B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a Starbucks tall latte cost $4.00 in the United States and 2.50 euros in the Euro area. Also, suppose a McDonald's Big Mac costs $4.50 in the United States and 3.60 euros in the Euro area. If the nominal exchange rate is .80 euros per dollar, which goods have prices that are consistent with purchasing-power parity?

A) both the tall latte and the Big Mac

B) the tall latte but not the Big Mac

C) the Big Mac but not the tall latte

D) neither the Big Mac nor the tall latte

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A Texas ranch sells beef to a U.S. company that sells it to a grocery chain in Japan. These sales

A) decrease U.S. exports but increase U.S. net exports.

B) decrease both U.S. exports and U.S. net exports.

C) increase both U.S. exports and U.S. net exports.

D) increase U.S. exports but decrease U.S. net exports.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From 1970 to 1998 the U.S. dollar

A) gained value compared to the Italian lira because inflation was higher in Italy.

B) gained value compared to the Italian lira because inflation was lower in Italy.

C) lost value compared to the Italian lira because inflation was higher in Italy.

D) lost value compared to the Italian lira because inflation was lower in Italy.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When U.S. national saving rises, domestic investment also necessarily rises.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Other things the same, an increase in the nominal exchange rate raises the real exchange rate.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the U.S. real exchange rate is greater than 1, then there is the possibility of arbitraging by buying foreign goods to sell in the U.S.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that foreign citizens decide to purchase more U.S. pharmaceuticals and U.S. citizens decide to buy more stock in foreign corporations. Other things the same, these actions

A) raise both U.S. net exports and U.S. net capital outflows.

B) raise U.S. net exports and lower U.S. net capital outflows.

C) lower both U.S. net exports and U.S. net capital outflows.

D) lower U.S. net exports and raise U.S. net capital outflows.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If it took as many dollars to buy goods in the United States as it did to buy enough currency to buy the same goods in India, the real exchange rate would be computed as how many Indian goods per U.S. goods?

A) one

B) the number of dollars needed to buy U.S. goods divided by the number of rupees needed to buy Indian goods

C) the number of rupees needed to buy Indian goods divided by the number of dollars needed to buy U.S. goods

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of U.S. foreign direct investment?

A) A Chinese company opens a restaurant in the U.S.

B) An Australian bank buys stocks issued by a U.S. corporation.

C) A U.S. bank buys bonds issued by an Australian corporation.

D) A U.S. company opens an auto parts factory in Canada.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When Jamie, a U.S. citizen, purchases a wool jacket made in Ireland, the purchase is

A) both a U.S. and Irish import.

B) a U.S. import and an Irish export.

C) a U.S. export and an Irish import.

D) neither an export nor an import for either country.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During some year a country had exports of $50 billion, imports of $70 billion, and domestic investment of $100 billion. What was its saving during the year?

A) $80 billion

B) $100 billion

C) $120 billion

D) $150 billion

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A pair of jeans cost $25 in the U.S. and 1600 dinar in Algeria. If the nominal exchange rate is 75 dinar per U.S. dollar, then the real exchange rate is

A) more than one, so a profit could be made by buying jeans in Algeria and selling them in the U.S.

B) more than one, so a profit could be made by buying jeans in the U.S. and selling them in Algeria.

C) less than one, so a profit could be made by buying jeans in Algeria and selling them in the U.S.

D) less than one, so a profit could be made by buying jeans in the U.S. and selling them in Algeria.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Movies are a major export of the U.S.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the real exchange rate is greater than 1, then the

A) nominal exchange rate x U.S. price > foreign price. The dollars required to purchase a good in the U.S. would buy more than enough foreign currency to buy the same good overseas.

B) nominal exchange rate x U.S. price > foreign price. The dollars required to purchase a good in the U.S. would not buy enough foregoing currency to buy the same good overseas.

C) nominal exchange rate x U.S. price < foreign price. The dollars required to purchase a good in the U.S. would buy more than enough foreign currency to buy the same good overseas.

D) nominal exchange rate x U.S. price < foreign price. The dollars required to purchase a good in the U.S. would not buy enough foreign currency to buy the same good overseas.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to purchasing-power parity, if the price of a basket of goods in the U.S. rose from $1,500 to $2,000 and the price of the same basket of goods rose from 600 units of some other country's currency to 1,000 units of that country's currency, then the

A) nominal exchange rate would appreciate.

B) nominal exchange rate would depreciate.

C) real exchange rate would appreciate.

D) real exchange rate would depreciate.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of U.S. foreign direct investment?

A) A Greek company opens a cheese factory in the U.S.

B) A German mutual fund buys stock issued by a U.S. corporation.

C) A U.S. beverage company opens a bottling plant in Russia.

D) A U.S. bank buys bonds issued by an Argentinean company.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the exchange rate rises from .65 British pounds per dollar to .70 pounds per dollar, then compared to British goods, U.S. goods become

A) relatively more expensive for both British and U.S. residents.

B) relatively more expensive for British residents and relatively less expensive for U.S. residents.

C) relatively less expensive for British residents and relatively more expensive for U.S. residents.

D) relatively less expensive for both British and U.S. residents.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same, if a country's domestic investment decreases, then

A) net capital outflow rises, so net exports rise.

B) net capital outflow rises, so net exports fall.

C) net capital outflow falls, so net exports rise.

D) net capital outflow falls, so net exports fall.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

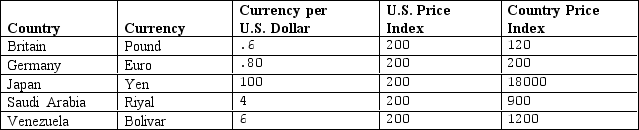

Table 31-2

-Refer to Table 31-2. For which countries in the table does purchasing-power parity with the U.S. hold?

-Refer to Table 31-2. For which countries in the table does purchasing-power parity with the U.S. hold?

A) Germany and Japan

B) Japan and Saudi Arabia

C) Britain and Venezuela

D) Germany

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 361 - 380 of 520

Related Exams