A) $75

B) $87

C) $90

D) $106

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

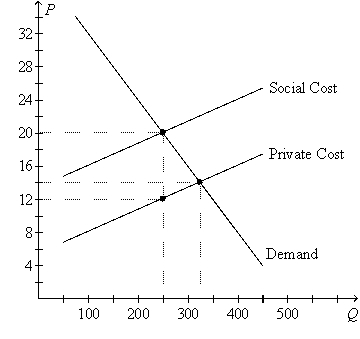

Figure 10-13.On the graph,Q represents the quantity of plastics and P represents the price of plastics.  -Refer to Figure 10-13.If 325 units of plastics are produced and consumed,then the

-Refer to Figure 10-13.If 325 units of plastics are produced and consumed,then the

A) social optimum has been reached.

B) market equilibrium has been reached.

C) government must have imposed a corrective tax to guide the market to this outcome.

D) government must have offered a corrective subsidy to guide the market to this outcome.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Research into new technologies

A) provides positive externalities because it creates knowledge others can use.

B) results in negative externalities because government funding for research causes less government spending in other areas.

C) is protected by patent laws,which eliminates the need for government intervention.

D) should only be funded by the corporations that will receive the profits from the research.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

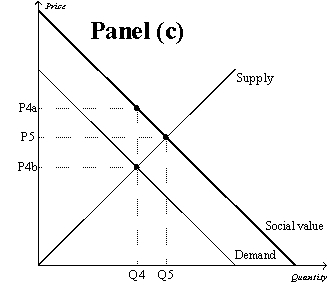

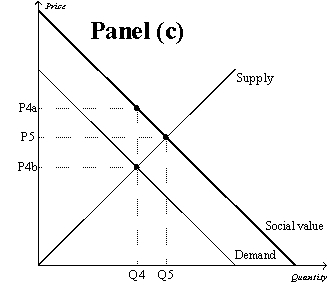

Figure 10-9

-Refer to Figure 10-9,Panel (c) .The market equilibrium quantity is

-Refer to Figure 10-9,Panel (c) .The market equilibrium quantity is

A) Q4,which is the socially optimal quantity.

B) Q5,which is the socially optimal quantity.

C) Q4,and the socially optimal quantity is Q5.

D) Q5,and the socially optimal quantity is Q4.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When negative externalities are present in a market

A) private costs will be greater than social costs.

B) social costs will be greater than private costs.

C) only government regulation will solve the problem.

D) the market will not be able to reach any equilibrium.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that elementary education creates a positive externality.If the government does not subsidize education,then

A) the equilibrium quantity of education will be equal to the socially optimal quantity of education.

B) the equilibrium quantity of education will be greater than the socially optimal quantity of education.

C) the equilibrium quantity of education will be less than the socially optimal quantity of education.

D) There is not enough information to answer the question.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a market economy,government intervention

A) will always improve market outcomes.

B) reduces efficiency in the presence of externalities.

C) may improve market outcomes in the presence of externalities.

D) is necessary to control individual greed.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

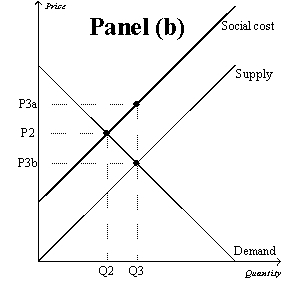

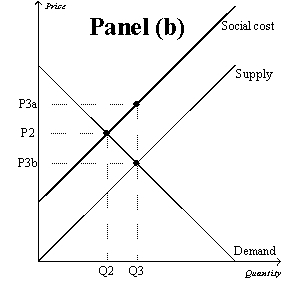

Figure 10-9

-Refer to Figure 10-9,Panel (b) and Panel (c) .Which of the following is correct?

-Refer to Figure 10-9,Panel (b) and Panel (c) .Which of the following is correct?

A) A tax would move the market in Panel (b) and the market in Panel (c) closer to the socially optimal outcome.

B) A subsidy would move the market in Panel (b) and the market in Panel (c) closer to the socially optimal outcome.

C) A tax would move the market in Panel (b) closer to the socially optimal outcome,but a subsidy would move the market in Panel (c) closer to the socially optimal outcome.

D) A subsidy would move the market in Panel (b) closer to the socially optimal outcome,but a tax would move the market in Panel (c) closer to the socially optimal outcome.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Automotive manufacturers prefer stricter fuel economy regulations to higher gasoline taxes.

B) Higher gasoline taxes have provided a market-based incentive for Europeans to buy more fuel-efficient vehicles.

C) Higher gasoline taxes have had no effect on the U.S.demand for gasoline because the demand for gasoline is perfectly inelastic.

D) Fuel efficiency regulations are more effective than gasoline taxes in reducing the demand for gasoline in the United States and Europe.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

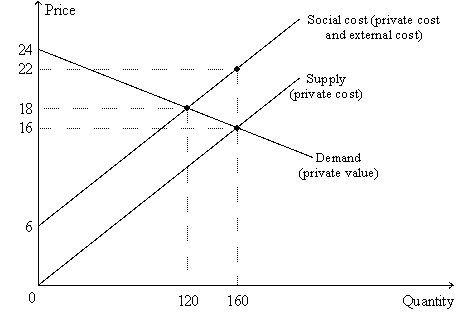

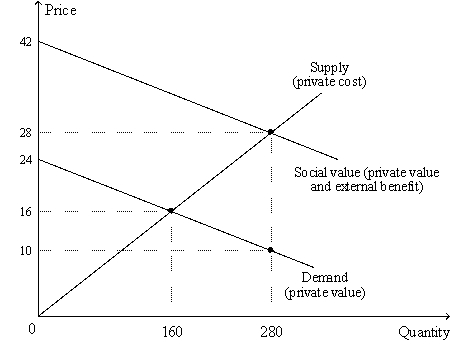

Figure 10-10  -Refer to Figure 10-10.The socially optimal quantity of output is

-Refer to Figure 10-10.The socially optimal quantity of output is

A) 120 units,since the value to the buyer of the 120th unit is equal to the cost incurred by the seller of the 120th unit.

B) 120 units,since the value to the buyer of the 120th unit is equal to the cost incurred by society of the 120th unit.

C) 160 units,since the value to the buyer of the 160th unit is equal to the cost incurred by the seller of the 160th unit.

D) 160 units,since the value to the buyer of the 160th unit is equal to the cost incurred by society of the 160th unit.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Suppose a certain good conveys either an external cost or an external benefit.If the private cost of the last unit of the good that was produced is equal to the private value of that unit,then the sum of producer and consumer surplus is maximized.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Patent protection is one way to deal with technology spillovers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Transaction costs

A) can keep private parties from solving externality problems.

B) are incurred in the production process due to externalities.

C) increase when taxes are imposed to correct negative externalities.

D) are eliminated when the government intervenes in a market with externalities.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Corrective taxes enhance efficiency,but the cost to administer them exceeds the revenue they raise for the government.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In many cases selling pollution permits is a better method for reducing pollution than imposing a corrective tax because

A) it is hard to estimate the market demand curve and thus charge the "right" corrective tax.

B) selling pollution permits create a net increase in pollution.

C) Corrective taxes distort incentives.

D) Corrective taxes provide greater flexibility to firms that can reduce pollution at a low cost.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of an externality?

A) cigarette smoke that permeates an entire restaurant

B) a flu shot that prevents a student from transmitting the virus to her roommate

C) a beautiful flower garden outside of the local post office

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

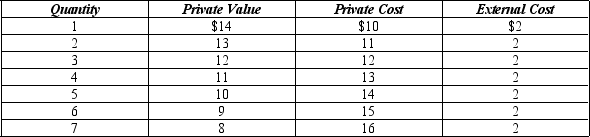

Table 10-1

The following table shows the private value,private cost,and external cost for various quantities of output in a market.

-Refer to Table 10-1.Which of the following statements is correct?

-Refer to Table 10-1.Which of the following statements is correct?

A) If the external benefit per unit of output were $0 instead of $2,then the socially efficient quantity of output would be 4 units.

B) A tax of $4 per unit would enable this market to move from the equilibrium quantity of output to the socially optimal level of output.

C) Taking the external cost into account,total surplus declines when the 3rd unit of output is produced and consumed.

D) The market for flu shots is a market to which the concepts in this table apply very well.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 10-11  -Refer to Figure 10-11."The social value of the last unit produced exceeds the private cost of the last unit produced by $9." This statement is correct at which quantity of output?

-Refer to Figure 10-11."The social value of the last unit produced exceeds the private cost of the last unit produced by $9." This statement is correct at which quantity of output?

A) 140 units

B) 180 units

C) 220 units

D) 260 units

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) Private markets tend to over-produce products with negative externalities.

B) Private markets tend to under-produce products with positive externalities.

C) Private parties can bargain to efficient outcomes even in the presence of externalities.

D) Private parties are usually more successful in achieving efficient outcomes than government policies.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the government intervenes in markets with externalities,it does so in order to

A) increase production when negative externalities are present.

B) protect the interests of bystanders.

C) make certain all benefits are received by market participants.

D) reduce production when positive externalities are present.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 301 - 320 of 439

Related Exams