A) results in a surplus.

B) is set above the equilibrium price.

C) causes quantity demanded to exceed quantity supplied.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A minimum wage that is set below a market's equilibrium wage will result in an excess

A) demand for labor,that is,unemployment.

B) demand for labor,that is,a shortage of workers.

C) supply of labor,that is,unemployment.

D) None of the above is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

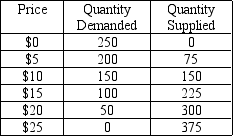

Table 6-2

-Refer to Table 6-2.A price ceiling set at $15 will

-Refer to Table 6-2.A price ceiling set at $15 will

A) be binding and will result in a shortage of 50 units.

B) be binding and will result in a shortage of 100 units.

C) be binding and will result in a shortage of 125 units.

D) not be binding.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To say that a price floor is binding is to say that the price floor

A) results in a shortage.

B) is set below the equilibrium price.

C) causes quantity supplied to exceed quantity demanded.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

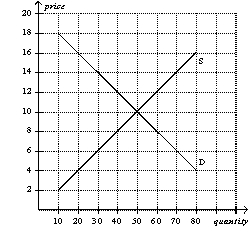

Figure 6-6  -Refer to Figure 6-6.Which of the following price ceilings would be binding in this market?

-Refer to Figure 6-6.Which of the following price ceilings would be binding in this market?

A) $8

B) $10

C) $12

D) $14

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following causes a shortage of a good?

A) a binding price floor

B) a binding price ceiling

C) a tax on the good

D) None of the above is correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In response to a shortage caused by the imposition of a binding price ceiling on a market,

A) price will no longer be the mechanism that rations scarce resources.

B) long lines of buyers may develop.

C) sellers could ration the good or service according to their own personal biases.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose there is currently a tax of $50 per ticket on airline tickets.Sellers of airline tickets are required to pay the tax to the government.If the tax is reduced from $50 per ticket to $30 per ticket,then the

A) demand curve will shift upward by $20,and the price paid by buyers will decrease by less than $20.

B) demand curve will shift upward by $20,and the price paid by buyers will decrease by $20.

C) supply curve will shift downward by $20,and the effective price received by sellers will increase by less than $20.

D) supply curve will shift downward by $20,and the effective price received by sellers will increase by $20.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Whether a tax is levied on sellers or buyers,buyers and sellers usually share the burden of taxes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Long lines and discrimination are examples of rationing methods that may naturally develop in response to a binding price ceiling.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The imposition of a binding price floor on a market causes quantity demanded to be

A) greater than quantity supplied.

B) less than quantity supplied.

C) equal to quantity supplied.

D) Both a) and b) are possible.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Price floors are typically imposed to benefit sellers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Price controls often hurt those they are trying to help.

B) False

Correct Answer

verified

Correct Answer

verified

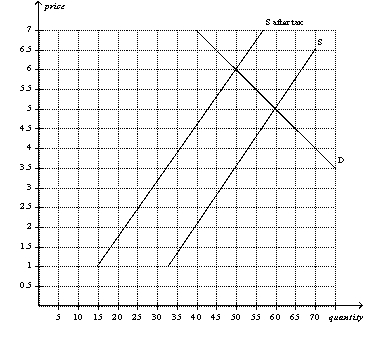

Multiple Choice

Figure 6-18  -Refer to Figure 6-18.Buyers pay how much of the tax per unit?

-Refer to Figure 6-18.Buyers pay how much of the tax per unit?

A) $1.

B) $1.50.

C) $2.50.

D) $3.50.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the demand for digital cameras is elastic,and the supply of digital cameras is inelastic.A tax of $20 per camera levied on digital cameras will decrease the effective price received by sellers of digital cameras by

A) less than $10.

B) $10.

C) between $10 and $20.

D) $20.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

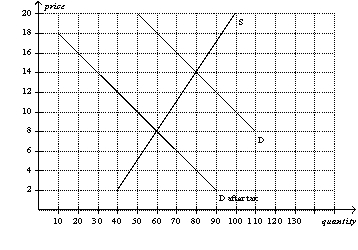

Figure 6-23  -Refer to Figure 6-23.How much tax revenue does this tax produce for the government?

-Refer to Figure 6-23.How much tax revenue does this tax produce for the government?

A) $480

B) $600

C) $800

D) $1120

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a 20-cent tax on the sellers of iced tea.Which of the following is not correct? The tax would

A) shift the supply curve upward by 20 cents.

B) raise the equilibrium price by 20 cents.

C) reduce the equilibrium quantity.

D) discourage market activity.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Most labor economists believe that the supply of labor is much more elastic than the demand.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Price controls are usually enacted

A) as a means of raising revenue for public purposes.

B) when policymakers believe that the market price of a good or service is unfair to buyers or sellers.

C) when policymakers detect inefficiencies in a market.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Price controls

A) always produce a fair outcome.

B) always produce an efficient outcome.

C) can generate inequities of their own.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 481 - 500 of 553

Related Exams