A) money market deposit accounts

B) large time deposit

C) demand deposits

D) money market mutual funds

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the reserve ratio increased from 10 percent to 20 percent, the money multiplier would

A) rise from 10 to 20.

B) rise from 5 to 10.

C) fall from 10 to 5.

D) not change.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

M2 is both larger and less liquid than M1.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When conducting an open-market purchase, the Fed

A) buys government bonds, and in so doing increases the money supply.

B) buys government bonds, and in so doing decreases the money supply.

C) sells government bonds, and in so doing increases the money supply.

D) sells government bonds, and in so doing decreases the money supply.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists equate money with

A) individual wealth.

B) income regularly earned.

C) assets people use regularly to buy goods and services.

D) individual saving.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

M1 includes savings deposits.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As opposed to a payments system based on barter, a payments system based on money

A) requires a double coincidence of wants.

B) leads to less specialization.

C) makes trades less costly.

D) None of the above is correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the reserve ratio is 5 percent, banks do not hold excess reserves, and people do not hold currency, then when the Fed purchases $20 million worth of government bonds, bank reserves

A) increase by $20 million and the money supply eventually increases by $400 million.

B) decrease by $20 million and the money supply eventually decreases by $400 million.

C) increase by $20 million and the money supply eventually increases by $100 million.

D) decrease by $20 million and the money supply eventually decreases by $100 million.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 29-1. The monetary policy of Namdian is determined by the Namdian Central Bank. The local currency is the dia. Namdian banks collectively hold 100 million dias of required reserves, 25 million dias of excess reserves, 250 million dias of Namdian Treasury Bonds, and their customers hold 1,000 million dias of deposits. Namdians prefer to use only demand deposits and so the money supply consists of demand deposits. -Refer to Scenario 29-1 . Suppose the Central Bank of Namdia purchases 25 million dias of Namdian Treasury Bonds from banks. Suppose also that both the reserve requirement and the percentage of deposits held as excess reserves stay the same. By how much would the money supply of Namdia change?

A) 200 million dias

B) 150 million dias

C) 100 million dias

D) None of the above is correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the discount rate is raised then banks borrow

A) more from the Fed so reserves increase.

B) more from the Fed so reserves decrease.

C) less from the Fed so reserves increase.

D) less from the Fed so reserves decrease.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose banks decide to hold more excess reserves relative to deposits. Other things the same, this action will cause the

A) money supply to fall. To reduce the impact of this the Fed could lower the discount rate.

B) money supply to fall. To reduce the impact of this the Fed could raise the discount rate.

C) money supply to rise. To reduce the impact of this the Fed could lower the discount rate.

D) money supply to rise. To reduce the impact of this the Fed could raise the discount rate.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a fractional-reserve banking system, a bank

A) does not make loans.

B) does not accept deposits.

C) keeps only a fraction of its deposits in reserve.

D) None of the above is correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Reserve Board of Governors

A) rotate each four years.

B) are appointed by the President and confirmed by the Senate.

C) are elected by popular vote.

D) hold lifetime appointments.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the reserve ratio is 6 percent, then $9,000 of additional reserves can create up to

A) $159,000 of new money.

B) $54,000 of new money.

C) $150,000 of new money.

D) $141,000 of new money.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

People can write checks against

A) demand deposits and money market mutual funds

B) demand deposits but not money market mutual funds

C) money market mutual funds but not demand deposits

D) neither demand deposits nor money market mutual funds

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

Draw a simple T-account for First National Bank which has $5,000 of deposits, a required reserve ratio of 10 percent, and excess reserves of $300. Make sure your balance sheet balances.

Correct Answer

verified

Correct Answer

verified

True/False

A debit card is more similar to a credit card than to a check.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

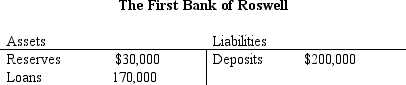

Table 29-5.

-Refer to Table 29-5. If the bank is holding $4,000 in excess reserves, then the reserve requirement with which it must comply is

-Refer to Table 29-5. If the bank is holding $4,000 in excess reserves, then the reserve requirement with which it must comply is

A) 17 percent.

B) 12 percent.

C) 13 percent.

D) 14 percent.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The banking system currently has $200 billion of reserves, none of which are excess. People hold only deposits and no currency, and the reserve requirement is 4 percent. If the Fed raises the reserve requirement to 10 percent and at the same time buys $50 billion worth of bonds, then by how much does the money supply change?

A) It rises by $600 billion.

B) It rises by $125 billion.

C) It falls by $2,500 billion.

D) None of the above is correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed sells government bonds to the public, then reserves

A) increase and the money supply increases.

B) increase and the money supply decreases.

C) decrease and the money supply increases.

D) decrease and the money supply decreases.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 517

Related Exams