A) provide a higher return than the market average.

B) provide a lower return than the market average.

C) pay higher returns when interest rates rise and lower returns when interest rates fall.

D) pay lower returns when interest rates rise and higher returns when interest rates fall.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

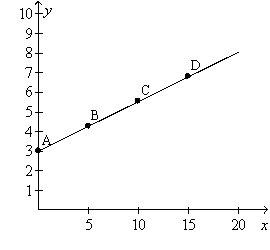

Figure 9-5. On the graph, x represents risk and y represents return.

-Refer to Figure 9-5. Point A represents a situation in which

-Refer to Figure 9-5. Point A represents a situation in which

A) all of a person's savings are allocated to a class of safe assets.

B) the person knows with certainty that his or her return will be 3 percent.

C) the standard deviation of the person's portfolio is zero.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

As the interest rate increases, what happens to the present value of a future payment? Explain why changes in the interest rate will lead to changes in the quantity of loanable funds demanded and investment spending.

Correct Answer

verified

An increase in the interest rate reduces the present value of future payments. Investment spending is the purchasing of capital goods that are expected to raise future revenues. When interest rates rise, the present value of these future revenues decline so that fewer capital expenditures are likely to generate enough revenue to justify their price. Consequently firms will want to buy fewer capital goods and will demand a lower quantity of loanable funds.

Correct Answer

verified

Multiple Choice

Suppose that Thom experiences a greater loss in utility if he loses $50 than he would gain in utility if he wins $50. This implies that Thom's

A) marginal utility diminishes as wealth rises, so he must be risk averse.

B) marginal utility diminishes as wealth rises, but we can't tell from this if he is risk averse.

C) marginal utility increases as wealth rises, so he must be risk averse.

D) marginal utility increases as wealth rises, but we can't tell from this if he is risk averse.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

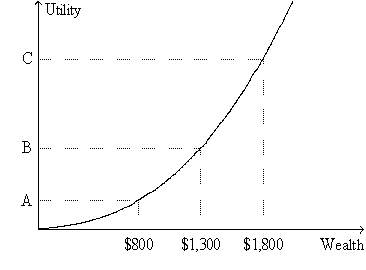

Figure 9-4. The figure shows a utility function for Dexter.

-Refer to Figure 9-4. In what way(s) does the graph differ from the usual case?

-Refer to Figure 9-4. In what way(s) does the graph differ from the usual case?

A) The utility function shown here is upward-sloping, whereas in the usual case the utility function is downward-sloping.

B) The utility function shown here is bowed downward (convex) , whereas in the usual case the utility function is bowed upward (concave) .

C) On the graph shown here, wealth is measured along the horizontal axis, whereas in the usual case saving is measured along the horizontal axis.

D) On the graph shown here, utility is measured along the vertical axis, whereas in the usual case satisfaction is measured along the vertical axis.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Yoyo's Frozen Yogurt, Inc. is thinking of building a new warehouse. They believe that this will give them $50,000 of additional revenue at the end of one year, $60,000 additional revenue at the end of two years, and $70,000 in additional revenue at the end of three years. If the interest rate is 5 percent, Yoyo would be willing to pay

A) $140,000, but not $150,000.

B) $150,000, but not $160,000.

C) $160,000, but not $170,000.

D) $170,000, but not $180,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Four years ago Ollie deposited some money into an account. He earned 5 percent interest on this account and now it has a balance of $303.88. About how much money did Ollie deposit into his account when he opened it?

A) $210

B) $220

C) $240

D) $250

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Diversification

A) increases the likely fluctuation in a portfolio's return. Thus, the likely standard deviation of the portfolio's return is higher.

B) increases the likely fluctuation in a portfolio's return. Thus, the likely standard deviation of the portfolio's return is lower.

C) reduces the likely fluctuation in a portfolio's return. Thus, the likely standard deviation of the portfolio's return is higher.

D) reduces the likely fluctuation in a portfolio's return. Thus, the likely standard deviation of the portfolio's return is lower.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The possibility of speculative bubbles in the stock market arises in part because

A) stock prices may not depend at all on psychological factors.

B) fundamental analysis may be the correct way to evaluate the value of stocks.

C) future streams of dividend payments are very hard to estimate.

D) the value of shares of stock depends not only on the future stream of dividend payments but also on the price at which the stock will be sold.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Managed mutual funds usually outperform mutual funds that are supposed to follow some stock index.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Halvorson Construction has an investment project that would cost $150,000 today and yield a one-time payoff of $167,000 in three years. What is the highest interest rate at which Halvorson would find this project profitable?

A) 7%

B) 6%

C) 5%

D) It is not profitable at any of these interest rates.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At which interest rate is the present value of $95.40 one year from today equal to $90 today?

A) 4 percent

B) 5 percent

C) 6 percent

D) 7 percent

F) A) and B)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

What is the present value of a payment of $100 one year from today if the interest rate is 5 percent?

A) $95.50

B) $95.24

C) $95.00

D) None of the above are correct to the nearest cent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you are convinced that stock prices are impossible to predict from available information, then you probably also believe that

A) the efficient markets hypothesis is not a correct hypothesis.

B) the stock market is informationally efficient.

C) the stock market is informationally inefficient.

D) there is no reason to establish a diversified portfolio of stocks.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk of a portfolio

A) increases as the number of stocks in the portfolio increases.

B) is usually measured using a statistic called the standard diversification.

C) is positively related to the average return of the portfolio.

D) bears no relationship to the average return of the portfolio.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the following interest rates, which is the highest one at which you would prefer to have $170 ten years from today instead of $100 today?

A) 3 percent

B) 5 percent

C) 7 percent

D) 9 percent

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marcia has four savings accounts. Which account has the largest balance?

A) $100 deposited 1 year ago at an 8 percent interest rate

B) $100 deposited 2 years ago at a 4 percent interest rate

C) $100 deposited 4 years ago at a 2 percent interest rate

D) $100 deposited 8 years ago at a 1 percent interest rate

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You could borrow $1,000 today from Bank A and repay the loan, with interest, by paying Bank A $1,060 one year from today. Or, you could borrow $1,500 today from Bank B and repay the loan, with interest, by paying Bank B $1,600 one year from today. Which of the following statements is correct?

A) The interest rate on the loan from Bank A is higher than the interest rate on the loan from Bank B.

B) The interest rate on the loan from Bank A is lower than the interest rate on the loan from Bank B.

C) The interest rates on the two loans are the same.

D) There is not enough information to determine which loan has the higher interest rate.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the efficient markets hypothesis, worse-than-expected news about a corporation will

A) have no effect on its stock price.

B) raise the price of the stock.

C) lower the price of the stock.

D) change the price of the stock in a random direction.

F) B) and D)

Correct Answer

verified

C

Correct Answer

verified

True/False

Increasing the number of corporations whose stocks are in your portfolio reduces market risk.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 419

Related Exams