B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A U.S.corporation may be able to alleviate the problem of excess foreign taxes by:

A) Repatriating more foreign income to the United States in the year there is an excess limitation.

B) Generating "same basket" foreign-source income that is subject to a tax rate lower than the U.S.tax rate.

C) Deducting the excess foreign taxes.

D) a. ,b. ,and c.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The transfer of the assets of a foreign branch (of a U.S.corporation)to a newly formed foreign corporation is always tax deferred under § 351.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

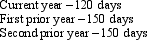

Madison is a citizen of Italy and does not have permanent resident status in the United States.During the last three years she has spent a number of days in the United States.

Is Madison treated as a U.S.resident for the current year?

Is Madison treated as a U.S.resident for the current year?

A) Yes,because Madison was present in the United States at least 31 days during the current year and 195 days during the current and prior two years (using the appropriate fractions for the prior years) .

B) No,because although Madison was present in the United States at least 31 days during the current year,she was not present at least 183 days in a single year during the current or prior two years.

C) No,because Madison is a citizen of Italy.

D) No,because Madison was not present at least 183 days during the current year.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the sourcing of dividend income is true?

A) Dividends from foreign corporations are always foreign source.

B) Dividends are sourced based on the residence of the recipient.

C) Dividends from foreign corporations are foreign-source only to the extent that 80% or more of the foreign corporation's gross income for the 3 years preceding the year of the dividend payment was effectively connected with the conduct of a foreign trade or business.

D) A percentage of dividends from foreign corporations are U.S.source to the extent that 25% or more of the foreign corporation's gross income for the 3 years preceding the year of the dividend payment was effectively connected with the conduct of a U.S.trade or business.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The IRS can use § 482 reallocations to assure that transactions between related parties are properly reflected in a tax return.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

USCo,a domestic corporation,receives $100,000 of foreign-source income in the general limitation income category and $40,000 of foreign-source income in the passive income category.Worldwide taxable income is $1,200,000 and the U.S.tax liability before FTC is $420,000.Foreign taxes attributable to the general limitation income are $60,000 and to the passive income are $4,000.What is USCo's foreign tax credit for the tax year?

A) $39,000.

B) $64,000.

C) $60,000.

D) $4,000.

E) Some other amount.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The purpose of the transfer pricing rules is to ensure that taxpayers have ultimate flexibility in shifting profits between related entities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning the sourcing of income from inventory produced by the taxpayer in the United States and sold outside the United States is true?

A) If title passes on the inventory outside the United States,all of the inventory income is foreign source.

B) Because the inventory is manufactured in the United States,all of the inventory income is U.S.source.

C) The taxpayer may use the 50-50 method to source one-half the income based on title passage and one-half the income based on location of production assets.

D) The taxpayer may use the 50-50 method to source one-half the income based on title passage and one-half the income based on where the sale negotiation takes place.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Disposition of stock of a domestic corporation that is a real property holding corporation is subject to tax under FIRPTA.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Yosef Barbutz,an NRA,is employed by Fisher,Inc. ,a foreign corporation.In November,Yosef spends 12 days in the United States performing consulting services for Fisher's U.S.branch.He earns $5,000 per month.A month includes 28 workdays.

A) Yosef has no U.S.-source income under the commercial traveler exception.

B) Yosef has $2,143 U.S.-source income since his foreign employer has a U.S.branch.

C) Yosef has $2,143 U.S.-source income which is exempt from U.S.taxation since he is in the U.S.for 90 days or less.

D) Yosef has $60,000 U.S.-source income which is exempt from U.S.taxation since he is working for a foreign employer.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Income tax treaties may provide for higher withholding tax rates on interest income than the rate provided under U.S.statutory law.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following situations requires the filing of an information return with the U.S.government?

A) A domestic corporation that is 25% or more foreign owned.

B) A foreign corporation carrying on a trade or business in the United States.

C) U.S.persons who acquire or dispose of an interest in a foreign partnership.

D) All of the above.

E) None of the above.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

WorldCo,a foreign corporation not engaged in a U.S.trade or business,receives $50,000 in interest income from deposits with the foreign branch of a U.S.bank.The U.S.bank earns 78% of its income from foreign sources.How much of WorldCo's interest income is U.S.source?

A) $0.

B) $11,000.

C) $39,000.

D) $50,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Peanut,Inc. ,a domestic corporation,receives $500,000 of foreign-source interest income on which foreign taxes of $5,000 are withheld.Its worldwide taxable income is $900,000,and U.S.tax liability before FTC is $315,000.What is Peanut's foreign tax credit?

A) $500,000.

B) $315,000.

C) $175,000.

D) $5,000.

E) Some other amount.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Old,Inc. ,a U.S.corporation,earns foreign-source income classified in two different limitation baskets in the current year.It earns $20,000 in passive foreign-source income and suffers a net loss of $35,000 in the general limitation basket.What is the numerator of the FTC limitation formula for the passive basket in the current year?

A) $0.

B) ($5,000) .

C) $20,000.

D) $55,000.

E) Some other amount.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Dividends received from Shamrock,Ltd. ,an Irish corporation that earns 40% of its income from U.S.business activities,are foreign-source income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

ForCo,a foreign corporation not engaged in a U.S.trade or business,recognizes a $3 million gain from the sale of land located in the United States.The amount realized on the sale was $50 million.Absent any exceptions,what is the required withholding amount on the part of the purchaser of this land?

A) $0.

B) $300,000.

C) $3 million.

D) $5 million.

E) $50 million.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

GlobalCo,a foreign corporation not engaged in a U.S.trade or business,receives $80,000 in interest income from deposits with the foreign branch of a U.S.bank.The U.S.bank earns 24% of its income from foreign sources.How much of GlobalCo's interest income is U.S.source?

A) $0.

B) $19,200.

C) $60,800.

D) $80,000.

F) B) and D)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Mark,Inc. ,a U.S.corporation,operates an unincorporated branch manufacturing operation in Germany.Mark,Inc. ,reports $100,000 of taxable income from the German branch on its U.S.tax return along with $400,000 of taxable income from its U.S.operations.Mark paid $40,000 in German income taxes related to the $100,000 in branch income.Assuming a U.S.tax rate of 35%,what is Mark's U.S.tax liability after any allowable foreign tax credits?

A) $0.

B) $175,000.

C) $135,000.

D) $140,000.

E) Some other amount.

G) None of the above

Correct Answer

verified

D

Correct Answer

verified

Showing 1 - 20 of 153

Related Exams