B) False

Correct Answer

verified

Correct Answer

verified

True/False

The two methods discussed in the text for dealing with unequal project lives are (1)the replacement chain approach and (2)the equivalent annual annuity (EAA)approach.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

It is extremely difficult to estimate the revenues and costs associated with large,complex projects that take several years to develop.This is why subjective judgment is often used for such projects along with discounted cash flow analysis.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The primary advantage to using accelerated rather than straight-line depreciation is that with accelerated depreciation the present value of the tax savings provided by depreciation will be higher,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mulroney Corp.is considering two mutually exclusive projects.Both require an initial investment of $10,000 at t = 0.Project X has an expected life of 2 years with after-tax cash inflows of $6,000 and $7,800 at the end of Years 1 and 2,respectively.In addition,Project X can be repeated at the end of Year 2 with no changes in its cash flows.Project Y has an expected life of 4 years with after-tax cash inflows of $4,300 at the end of each of the next 4 years.Each project has a WACC of 8%.Using the replacement chain approach,what is the NPV of the most profitable project?

A) $4,242

B) $4,246

C) $4,286

D) $4,325

E) $4,433

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

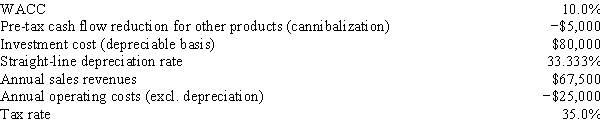

TexMex Food Company is considering a new salsa whose data are shown below.The equipment to be used would be depreciated by the straight-line method over its 3-year life and would have a zero salvage value,and no change in net operating working capital would be required.Revenues and other operating costs are expected to be constant over the project's 3-year life.However,this project would compete with other TexMex products and would reduce their pre-tax annual cash flows.What is the project's NPV? (Hint: Cash flows are constant in Years 1-3.)

A) $3,636

B) $3,828

C) $4,019

D) $4,220

E) $4,431

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

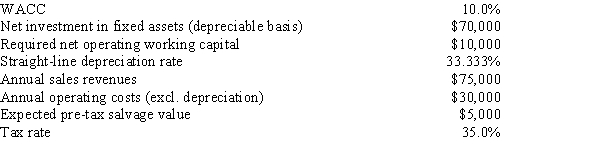

Thomson Media is considering some new equipment whose data are shown below.The equipment has a 3-year tax life and would be fully depreciated by the straight-line method over 3 years,but it would have a positive pre-tax salvage value at the end of Year 3,when the project would be closed down.Also,additional net operating working capital would be required,but it would be recovered at the end of the project's life.Revenues and other operating costs are expected to be constant over the project's 3-year life.What is the project's NPV?

A) $20,762

B) $21,854

C) $23,005

D) $24,155

E) $25,363

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

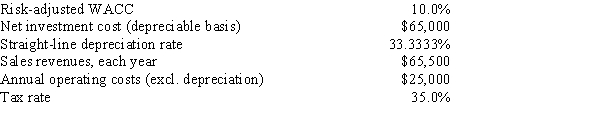

Your company,RMU Inc.,is considering a new project whose data are shown below.What is the project's Year 1 cash flow?

A) $ 8,903

B) $ 9,179

C) $ 9,463

D) $ 9,746

E) $10,039

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Superior analytical techniques,such as NPV,used in combination with risk-adjusted cost of capital estimates,can overcome the problem of poor cash flow estimation and lead to generally correct accept/reject decisions for capital budgeting projects.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Atlas Corp.is considering two mutually exclusive projects.Both require an initial investment of $10,000 at t = 0.Project S has an expected life of 2 years with after-tax cash inflows of $6,000 and $8,000 at the end of Years 1 and 2,respectively.Project L has an expected life of 4 years with after-tax cash inflows of $4,373 at the end of each of the next 4 years.Each project has a WACC of 9.25%,and Project S can be repeated with no changes in its cash flows.The controller prefers Project S,but the CFO prefers Project L.How much value will the firm gain or lose if Project L is selected over Project S,i.e.,what is the value of NPVL - NPVS?

A) $56.50

B) $62.15

C) $68.37

D) $75.21

E) $82.73

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The two cardinal rules that financial analysts should follow to avoid errors are: (1)in the NPV equation,the numerator should use income calculated in accordance with generally accepted accounting principles,and (2)all incremental cash flows should be considered when making accept/reject decisions for capital budgeting projects.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Estimating project cash flows is generally the most important,but also the most difficult,step in the capital budgeting process.Methodology,such as the use of NPV versus IRR,is important,but less so than obtaining a reasonably accurate estimate of projects' cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liberty Services is now at the end of the final year of a project.The equipment originally cost $22,500,of which 75% has been depreciated.The firm can sell the used equipment today for $6,000,and its tax rate is 40%.What is the equipment's after-tax salvage value for use in a capital budgeting analysis? Note that if the equipment's final market value is less than its book value,the firm will receive a tax credit as a result of the sale.

A) $5,558

B) $5,850

C) $6,143

D) $6,450

E) $6,772

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Tapley Inc.uses a WACC of 8% for below-average risk projects,10% for average-risk projects,and 12% for above-average risk projects.Which of the following independent projects should Tapley accept,assuming that the company uses the NPV method when choosing projects?

A) Project A, which has average risk and an IRR = 9%.

B) Project B, which has below-average risk and an IRR = 8.5%.

C) Project C, which has above-average risk and an IRR = 11%.

D) Without information about the projects' NPVs we cannot determine which one or ones should be accepted.

E) All of these projects should be accepted as they will produce a positive NPV.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following factors should be included in the cash flows used to estimate a project's NPV?

A) All costs associated with the project that have been incurred prior to the time the analysis is being conducted.

B) Interest on funds borrowed to help finance the project.

C) The end-of-project recovery of any additional net operating working capital required to operate the project.

D) Cannibalization effects, but only if those effects increase the project's projected cash flows.

E) Expenditures to date on research and development related to the project, provided those costs have already been expensed for tax purposes.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Temple Corp.is considering a new project whose data are shown below.The equipment that would be used has a 3-year tax life,would be depreciated by the straight-line method over its 3-year life,and would have a zero salvage value.No change in net operating working capital would be required.Revenues and other operating costs are expected to be constant over the project's 3-year life.What is the project's NPV?

A) $15,740

B) $16,569

C) $17,441

D) $18,359

E) $19,325

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) An example of a sunk cost is the cost associated with restoring the site of a strip mine once the ore has been depleted.

B) Sunk costs must be considered if the IRR method is used but not if the firm relies on the NPV method.

C) A good example of a sunk cost is a situation where a bank opens a new office, and that new office leads to a decline in deposits of the bank's other offices.

D) A good example of a sunk cost is money that a banking corporation spent last year to investigate the site for a new office, then expensed that cost for tax purposes, and now is deciding whether to go forward with the project.

E) If sunk costs are considered and reflected in a project's cash flows, then the project's calculated NPV will be higher than it otherwise would have been had the sunk costs been ignored.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Any cash flows that can be classified as incremental to a particular project: i.e.,results directly from the decision to undertake the project: should be reflected in the capital budgeting analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statement completions is NOT CORRECT? For a profitable firm,when MACRS accelerated depreciation is compared to straight-line depreciation,MACRS accelerated allowances produce

A) Higher depreciation charges in the early years of an asset's life.

B) Larger cash flows in the earlier years of an asset's life.

C) Larger total undiscounted profits from the project over the project's life.

D) Smaller accounting profits in the early years, assuming the company uses the same depreciation method for tax and book purposes.

E) Lower tax payments in the earlier years of an asset's life.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fool Proof Software is considering a new project whose data are shown below.The equipment that would be used has a 3-year tax life,and the allowed depreciation rates for such property are 33%,45%,15%,and 7% for Years 1 through 4.Revenues and other operating costs are expected to be constant over the project's 10-year expected life.What is the Year 1 cash flow?

A) $30,258

B) $31,770

C) $33,359

D) $35,027

E) $36,778

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 81

Related Exams