A) discourages both U.S.and foreign residents from buying U.S.assets.

B) encourages both U.S.and foreign residents to buy U.S.assets.

C) encourages U.S.residents to buy U.S.assets,but discourages foreign residents from buying U.S.assets.

D) encourages foreign residents to buy U.S.assets,but discourages U.S.residents from buying U.S.assets.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

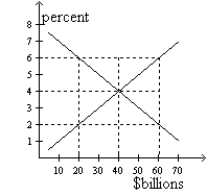

Figure 32-1  -Refer to Figure 32-1.If the real interest rate is 6 percent,there will be pressure for

-Refer to Figure 32-1.If the real interest rate is 6 percent,there will be pressure for

A) the real interest rate to fall.

B) the demand for loanable funds curve to shift left.

C) the supply for loanable funds curve to shift right.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would make the equilibrium real interest rate increase and the equilibrium quantity of funds decrease?

A) The demand for loanable funds shifts right.

B) The demand for loanable funds shifts left.

C) The supply of loanable funds shifts right.

D) The supply of loanable funds shifts left.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the real exchange rate for the dollar depreciates,U.S.goods become

A) less expensive relative to foreign goods,which makes exports rise and imports fall.

B) less expensive relative to foreign goods,which makes exports fall and imports rise.

C) more expensive relative to foreign goods,which makes exports rise and imports fall.

D) more expensive relative to foreign goods,which makes exports fall and imports rise.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the equilibrium real interest rate in the open-economy macroeconomic model,the equilibrium quantity of loanable funds equals

A) net capital outflow.

B) domestic investment.

C) foreign currency supplied.

D) national saving.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the real exchange rate for the dollar is below the equilibrium level,the quantity of dollars supplied in the market for foreign-currency exchange is

A) less than the quantity demanded and the dollar will appreciate.

B) less than the quantity demanded and the dollar will depreciate.

C) greater than the quantity demanded and the dollar will appreciate.

D) greater than the quantity demanded and the dollar will depreciate.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 32-2  -Refer to Figure 32-2.What are the equilibrium values of the real exchange rate and net exports?

-Refer to Figure 32-2.What are the equilibrium values of the real exchange rate and net exports?

A) 1,300

B) 8,400

C) 6,500

D) None of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the open-economy macroeconomic model,the supply of loanable funds equals

A) national saving.The demand for loanable funds comes from domestic investment + net capital outflow.

B) national saving.The demand for loanable funds comes only from domestic investment.

C) private saving.The demand for loanable funds comes from domestic investment + net capital outflow.

D) private saving.The demand for loanable funds comes only from domestic investment.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In an open economy,national saving equals

A) domestic investment plus net capital outflow.

B) domestic investment minus net capital outflow.

C) domestic investment.

D) net capital outflow.

F) None of the above

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

The slope of the supply of loanable funds is based on an increase in

A) only national saving when the interest rate rises.

B) both national saving and net capital outflow when the interest rate rises.

C) only national saving when the interest rate falls.

D) both national saving and net capital outflow when the interest rate falls.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the supply of loanable funds shifts right,then the equilibrium

A) interest rate falls,so domestic residents will want to purchase more foreign assets.

B) interest rate falls,so domestic residents will want to purchase fewer foreign assets.

C) interest rate rises,so domestic residents will want to purchase more foreign assets.

D) interest rate rises,so domestic residents will want to purchase fewer foreign assets.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A country has I = $200 billion,S = $400 billion,and purchased $600 billion of foreign assets,how many of its assets did foreigners purchase?

A) $0

B) $200 billion

C) $400 billion

D) $800 billion

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same,a higher real interest rate raises the quantity of

A) domestic investment.

B) net capital outflow.

C) loanable funds demanded.

D) loanable funds supplied.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A country has private saving of $100 billion,public saving of -$30 billion,domestic investment of $50 billion,and net capital outflow of $20 billion.What is its supply of loanable funds?

A) $50 billion

B) $70 billion

C) $90 billion

D) $120 billion

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would make both the equilibrium real interest rate and the equilibrium quantity of loanable funds decrease?

A) The demand for loanable funds shifts right.

B) The demand for loanable funds shifts left.

C) The supply of loanable funds shifts right.

D) The supply of loanable funds shifts left.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A country has output of $600 billion,consumption of $350 billion,government expenditures of $90 billion and investment of $60 billion.What is its supply of loanable funds?

A) $160 billion

B) $150 billion

C) $60 billion

D) $30 billion

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the open-economy macroeconomic model,if for some reason foreign citizens want to purchase more U.S.goods and services at each exchange rate,then

A) the demand for dollars in the market for foreign-currency exchange shifts right.

B) the demand for dollars in the market for foreign-currency exchange shifts left.

C) the supply of dollars in the market for foreign-currency exchange shifts right.

D) the supply of dollars in the market for foreign-currency exchange shifts left.

F) B) and C)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Other things the same,an increase in the U.S.real interest rate induces

A) Americans to buy more foreign assets,which increases U.S.net capital outflow.

B) Americans to buy more foreign assets,which reduces U.S.net capital outflow.

C) foreigners to buy more U.S.assets,which reduces U.S.net capital outflow.

D) foreigners to buy more U.S.assets,which increases U.S.net capital outflow.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A U.S.grocery chain borrows money to buy a warehouse in Ohio and another in Italy.Borrowing for which warehouse(s) is included in the demand for loanable funds in the U.S.?

A) both the one in Ohio and the one in Italy

B) only the one in Ohio

C) only the one in Italy

D) neither the one in Ohio nor the one in Italy

F) B) and D)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

If there is a surplus of loanable funds,the quantity demanded is

A) greater than the quantity supplied and the interest rate will rise.

B) greater than the quantity supplied and the interest rate will fall.

C) less than the quantity supplied and the interest rate will rise.

D) less than the quantity supplied and the interest rate will fall.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 141

Related Exams