Filters

Question type

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 62

True/False

Shirley pays FICA (employer's share) on the wages she pays her housekeeper to clean and maintain Shirley's personal residence.The FICA payment is not deductible as an itemized deduction.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 63

True/False

Judy paid $40 for Girl Scout cookies and $40 for Boy Scout popcorn.Judy may claim an $80 charitable contribution deduction.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 64

True/False

Maria made significant charitable contributions of capital gain property in the current year.In fact,the amount of the contributions exceeds 30% of her AGI.The excess charitable contribution that is not deductible this year can be carried over for five years.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 65

Multiple Choice

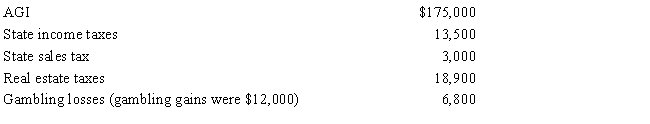

Paul,a calendar year married taxpayer,files a joint return for 2017.Information for 2017 includes the following:

Paul's allowable itemized deductions for 2017 are:

A) $13,500.

B) $32,400.

C) $39,200.

D) $42,200.

E) None of the above.

F) D) and E)

G) B) and E)

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 105 of 105

Related Exams