A) $0.

B) $200,000.

C) $250,000.

D) $425,000.

E) None of the above.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In the current year, Pink Corporation has a § 179 expense of $80,000. As a result, next year, taxable income must be decreased by $16,000 to determine current E & P.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jose receives a nontaxable distribution of stock rights during the year from Gold Corporation on January 30. Each right entitles the holder to purchase one share of stock for $50. One right is issued for every share of stock owned. Jose owns 100 shares of stock purchased two years ago for $5,000. At the date of distribution, the rights are worth $1,000 (100 rights at $10 per right) and Jose's stock in Gold is worth $6,000 (or $60 per share) . On December 1, Jose sells all stock rights for $13 per right. How much gain does Jose recognize on the sale?

A) $1,300.

B) $586.

C) $500.

D) $0.

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

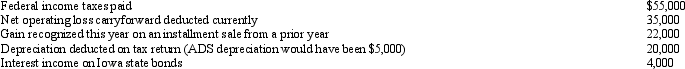

Scarlet Corporation (a calendar year taxpayer) has taxable income of $150,000, and its financial records reflect the following for the year.  Scarlet Corporation's current E & P is:

Scarlet Corporation's current E & P is:

A) $127,000.

B) $107,000.

C) $97,000.

D) $57,000.

E) None of the above.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

To determine E & P, some (but not all) previously excluded income items are added back to taxable income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Glenda is the sole shareholder of Condor Corporation. She sold her stock to Melissa on October 31 for $150,000. Glenda's basis in Condor stock was $50,000 at the start of the year. Condor distributed land to Glenda immediately before the sale. Condor's basis in the land was $20,000 (fair market value of $25,000) . On December 31, Melissa received a $75,000 cash distribution from Condor. During the year, Condor has $20,000 of current E & P and its accumulated E & P balance on January 1 is $10,000. Which of the following statements is true?

A) Glenda recognizes a $110,000 gain on the sale of her stock.

B) Glenda recognizes a $100,000 gain on the sale of her stock.

C) Melissa receives $5,000 of dividend income.

D) Glenda receives $20,000 of dividend income.

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Nondeductible meal and entertainment expenses must be subtracted from taxable income to determine current E & P.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Swan Corporation makes a property distribution to its sole shareholder, Matthew. The property distributed is a cottage (fair market value of $135,000; basis of $110,000) that is subject to a $175,000 mortgage that Matthew assumes. Before considering the consequences of the distribution, Swan's current E & P is $25,000 and its accumulated E & P is 100,000. Swan makes no other distributions during the current year. What is Swan's taxable gain on the distribution of the cottage?

A) $0.

B) $15,000.

C) $25,000.

D) $65,000.

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Falcon Corporation has $200,000 of current E & P and a deficit in accumulated E & P of $90,000. If Swan pays a $300,000 distribution to its shareholders on July 1, how much dividend income do the shareholders report?

A) $0.

B) $10,000.

C) $110,000.

D) $200,000.

E) None of the above.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

When computing E & P, taxable income is not adjusted for additional first-year depreciation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Dividends taxed as ordinary income are considered investment income for purposes of the investment interest expense limitation.

B) False

Correct Answer

verified

True

Correct Answer

verified

Essay

Thistle Corporation declares a nontaxable dividend payable in rights to subscribe to common stock. One right and $25 entitle the holder to subscribe to one share of stock. One right is issued for each share of stock held. Annette, a shareholder, owns 200 shares of stock that she purchased five years ago for $3,000. At the date of distribution of the rights, the market values were $50 per share for the stock and $25 for a right. Annette received 200 rights. She exercises 160 rights and purchases 160 additional shares of stock. She sells the remaining 40 rights for $1,080. What are the tax consequences to Annette?

Correct Answer

verified

Because the fair market value of the rights is 15% or more of the value of the old stock, Annette allocates her basis in the stock between the stock and the stock rights. Annette allocates basis as follows.

11ea8545_adb9_6f74_9aec_3169ec5e5a4c_TB4127_00 There is a capital gain on the sale of the rights of $880, computed as follows.

11ea8545_adb9_6f75_9aec_d1d382426eaf_TB4127_00 Basis of the new stock is $4,800, computed as follows.

11ea8545_adb9_9686_9aec_7b7de14c1daa_TB4127_00 Holding period of the 160 new shares begins on the date of purchase.

Correct Answer

verified

Multiple Choice

Gander, a calendar year corporation, has a deficit in current E & P of $100,000 and a $290,000 positive balance in accumulated E & P. If Gander determines that a $500,000 distribution to its shareholders is appropriate at some point during the year, what is the maximum amount of the distribution that could potentially be treated as a dividend?

A) $0.

B) $190,000.

C) $240,000.

D) $290,000.

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Distributions by a corporation to its shareholders are presumed to be a return of capital unless the parties can prove otherwise.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under certain circumstances, a distribution can generate (or add to) a deficit in E & P.

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

Corporate distributions are presumed to be paid out of E & P and are treated as dividends unless the parties to the transaction can show otherwise.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Federal income tax paid in the current year must be subtracted from taxable income to determine E & P.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

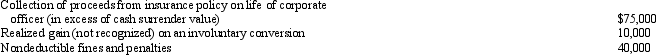

Platinum Corporation, a calendar year taxpayer, has taxable income of $500,000. Among its transactions for the year are the following:  Disregarding any provision for Federal income taxes, Platinum Corporation's current E & P is:

Disregarding any provision for Federal income taxes, Platinum Corporation's current E & P is:

A) $455,000.

B) $535,000.

C) $545,000.

D) $625,000.

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maria and Christopher each own 50% of Cockatoo Corporation, a calendar year taxpayer. Distributions from Cockatoo are: $750,000 to Maria on April 1 and $250,000 to Christopher on May 1. Cockatoo's current E & P is $300,000 and its accumulated E & P is $600,000. How much of the accumulated E & P is allocated to Christopher's distribution?

A) $0.

B) $75,000.

C) $150,000.

D) $300,000.

E) None of the above.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, Gull Corporation (a calendar year taxpayer) has accumulated E & P of $200,000. During the year, Gull incurs a net loss of $280,000 from operations that accrues ratably. On June 30, Gull distributes $120,000 to Sharon, its sole shareholder, who has a basis in her stock of $75,000. How much of the $120,000 is a dividend to Sharon?

A) $0.

B) $60,000.

C) $75,000.

D) $120,000.

E) None of the above.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 89

Related Exams