts to maximize profits.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An decrease in taxes shifts aggregate demand

A) to the right. The larger the multiplier is, the farther it shifts.

B) to the right. The larger the multiplier is, the less it shifts.

C) to the left. The larger the multiplier is, the farther it shifts.

D) to the left. The larger the multiplier is, the less it shifts.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Initially, the economy is in long-run equilibrium. The aggregate demand curve then shifts $50 billion to the left. The government wants to change its spending to offset this decrease in demand. The MPC is 0.80. Suppose the effect on aggregate demand from a change in taxes is 4/5 the size of the change from government expenditures. There is no crowding out and no accelerator effect. What should the government do if it wants to offset the decrease in aggregate demand?

A) Raise both taxes and expenditures by $5.56 billion dollars.

B) Raise taxes by $40 billion dollars and increase expenditures by $50 billion dollars.

C) Reduce taxes by $10 billion dollars and increase expenditures by $10 billion dollars.

D) Reduce taxes by $5.56 billion dollars and increase expenditures by $5.56 billion dollars.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest-rate effect

A) depends on the idea that decreases in interest rates increase the quantity of goods and services demanded.

B) depends on the idea that decreases in interest rates decrease the quantity of goods and services demanded.

C) is responsible for the downward slope of the money-demand curve.

D) is the least important reason, in the case of the United States, for the downward slope of the aggregate- demand curve.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A situation in which the Fed's target interest rate has fallen as far as it can fall is sometimes described as a

A) liquidity preference.

B) liquidity trap.

C) open-market trap.

D) interest-rate contraction.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

During recessions, the government tends to run a budget deficit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

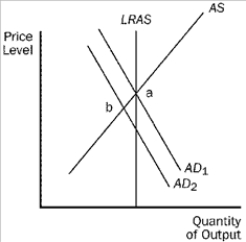

Figure 34-7  -Refer to Figure 34-7. Which of the following is correct?

-Refer to Figure 34-7. Which of the following is correct?

A) A wave of optimism could move the economy from point a to point b.

B) If aggregate demand moves from AD1 to AD2, the economy will stay at point b in both the short run and long run.

C) It is possible that either fiscal or monetary policy might have caused the shift from AD1 to AD2.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The Fed can influence the money supply by changing the interest rate it pays banks on the reserves they are holding.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the multiplier is 5.25, then the MPC is

A) 0.19.

B) 0.68.

C) 0.81.

D) 0.84.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the marginal propensity to consume is 0.75, and there is no investment accelerator or crowding out, a $15 billion increase in government expenditures would shift the aggregate demand curve right by

A) $60 billion, but the effect would be larger if there were an investment accelerator.

B) $60 billion, but the effect would be smaller if there were an investment accelerator.

C) $45 billion, but the effect would be larger if there were an investment accelerator.

D) $45 billion, but the effect would be smaller if there were an investment accelerator.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Federal Reserve decreases the Federal Funds target rate, the lower rate is achieved through

A) sales of government bonds, which reduces interest rates and causes people to hold less money.

B) purchases of government bonds, which reduces interest rates and causes people to hold less money.

C) purchases of government bonds, which reduces interest rates and causes people to hold more money.

D) sales of government bonds, which reduces interest rates and causes people to hold more money.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A 2009 article in The Economist noted that

A) recent research has allowed economists to estimate the values of fiscal multipliers with a great deal of precision.

B) research on multipliers indicates that multipliers for permanent tax cuts tend to be smaller than multipliers for temporary tax cuts.

C) most of the evidence on multipliers for government spending is based on changes in military expenditures.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the money market is initially in equilibrium. If the price level decreases, then according to liquidity preference theory there is an excess

A) supply of money until the interest rate increases.

B) supply of money until the interest rate decreases.

C) demand for money until the interest rate increases.

D) demand for money until the interest rate decreases.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the interest rate is below the Fed's target, the Fed should

A) buy bonds to increase bank reserves.

B) buy bonds to decrease bank reserves.

C) sell bonds to increase bank reserves.

D) sell bonds to decrease bank reserves.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 221 - 240 of 512

Related Exams