A) a junk bond

B) a bond issued by the state of Arizona

C) a bond issued by the federal government

D) a bond issued by General Electric Corporation

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Skyline Chili wants to finance the purchase of new equipment for its restaurants. The firm has limited internal funds, so Skyline likely will

A) demand funds from the financial system by buying bonds.

B) demand funds from the financial system by selling bonds.

C) supply funds to the financial system by buying bonds.

D) supply funds to the financial system by selling bonds.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 8-3. Assume the following information for an imaginary, open economy. Consumption = $1,000; investment = $300; net exports = $100; taxes = $230; private saving = $200; and national saving = $150. -Refer to Scenario 8-3. This economy's government is running a

A) budget deficit of $50.

B) budget deficit of $80.

C) budget surplus of $50.

D) budget surplus of $80.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would a macroeconomist consider as investment?

A) Marisa purchases a bond issued by Proctor and Gamble Corp.

B) Karlee purchases stock issued by Texas Instruments, Inc.

C) Charlie builds a new coffee shop.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there is a shortage of loanable funds, then

A) the quantity demanded is greater than the quantity supplied and the interest rate will rise.

B) the quantity demanded is greater than the quantity supplied and the interest rate will fall.

C) the quantity supplied is greater than the quantity demanded and the interest rate will rise.

D) the quantity supplied is greater than the quantity demanded and the interest rate will fall.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the Congress and president decreased the maximum annual contributions limits to retirement accounts and at the same time reduced the budget deficit. What would happen to the interest rate?

A) It would decrease.

B) It would increase.

C) It would stay the same.

D) It might do any of the above.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A mutual fund

A) is a financial institution that stands between savers and borrowers.

B) is a financial intermediary.

C) allows people with small amounts of money to diversify their holdings.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When a firm wants to borrow directly from the public to finance the purchase of new equipment, it does so by selling shares of stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For an imaginary economy, when the real interest rate is 7 percent, the quantity of loanable funds demanded is $500 and the quantity of loanable funds supplied is $500. Currently, the nominal interest rate is 9 percent and the inflation rate is 4 percent. Currently,

A) the market for loanable funds is in equilibrium.

B) the quantity of loanable funds supplied exceeds the quantity of loanable funds demanded, and as a result the real interest rate will rise.

C) the quantity of loanable funds supplied exceeds the quantity of loanable funds demanded, and as a result the real interest rate will fall.

D) the quantity of loanable funds demanded exceeds the quantity of loanable funds supplied, and as a result the real interest rate will rise.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which case would people desire to borrow the most?

A) the nominal interest rate is 8% and the inflation rate is 7%

B) the nominal interest rate is 7% and the inflation rate is 5%

C) the nominal interest rate is 6% and the inflation rate is 3%

D) the nominal interest rate is 5% and the inflation rate is 1%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The financial system coordinates investment and saving, which are important determinants of long-run real GDP.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

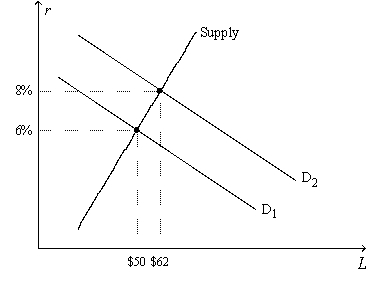

Figure 8-4. On the horizontal axis of the graph, L represents the quantity of loanable funds in billions of dollars.

-Refer to Figure 8-4. If the equilibrium quantity of loanable funds is $56 billion and if the rate of inflation is 4 percent, then the equilibrium real interest rate is

-Refer to Figure 8-4. If the equilibrium quantity of loanable funds is $56 billion and if the rate of inflation is 4 percent, then the equilibrium real interest rate is

A) lower than 6 percent..

B) 6 percent.

C) between 6 percent and 8 percent.

D) higher than 8 percent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a characteristic of a bond?

A) its tax treatment

B) its credit risk

C) its term

D) its dividend yield

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Queen City Sausage stock is selling at $40 per share, it has retained earnings of $2.00 per share and dividends of $.50 per share. What is the price-earnings ratio and what is the dividend yield?

A) 20, 1.25 percent

B) 20, 6.25 percent

C) 16, 1.25 percent

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compared to short-term bonds, other things the same, long-term bonds generally have

A) more risk and so they pay higher interest rates.

B) less risk and so they pay lower interest rates.

C) less risk and so they pay higher interest rates.

D) about the same risk and so they pay about the same interest rate.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The slope of the demand for loanable funds curve represents the

A) positive relation between the real interest rate and investment.

B) negative relation between the real interest rate and investment.

C) positive relation between the real interest rate and saving.

D) negative relation between the real interest rate and saving.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Other things the same, the higher the rate of saving and investment in a country, the higher will be the standard of living in the future.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As an alternative to selling shares of stock as a means of raising funds, a large company could, instead,

A) invest in physical capital.

B) use equity finance.

C) sell bonds.

D) purchase bonds.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

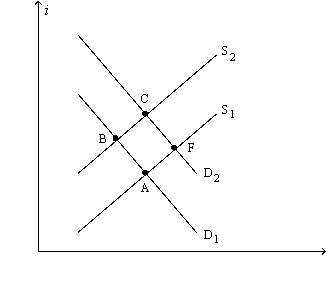

Figure 8-3. The figure shows two demand-for-loanable-funds curves and two supply-of-loanable-funds curves.

-Refer to Figure 8-3. What, specifically, does the label on the vertical axis, i, represent?

-Refer to Figure 8-3. What, specifically, does the label on the vertical axis, i, represent?

A) the nominal interest rate

B) the real interest rate

C) the inflation rate

D) the dividend yield

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a closed economy, public saving is the amount of

A) income that households have left after paying for taxes and consumption.

B) income that businesses have left after paying for the factors of production.

C) tax revenue that the government has left after paying for its spending.

D) spending that the government undertakes in excess of the taxes it collects.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 473

Related Exams