A) nominal and real GDP would fall by 7 percent.

B) nominal GDP would fall by 7 percent; real GDP would be unchanged.

C) nominal GDP would be unchanged; real GDP would fall by 7 percent.

D) neither nominal GDP nor real GDP would change.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that M is fixed.According to the quantity equation,which of the following would make the price level lower?

A) Y or V rise

B) Y or V fall

C) Y rises or V falls

D) Y falls or V rises

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the 1970s,in response to recessions caused by an increase in the price of oil,the central banks in many countries increased their money supplies.The central banks might have done this by

A) selling bonds on the open market,which would have raised the value of money

B) purchasing bonds on the open market,which would have raised the value of money.

C) selling bonds on the open market,which would have raised the value of money.

D) purchasing bonds on the open market,which would have lowered the value of money.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same,a decrease in velocity means that

A) the rate at which money changes hands falls,so the price level rises.

B) the rate at which money changes hands falls,so the price level falls.

C) the rate at which money changes hands rises,so the price level rises.

D) the rate at which money changes hands rises,so the price level falls.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With the value of money on the vertical axis,the money supply curve is

A) upward sloping because people supply a larger quantity of money when the value of money increases.

B) downward sloping because people supply a larger quantity of money when the value of money decreases.

C) horizontal because we assume the central bank controls the money supply

D) vertical because we assume the central bank controls the money supply.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If P = 2 and Y = 1000,then which of the following pairs of values are possible?

A) M = 500,V = 4

B) M = 1500,V = 3

C) M = 2000,V = 2

D) M = 500,V = 1

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which case below does a person's purchasing power from saving increase the least?

A) the nominal interest rate = 10% and inflation = 8%

B) the nominal interest rate = 9% and inflation = 6%

C) the nominal interest rate = 8% and inflation = 4%

D) the nominal interest rate = 7% and inflation = 2%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From the early 1980's through the 1990's,the nominal interest rate

A) fell because the Fed got inflation under control.

B) fell because the Fed let inflation get out of control.

C) rose because the Fed got inflation under control.

D) rose because the Fed let inflation get out of control.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the CPI rises,the number of dollars needed to buy a representative basket of goods

A) increases,and so the value of money rises.

B) increases,and so the value of money falls.

C) decreases,and so the value of money rises.

D) decreases,and so the value of money falls

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the money market is drawn with the value of money on the vertical axis,an increase in the money supply causes the equilibrium value of money

A) and equilibrium quantity of money to increase.

B) and equilibrium quantity of money to decrease.

C) to increase,while the equilibrium quantity of money decreases.

D) to decrease,while the equilibrium quantity of money increases.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the principle of monetary neutrality,a decrease in the money supply will not change

A) nominal GDP.

B) the price level.

C) unemployment.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You bought some shares of stock and,over the next year,the price per share increased by 5 percent and the price level increased by 8 percent.Before taxes,you experienced

A) both a nominal gain and a real gain,and you paid taxes on the nominal gain.

B) both a nominal gain and a real gain,and you paid taxes only on the real gain.

C) a nominal gain and a real loss,and you paid taxes on the nominal gain.

D) a nominal gain and a real loss,and you paid no taxes on the transaction.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In order to maintain stable prices,a central bank must

A) maintain low interest rates.

B) keep unemployment low.

C) tightly control the money supply.

D) sell indexed bonds.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose monetary neutrality holds and velocity is constant.A 5 percent increase in the money supply

A) increases the price level by more than 5 percent.

B) increases the price level by 5 percent.

C) increases the price level by 5 percent

D) does not change the price level.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

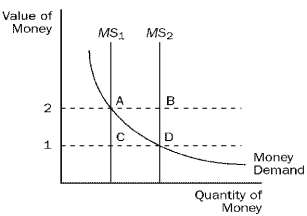

Figure 22-1  -Refer to Figure 22-1.If the current money supply is MS1,then

-Refer to Figure 22-1.If the current money supply is MS1,then

A) there is no excess supply or excess demand if the value of money is 2.

B) the equilibrium is at point C.

C) there is an excess supply of money if the value of money is 1.

D) None of the above is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The quantity theory of money implies that if output and velocity are constant,then a 50 percent increase in the money supply would lead to less than a 50 percent increase in the price level.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Inflation impedes financial markets in their role of allocating savings to alternative investments.

B) Inflation encourages savings through the tax treatment on capital gains.

C) Inflation encourages larger holdings of currency by the public.

D) Inflation reduces people's real purchasing power.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the Fed conducts open market sales,the equilibrium value of money decreases and the equilibrium price level increases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You put money into an account and earn a real interest rate of 6 percent.Inflation is 2 percent,and your marginal tax rate is 20 percent.What is your after-tax real rate of interest?

A) 4.8 percent

B) 3.2 percent

C) 2.8 percent

D) None of the above is correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deflation

A) increases incomes and enhances the ability of debtors to pay off their debts.

B) increases incomes and reduces the ability of debtors to pay off their debts.

C) decreases incomes and enhances the ability of debtors to pay off their debts.

D) decreases incomes and reduces the ability of debtors to pay off their debts.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 321 - 340 of 386

Related Exams