B) False

Correct Answer

verified

Correct Answer

verified

True/False

A tax on buyers usually causes buyers to pay more for the good and sellers to receive less for the good than they did before the tax was levied.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The minimum wage does not apply to

A) jobs for teenagers.

B) jobs for members of minority groups.

C) unpaid internships.

D) jobs that include on-the-job training.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the equilibrium wage is $4 per hour and the minimum wage is $5.15 per hour, then a shortage of labor will exist.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Lawmakers can decide whether the buyers or the sellers must send a tax to the government, but they cannot legislate the true burden of a tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Opponents of the minimum wage point out that the minimum wage

A) encourages teenagers to drop out of school.

B) prevents some workers from getting needed on-the-job training.

C) contributes to the problem of unemployment.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

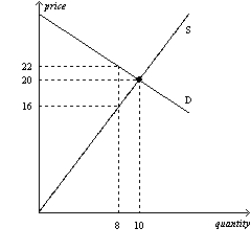

Figure 6-27

This figure shows the market demand and market supply curves for good Z.  -Refer to Figure 6-27. Suppose a tax of $6 per unit is imposed on this market. How much will buyers pay per unit after the tax is imposed?

-Refer to Figure 6-27. Suppose a tax of $6 per unit is imposed on this market. How much will buyers pay per unit after the tax is imposed?

A) $16

B) between $16 and $20

C) between $20 and $22

D) $22

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

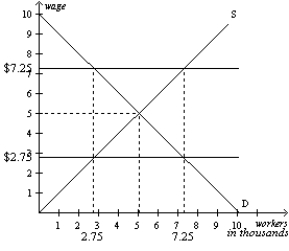

Figure 6-16  -Refer to Figure 6-16. In this market, a minimum wage of $7.25 is

-Refer to Figure 6-16. In this market, a minimum wage of $7.25 is

A) binding and creates a labor shortage.

B) binding and creates unemployment.

C) nonbinding and creates a labor shortage.

D) nonbinding and creates neither a labor shortage nor unemployment.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

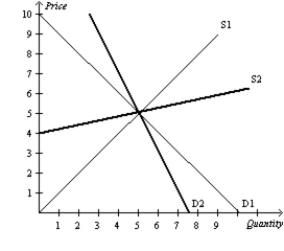

Figure 6-29

Suppose the government imposes a $2 on this market.  -Refer to Figure 6-29. Suppose D1 represents the demand curve for gasoline in both the short run and long run, S1 represents the supply curve for gasoline in the short run, and S2 represents the supply curve for gasoline in the long run. After the imposition of the $2,

-Refer to Figure 6-29. Suppose D1 represents the demand curve for gasoline in both the short run and long run, S1 represents the supply curve for gasoline in the short run, and S2 represents the supply curve for gasoline in the long run. After the imposition of the $2,

A) buyers bear a higher burden of the tax in the short run than in the long run.

B) sellers bear a higher burden of the tax in the short run than in the long run.

C) buyers and sellers bear an equal burden of the tax in both the short run and long run.

D) buyers and sellers bear an equal burden of the tax in the short run, but buyers bear a higher burden of the tax in the long run.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

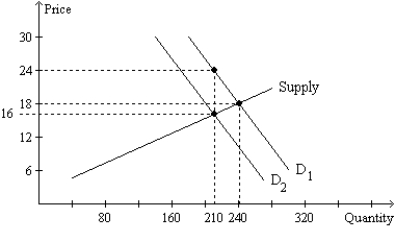

Figure 6-24  -Refer to Figure 6-24. Suppose sellers, rather than buyers, were required to pay this tax in the same amount per unit as shown in the graph) . Relative to the tax on buyers, the tax on sellers would result in

-Refer to Figure 6-24. Suppose sellers, rather than buyers, were required to pay this tax in the same amount per unit as shown in the graph) . Relative to the tax on buyers, the tax on sellers would result in

A) buyers bearing the same share of the tax burden.

B) sellers bearing the same share of the tax burden.

C) the same amount of tax revenue for the government.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Rent subsidies and wage subsidies are better than price controls at helping the poor because they have no costs associated with them.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following observations would be consistent with the imposition of a binding price ceiling on a market? After the price ceiling becomes effective,

A) a smaller quantity of the good is bought and sold.

B) a smaller quantity of the good is demanded.

C) a larger quantity of the good is supplied.

D) the price rises above the previous equilibrium.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sellers of a good bear the larger share of the tax burden when a tax is placed on a product for which the i) supply is more elastic than the demand. Ii) demand in more elastic than the supply. Iii) tax is placed on the sellers of the product. Iv) tax is placed on the buyers of the product.

A) i) only

B) ii) only

C) i) and iv) only

D) ii) and iii) only

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The imposition of a binding price ceiling on a market causes

A) quantity demanded to be greater than quantity supplied.

B) quantity demanded to be less than quantity supplied.

C) quantity demanded to be equal to quantity supplied.

D) the price of the good to be greater than its equilibrium price.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is imposed on the buyers of a good, the demand curve shifts

A) upward by the amount of the tax.

B) downward by the amount of the tax.

C) upward by less than the amount of the tax.

D) downward by less than the amount of the tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

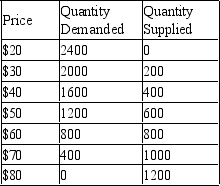

Table 6-1

-Refer to Table 6-1. Suppose the government imposes a price ceiling of $40 on this market. What will be the size of the shortage in this market?

-Refer to Table 6-1. Suppose the government imposes a price ceiling of $40 on this market. What will be the size of the shortage in this market?

A) 0 units

B) 400 units

C) 1200 units

D) 1600 units

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When the government imposes a binding price ceiling on a competitive market, a surplus of the good arises, and sellers must ration the scarce goods among the large number of potential buyers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

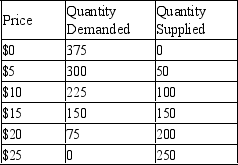

Table 6-2

-Refer to Table 6-2. A price floor set at $20 will

-Refer to Table 6-2. A price floor set at $20 will

A) be binding and will result in a surplus of 75 units.

B) be binding and will result in a surplus of 125 units.

C) be binding and will result in a surplus of 200 units.

D) not be binding.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

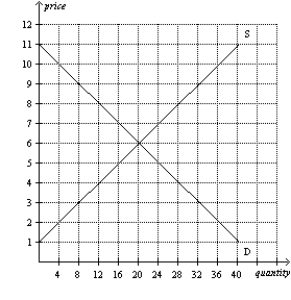

Figure 6-9  -Refer to Figure 6-9. A price ceiling set at

-Refer to Figure 6-9. A price ceiling set at

A) $4 will be binding and will result in a shortage of 8 units.

B) $4 will be binding and will result in a shortage of 16 units.

C) $7 will be binding and will result in a surplus of 4 units.

D) $7 will be binding and will result in a surplus of 8 units.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price received by sellers in a market will decrease if the government

A) increases a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) decreases a tax on the good sold in that market.

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 561 - 580 of 648

Related Exams