A) raised both the price level and the value of gold in Cairo.

B) raised the price level, but decreased the value of gold in Cairo.

C) lowered the price level, but increased the value of gold in Cairo.

D) lowered both the price level and the value of gold in Cairo.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In order to maintain stable prices, a central bank must

A) maintain low interest rates.

B) keep unemployment low.

C) tightly control the money supply.

D) sell indexed bonds.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the money market is drawn with the value of money on the vertical axis, an increase in the money supply shifts the money supply curve to the

A) right, lowering the price level.

B) right, raising the price level.

C) left, raising the price level.

D) left, lowering the price level.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about inflation is correct?

A) Evidence from studies indicates that, in U.S. newspapers, inflation is mentioned less frequently than other economic terms, such as unemployment and productivity.

B) People believe the inflation fallacy because they tend to believe too strongly in the principle of monetary neutrality.

C) Nominal incomes are determined by nominal factors; they are not affected by real factors.

D) Inflation does not in itself reduce people's real purchasing power.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marta lends money at a fixed interest rate and then inflation turns out to be higher than she had expected it to be. The real interest rate she earns is

A) higher than she had expected, and the real value of the loan is higher than she had expected.

B) higher than she had expected, and the real value of the loan is lower than she had expected.

C) lower than she had expected, and the real value of the loan is higher than she had expected.

D) lower then she had expected, and the real value of the loan is lower than she had expected.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Menu costs refers to

A) resources used by people to maintain lower money holdings when inflation is high.

B) resources used to price shop during times of high inflation.

C) the distortion in incentives created by inflation when taxes do not adjust for inflation.

D) the cost of more frequent price changes induced by higher inflation.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the money market is drawn with the value of money on the vertical axis, an increase in the money supply creates an excess

A) supply of money, causing people to spend more.

B) supply of money, causing people to spend less.

C) demand for money, causing people to spend more.

D) demand for money, causing people to spend less.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Walter puts money in a savings account at his bank earning 3.5 percent. One year later he takes his money out and notes that while hus money was earning interest, prices rose 1.5 percent. Walter earned a nominal interest rate of

A) 3.5 percent and a real interest rate of 5 percent.

B) 3.5 percent and a real interest rate of 2 percent.

C) 5 percent and a real interest rate of 3.5 percent

D) 5 percent and a real interest rate of 2 percent

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The quantity theory of money can explain hyperinflations but not moderate inflation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The country of Robinya has a tax system identical to that of the United States. Suppose someone in Robinya bought a parcel of land for 10,000 deera (the local currency) in 1970 when the price index equaled 100. In 2010, the person sold the land for 100,000 deera, and the price index equaled 500. The tax rate on nominal capital gains was 20 percent. Compute the taxes the person paid on the nominal gain and the change in the real value of the land in terms of 2010 prices to find the after-tax real rate of capital gain.

A) -20 percent

B) 20 percent

C) 42 percent

D) 64 percent

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The evidence from hyperinflations indicates that money growth and inflation

A) are positively related, which is consistent with the quantity theory of money.

B) are positively related, which is not consistent with the quantity theory of money.

C) are not related in a discernible fashion, which is consistent with the quantity theory of money.

D) are not related in a discernible fashion, which is not consistent with the quantity theory of money.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the nominal interest rate is 8 percent and expected inflation is 3.5 percent, then what is the real interest rate?

A) 11.5 percent

B) 7.5 percent

C) 4.5 percent

D) 2.5 percent

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Between 1880 and 1896 the average level of prices in the U.S. economy

A) fell 23 percent.

B) fell 4 percent.

C) rose 23 percent.

D) rose 50 percent.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that monetary neutrality and the Fisher effect both hold. An increase in the money supply growth rate increases

A) the inflation rate and the nominal interest rate by the same number of percentage points.

B) nominal interest rates but by less than the percentage point increase in the inflation rate.

C) the inflation rate but not the nominal interest.

D) neither the inflation rate nor the nominal interest rate.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

There is evidence that the rate at which money changed hands rose during the German hyperinflation. This means that

A) velocity rose. If monetary neutrality holds the rise in velocity increased the ratio M/P.

B) velocity rose. If monetary neutrality holds the rise in velocity decreased the ratio M/P.

C) velocity fell. If monetary neutrality holds the fall in velocity increased the ratio M/P.

D) velocity fell. If monetary neutrality holds the fall in velocity decreased the ratio M/P.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most economists believe that monetary neutrality provides

A) a good description of both the long run and the short run.

B) a good description of neither the long run nor the short run.

C) a good description of the short run, but not the long run.

D) a good description of the long run, but not the short run.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the real interest rate is 6 percent and the price level is falling at a rate of 2 percent, what is the nominal interest rate?

A) 4 percent

B) 6 percent

C) 8 percent

D) 10 percent

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The price level is determined by the supply of, and demand for, money.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

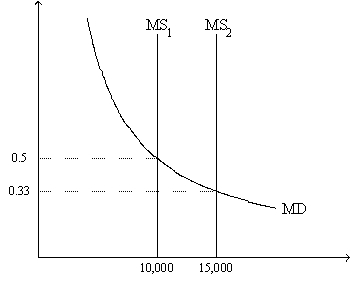

Figure 12-3. On the graph, MS represents the money supply and MD represents money demand. The usual quantities are measured along the axes.

-Refer to Figure 12-3. If the relevant money-supply curve is the one labeled MS2, then

-Refer to Figure 12-3. If the relevant money-supply curve is the one labeled MS2, then

A) when the money market is in equilibrium, one dollar purchases about one-third of a basket of goods and services.

B) when the money market is in equilibrium, one unit of goods and services sells for 33 cents.

C) there is an excess demand for money if the value of money in terms of goods and services is 0.5.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If inflation is higher than expected, then borrowers make nominal interest payments that are less than they expected.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 201 - 220 of 384

Related Exams