B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding foreign persons not engaged in a U.S.trade or business is true?

A) Foreign persons are subject to potential withholding taxes on the gross amount of U.S.-source investment income.

B) Foreign persons with any U.S.-source income are taxed on net investment income (after expenses) .

C) Foreign persons are not subject to U.S.tax if not engaged in a U.S.trade or business.

D) Foreign persons with only U.S.-source investment income are exempt from U.S.tax.

E) None of the above statements are true.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A U.S.corporation may be able to alleviate the problem of excess foreign taxes by:

A) Repatriating more foreign income to the United States in the year there is an excess limitation.

B) Deducting the excess foreign taxes that do not qualify for the credit.

C) Generating "same basket" foreign-source income that is subject to a tax rate lower than the U.S.tax rate.

D) Generating "same basket" foreign-source income that is subject to a tax rate higher than the U.S.tax rate.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The "residence of seller" rule is used in determining the sourcing of all gross income and deductions of a U.S.multinational business.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

WaterCo, a domestic corporation, purchases inventory for resale from unrelated distributors outside the United States and resells this inventory to customers inside the United States with title passing inside the United States.What is the source of WaterCo's inventory sales income?

A) 100% U.S.source.

B) 100% foreign source.

C) 50% U.S.source and 50% foreign source.

D) 50% foreign source and 50% sourced based on location of manufacturing assets.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Peanut, Inc., a domestic corporation, receives $500,000 of foreign-source interest income, on which foreign taxes of $5,000 are withheld.Peanut's worldwide taxable income is $900,000, and its U.S.Federal income tax liability before FTC is $270,000.What is Peanut's foreign tax credit?

A) $500,000.

B) $275,000.

C) $150,000.

D) $5,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Freda was born and continues to live in Uruguay. She exports widgets to U.S.customers. The U.S.does not have in force an income tax treaty with Urugauy. Freda's net U.S.income from the widgets is subject to a flat 30% Federal income tax rate.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The purpose of the transfer pricing rules is to ensure that taxpayers have ultimate flexibility in shifting profits between related entities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Kipp, a U.S.shareholder under the CFC provisions, owns 40% of a CFC.If the CFC's Subpart F income for the taxable year is $200,000, Kipp is not taxed on receipt of a constructive dividend of $80,000 because he doesn't own more than 50% of the CFC.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A domestic corporation is one whose assets are primarily (> 50%) located in the U.S.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In allocating interest expense between U.S.and foreign sources, a taxpayer must use the tax basis of the income-producing assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax haven often is:

A) A country with high internal income taxes.

B) A country with no or low internal income taxes.

C) A country without income tax treaties.

D) A country that prohibits "treaty shopping."

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following transactions, if entered into by an NRA, is not subject to U.S.taxation?

A) Sale of a commercial building located in Houston, Texas, and owned directly by the NRA.

B) Sale of stock of a foreign corporation whose only asset is a U.S.building.

C) Sale of stock of a domestic corporation whose only asset is undeveloped U.S.real estate.

D) Sale of partnership interest.The partnership's assets predominantly are made up of U.S.real estate.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following foreign taxes paid by a U.S.corporation may be eligible for the foreign tax credit?

A) Real property taxes.

B) Value added taxes.

C) Sales taxes.

D) Dividend withholding taxes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Unused foreign tax credits are carried back one year and then forward 10 years.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Hendricks Corporation, a domestic corporation, owns 40 percent of Shane Corporation and 55 percent of Ferrell Corporation, both foreign corporations.Ferrell owns the other 60 percent of Shane Corporation.Both Shane and Ferrell are CFCs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

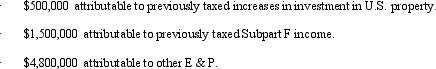

Xenia, Inc., a U.S.shareholder, owns 100% of Fredonia, a CFC.Xenia receives a $3 million cash distribution from Fredonia.Fredonia's E & P is composed of the following amounts.  Xenia recognizes a taxable dividend of:

Xenia recognizes a taxable dividend of:

A) $3 million.

B) $2.5 million.

C) $1.5 million.

D) $1 million.

E) $0.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Waltz, Inc., a U.S.taxpayer, pays foreign taxes of $50,000 on foreign-source general basket income of $90,000. Waltz's worldwide taxable income is $450,000, on which it owes U.S.taxes of $157,500 before FTC. Waltz's FTC is $50,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the taxation of U.S.real property gains recognized by foreign persons not engaged in a U.S.trade or business is false? Gains from the disposition of U.S.real property are:

A) Taxed to foreign persons notwithstanding the general exemption of capital gains from U.S.taxation.

B) Taxed to foreign persons without regard to whether such foreign persons are engaged in a U.S.trade or business.

C) Taxed in the U.S.because such gains are treated as if they are effectively connected to a U.S.trade or business.

D) Not taxed to foreign persons because real property gains are specifically exempt from U.S.taxation.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

GlobalCo, a foreign corporation not engaged in a U.S.trade or business, receives $80,000 in interest income from deposits with the foreign branch of a U.S.bank.The U.S.bank earns 24% of its income from foreign sources.How much of GlobalCo's interest income is U.S.source?

A) $0.

B) $19,200.

C) $60,800.

D) $80,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 148

Related Exams