B) False

Correct Answer

verified

Correct Answer

verified

True/False

Jason's business warehouse is destroyed by fire. As the insurance proceeds exceed the basis of the property, a gain results. If Jason shortly reinvests the proceeds in a new warehouse, no gain is recognized due to the application of the wherewithal to pay concept.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

States impose either a state income tax or a general sales tax, but not both types of taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

The tax law allows, under certain conditions, deferral of gain recognition for involuntary conversions. a.What is the justification for this relief measure? b.What happens if the proceeds are not entirely reinvested?

Correct Answer

verified

Correct Answer

verified

True/False

If fraud is involved, there is no time limit on the assessment of a deficiency by the IRS.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The objective of pay-as-you-go (paygo) is to improve administrative feasibility.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the statements that relate to each other. Note: Some choices may be used more than once. a.3 years from date return is filed b.3 years from due date of return c.20% of underpayment d.5% per month (25% limit) e.0.5% per month (25% limit) f.Conducted at IRS office g.Conducted at taxpayer's office h.6 years i.45-day grace period allowed to IRS j.No statute of limitations (period remains open) k.75% of underpayment l.No correct match provided -Fraud and statute of limitations

Correct Answer

verified

Correct Answer

verified

True/False

There is a Federal excise tax on hotel occupancy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

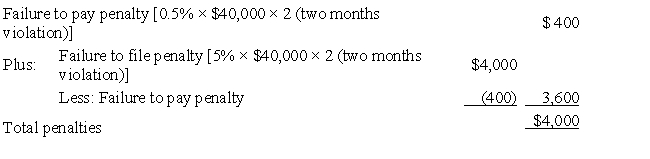

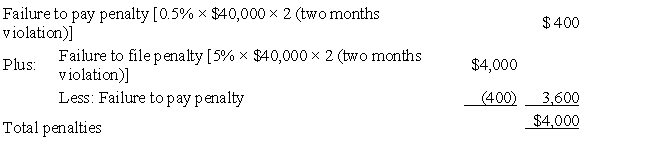

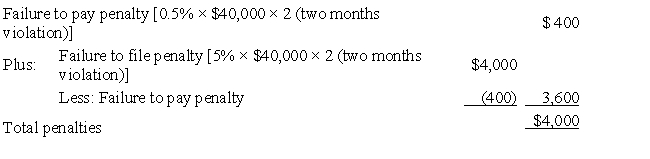

David files his tax return 45 days after the due date. Along with the return, David remits a check for $40,000 which is the balance of the tax owed. Disregarding the interest element, David's total failure to file and to pay penalties are:

A) $400.

B) $3,600.

C) $4,000.

D) $4,400.

E) None of these.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Short Answer

Using the choices provided below, show the justification for each provision of the tax law listed. a.Economic considerations b.Social considerations c.Equity considerations d.Both a. and b. -A small business corporation can elect to avoid the corporate income tax.

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the statements that relate to each other. Note: Some choices may be used more than once. a.3 years from date return is filed b.3 years from due date of return c.20% of underpayment d.5% per month (25% limit) e.0.5% per month (25% limit) f.Conducted at IRS office g.Conducted at taxpayer's office h.6 years i.45-day grace period allowed to IRS j.No statute of limitations (period remains open) k.75% of underpayment l.No correct match provided -Early filing and statute of limitations (deficiency situations)

Correct Answer

verified

Correct Answer

verified

Short Answer

Using the choices provided below, show the justification for each provision of the tax law listed. a.Economic considerations b.Social considerations c.Equity considerations d.Both a. and b. -A tax credit for amounts spent to furnish care for children while the parent is at work.

Correct Answer

verified

Correct Answer

verified

Short Answer

Using the choices provided below, show the justification for each provision of the tax law listed. a.Economic considerations b.Social considerations c.Equity considerations d.Both a. and b. -A Federal deduction for state and local income taxes paid.

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the statements that relate to each other. Note: Some choices may be used more than once. a.3 years from date return is filed b.3 years from due date of return c.20% of underpayment d.5% per month (25% limit) e.0.5% per month (25% limit) f.Conducted at IRS office g.Conducted at taxpayer's office h.6 years i.45-day grace period allowed to IRS j.No statute of limitations (period remains open) k.75% of underpayment l.No correct match provided -Office audit

Correct Answer

verified

Correct Answer

verified

Short Answer

Using the choices provided below, show the justification for each provision of the tax law listed. a.Economic considerations b.Social considerations c.Equity considerations d.Both a. and b. -A deduction for qualified tuition paid to obtain higher education.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which, if any, of the following provisions of the tax law cannot be justified as promoting administrative feasibility (simplifying the task of the IRS) ?

A) Penalties are imposed for failure to file a return or pay a tax on time.

B) Prepaid income is taxed in the year received and not in the year earned.

C) Annual adjustments for indexation increases the amount of the standard deduction allowed.

D) Casualty losses must exceed 10% of AGI to be deductible.

E) A deduction is allowed for charitable contributions.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The pay-as-you-go feature of the Federal income tax on individuals conforms to Adam Smith's canon (principle) of certainty.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For the negligence penalty to apply, the underpayment must be caused by intentional disregard of rules and regulations without intent to defraud.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Allowing a domestic production activities deduction for certain manufacturing income can be justified:

A) As mitigating the effect of the annual accounting period concept.

B) As promoting administrative feasibility.

C) By economic considerations.

D) Based on the wherewithal to pay concept.

E) None of these.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Stealth taxes have the effect of generating additional taxes from all taxpayers.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 194

Related Exams