B) False

Correct Answer

verified

Correct Answer

verified

Essay

When forming a corporation,a transferor-shareholder may choose to receive some corporate debt along with stock.Identify some of the issues the transferor must consider when deciding whether debt should be a part of the transaction. Significant tax differences exist between debt and equity in the capital structure.

Correct Answer

verified

Correct Answer

verified

True/False

In determining whether § 357(c)applies,assess whether the liabilities involved exceed the bases of all assets a shareholder transfers to the corporation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In a § 351 transaction,if a transferor receives consideration other than stock,the transaction can be taxable.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The transfer of an installment obligation in a transaction qualifying under § 351 is a disposition of the obligation that causes gain to be recognized by the transferor.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Three individuals form Skylark Corporation with the following contributions: Cliff,cash of $50,000 for 50 shares; Brad,land (fair market value of $20,000)for 20 shares; and Ron,cattle (fair market value of $9,000)for 9 shares and services (fair market value of $21,000)for 21 shares.Section 351 will not apply in this situation because the control requirement has not been satisfied.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In order to encourage the development of an industrial park,a county donates land to Ecru Corporation.The donation does not result in gross income to Ecru.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Similar to like-kind exchanges,the receipt of "boot" under § 351 can cause loss to be recognized.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Eve transfers property (basis of $120,000 and fair market value of $400,000) to Green Corporation for 80% of its stock (worth $350,000) and a long-term note (worth $50,000) ,executed by Green Corporation and made payable to Eve.As a result of the transfer:

A) Eve recognizes no gain.

B) Eve recognizes a gain of $230,000.

C) Eve recognizes a gain of $280,000.

D) Eve recognizes a gain of $50,000.

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

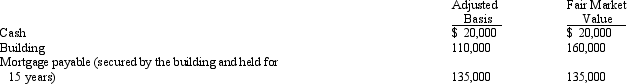

Tim,a cash basis taxpayer,incorporates his sole proprietorship.He transfers the following items to newly created Wren Corporation.  With respect to this transaction:

With respect to this transaction:

A) Wren Corporation's basis in the building is $110,000.

B) Tim has no recognized gain.

C) Tim has a recognized gain of $25,000.

D) Tim has a recognized gain of $5,000.

E) None of the above.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

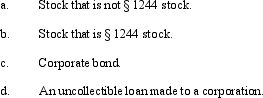

What are the tax consequences if an individual investor incurs a loss on the following:

Correct Answer

verified

11ea87e8_aaec_327c_b008_bb50d357c8f4_TB4126_00

Correct Answer

verified

Multiple Choice

Kevin and Nicole form Indigo Corporation with the following transfers: inventory from Kevin (basis of $360,000 and fair market value of $400,000) and improved real estate from Nicole (basis of $320,000 and fair market value of $375,000) .Nicole,an accountant,agrees to contribute her services (worth $25,000) in organizing Indigo.The corporation's stock is distributed equally to Kevin and Nicole.As a result of these transfers:

A) Indigo can deduct $25,000 as a business expense.

B) Nicole has a recognized gain of $55,000 on the transfer of the real estate.

C) Indigo has a basis of $360,000 in the inventory.

D) Indigo has a basis of $375,000 in the real estate.

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Erica transfers land worth $500,000,basis of $100,000,to a newly formed corporation,Robin Corporation,for all of Robin's stock,worth $300,000,and a 10-year note.The note was executed by Robin and made payable to Erica in the amount of $200,000.As a result of the transfer:

A) Erica does not recognize gain.

B) Erica recognizes gain of $400,000.

C) Robin Corporation has a basis of $100,000 in the land.

D) Robin Corporation has a basis of $300,000 in the land.

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pat,Maria,and Lynn are equal shareholders in Lime Corporation.Lime has assets with a basis of $150,000 and a fair market value of $1,200,000.In the current year,Pat lends Lime Corporation $200,000 and Maria lends it $150,000.Both notes bear interest at the rate of 8% per annum.Lime Corporation has no other debt outstanding.Lynn leases machinery to Lime Corporation for an annual rental of $16,000.

A) The IRS will be successful in reclassifying both loans as equity.

B) The IRS will be successful in reclassifying the $200,000 loan as equity.

C) Lime Corporation cannot support its debt-equity ratio.

D) Because the loans are not pro rata and Lime Corporation can support its debt-equity ratio, the loans should not be reclassified as equity.

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A shareholder lends money to his corporation in his capacity as an investor.If the loans become worthless,a business bad debt results.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sarah and Emily form Red Corporation with the following investments: Sarah transfers computers worth $200,000 (basis of $80,000) ,while Emily transfers real estate worth $180,000 (basis of $40,000) and services (worth $20,000) rendered in organizing the corporation.Each is issued 600 shares in Red Corporation.With respect to the transfers:

A) Sarah has no recognized gain; Emily recognizes income/gain of $160,000.

B) Neither Sarah nor Emily recognizes gain or income.

C) Red Corporation has a basis of $60,000 in the real estate.

D) Emily has a basis of $60,000 in the shares of Red Corporation.

E) None of the above.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Amy owns 20% of the stock of Wren Corporation,which she acquired several years ago at a cost of $10,000.Amy is Vice-President of Wren and earns a salary of $80,000 annually.Last year,Wren Corporation was experiencing financial problems,and Amy loaned the corporation $25,000.In the current year,Wren becomes bankrupt,and both her stock investment and the loan become worthless.Amy has a nonbusiness bad debt deduction this year of $25,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A shareholder's holding period for stock received under § 351 includes the holding period of the property transferred to the corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Ashley,a 70% shareholder of Wren Corporation,transfers property with a basis of $250,000 and a fair market value of $900,000 to Wren Corporation for additional stock.Ashley owns 78% of Wren after the transfer.Two other shareholders in Wren transfer a nominal amount of property to Wren along with Ashley's transfer so that Ashley and the two shareholders own 90% of the Wren stock after the transfer.Does Ashley have taxable gain on the transfer?

Correct Answer

verified

Ashley would have a taxable gain of $650,000 on the transfer.She does not have the requisite 80% control.The transfer by the two shareholders will not qualify the transfer for § 351 treatment because the primary purpose of the transfer was to qualify under this section.Should the transfer of property by the two shareholders have a value equal to or in excess of 10% of the fair market value of the stock owned by them after the transfer,the transfer would qualify.

Correct Answer

verified

Essay

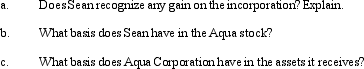

Sean,a sole proprietor,is engaged in a service business and uses the cash basis of accounting.In the current year,Sean incorporates his business by forming Aqua Corporation.In exchange for all of its stock,Aqua receives: assets (basis of $400,000 and fair market value of $2 million),trade accounts payable of $110,000,and loan due to a bank of $390,000.The proceeds from the bank loan were used by Sean to provide operating funds for the business.Aqua Corporation assumes all of the liabilities transferred to it.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 93

Related Exams