A) 3 percent.

B) 4 percent.

C) 5 percent.

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price of a bond is equal to the sum of the present values of its future payments. Suppose a certain bond pays $50 one year from today and $1,050 two years from today. What is the price of the bond if the interest rate is 5 percent?

A) $1,050.00

B) $1,045.35

C) $1,000.00

D) $945.35

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At which interest rate is the present value of $35.00 two years from today equal to about $30.00 today?

A) 5 percent

B) 6 percent

C) 7 percent

D) 8 percent

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Actively managed mutual funds usually fail to outperform index funds, and this fact provides evidence in favor of the efficient markets hypothesis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

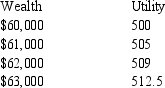

David's Utility Function  If David's current wealth is $61,000, then

If David's current wealth is $61,000, then

A) his gain in utility from gaining $1,000 is less than his loss in utility from losing $1,000. David is risk averse.

B) his gain in utility from gaining $1,000 is less than his loss in utility from losing $1,000. David is not risk averse.

C) his gain in utility from gaining $1,000 is greater than his loss in utility from losing $1,000. David is risk averse.

D) his gain in utility from gaining $1,000 is greater than his loss in utility from losing $1,000. David is not risk averse.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the number of corporations in a portfolio from 110 to 120 reduces

A) market risk by more than an increase from 1 to 10.

B) market risk by less than an increase from 1 to 10.

C) firm-specific risk by more than an increase from 1 to 10.

D) firm-specific risk by less than an increase from 1 to 10.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The You Look Marvelous! cosmetic company is considering building a new shampoo factory. Its accountants and board of directors meet and decide that it is not a good idea to build the factory. If interest rates fall after the meeting

A) the present value of the factory rises. It's more likely the company will build the factory.

B) the present value of the factory rises. It's less likely the company will build the factory.

C) the present value of the factory falls. It's more likely the company will build the factory.

D) the present value of the factory falls. It's less likely the company will build the factory.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two years ago Darryl put $3,000 into an account paying 3 percent interest. How much does he have in the account today?

A) $3,180.00

B) $3,182.70

C) $3,183.62

D) None of the above are correct to the nearest cent.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the efficient markets hypothesis, which of the following would decrease the price of stock in Veblen's Leisure Company?

A) Veblen announces, just as everyone had expected, that it has fired its CEO who has been accused of ethics violations.

B) Veblen announces, as the market had expected, that its profits were low.

C) Fundamental analysis published by KM Financial shows that Veblen's stock is undervalued.

D) A highly anticipated book is published by a Veblen insider which details Veblen's innovative technology in plain English, information that was previously unavailable to the public and which will now be used by Veblen's competitors.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturers of Weightbegone are concerned that genetic advances in weight control might reduce the demand for their diet snacks. This is an example of

A) firmspecific risk, which will likely raise shareholders' demand for higher return.

B) firmspecific risk, which will likely not likely raise shareholders' demand for higher return.

C) market risk, which will likely raise shareholders' demand for higher return.

D) market risk, which will likely not raise shareholders' demand for higher return.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Twenty years ago, Dr. Montgomery borrowed money from her parents to pay her tuition at graduate school. Now she wants to pay them back. She gives them double what they gave her. According to the rule of 70, what interest rate would have given her parents the same amount of money if they had put it in the bank rather than lending it to their daughter?

A) 3.5 percent

B) 4.5 percent

C) 5 percent

D) 7 percent

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Braden says that $400 saved for one year at 4 percent interest has a smaller future value than $400 saved for two years at 2 percent interest. Lefty says that the present value of $400 to be received one year from today if the interest rate is 4 percent exceeds the present value of $400 to be received two years from today if the interest rate is 2 percent.

A) Braden and Lefty are both correct.

B) Braden and Lefty are both incorrect.

C) Only Braden is correct.

D) Only Lefty is correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following has a present value of $100?

A) $109.12 in two years when the interest rate is 4 percent

B) $113.98 in two years when the interest rate is 6 percent

C) $116.64 in two years when the interest rate is 8 percent

D) $123.17 in two years when the interest rate is 10 percent

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If you wish to rely on fundamental analysis to choose a portfolio of stocks, then you have no choice but to do all the necessary research yourself.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you put $350 into a bank account today. Interest is paid annually and the annual interest rate is 6 percent. The future value of the $350 after 4 years is

A) $414.09.

B) $434.00.

C) $441.87.

D) $481.24.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you put $300 into an account paying 2 percent interest, what will be the value of this account in 4 years?

A) $320.69

B) $324.00

C) $324.73

D) $327.81

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are better off choosing $100 today rather than $200 in 9 years if the interest rate is

A) lower than about 8 percent.

B) higher than about 8 percent.

C) lower than about 10 percent.

D) higher than about 10 percent.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) The higher average return on stocks than on bonds comes at the price of higher risk.

B) Risk-averse persons will take the risks involved in holding stocks if the average return is high enough to compensate for the risk.

C) Insurance markets reduce risk, but not by diversification.

D) Risk can be reduced by placing a large number of small bets, rather than a small number of large bets.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A University of Iowa basketball standout is offered a choice of contracts by the New York Liberty. The first one gives her $100,000 one year from today and $100,000 two years from today. The second one gives her $132,000 one year from today and $66,000 two years from today. As her agent, you must compute the present value of each contract. Which of the following interest rates is the lowest one at which the present value of the second contract exceeds that of the first?

A) 7 percent

B) 8 percent

C) 9 percent

D) 10 percent

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Emilio offers you $500 today or $X in 10 years. If the interest rate is 6 percent, then at what value of X would you be indifferent between the two options?

A) X = 809.33

B) X = 855.56

C) X = 895.42

D) X = 916.74

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 513

Related Exams