B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

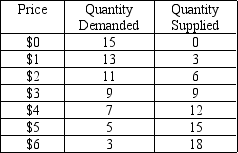

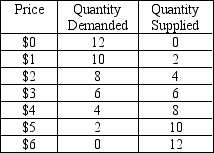

Table 6-4

The following table contains the demand schedule and supply schedule for a market for a particular good.Suppose sellers of the good successfully lobby Congress to impose a price floor $3 above the equilibrium price in this market.

-Refer to Table 6-4.Following the imposition of a price floor $3 above the equilibrium price,irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor.The resulting market price is

-Refer to Table 6-4.Following the imposition of a price floor $3 above the equilibrium price,irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor.The resulting market price is

A) $2.

B) $3.

C) $4.

D) $5.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When a free market for a good reaches equilibrium,anyone who is willing and able to sell at the market price can sell the good.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A large majority of economists favor eliminating the minimum wage.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the sellers of a product,then there will be a(n)

A) downward shift of the demand curve.

B) upward shift of the demand curve.

C) movement up and to the left along the demand curve.

D) movement down and to the right along the demand curve.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the minimum wage exceeds the equilibrium wage,then

A) the quantity demanded of labor will exceed the quantity supplied.

B) the quantity supplied of labor will exceed the quantity demanded.

C) the minimum wage will not be binding.

D) there will be no unemployment.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The wedge between the buyers' price and the sellers' price is the same,regardless of whether the tax is levied on buyers or sellers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

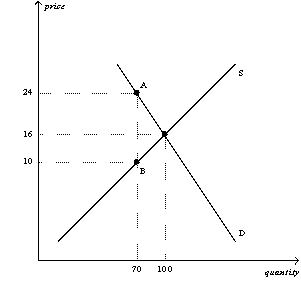

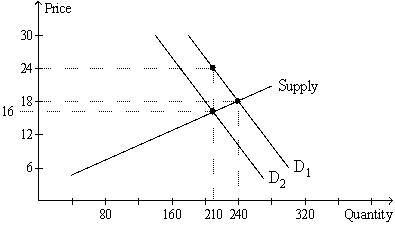

Figure 6-14

The vertical distance between points A and B represents the tax in the market.  -Refer to Figure 6-14.The per-unit burden of the tax on sellers is

-Refer to Figure 6-14.The per-unit burden of the tax on sellers is

A) $6.

B) $8.

C) $10.

D) $14.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

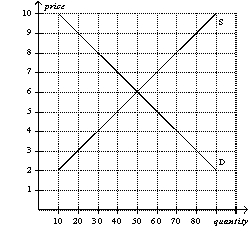

Figure 6-7  -Refer to Figure 6-7.Which of the following price controls would cause a shortage of 20 units of the good?

-Refer to Figure 6-7.Which of the following price controls would cause a shortage of 20 units of the good?

A) a price ceiling set at $4

B) a price ceiling set at $5

C) a price floor set at $7

D) a price floor set at $8

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

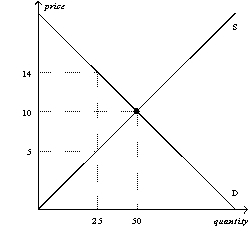

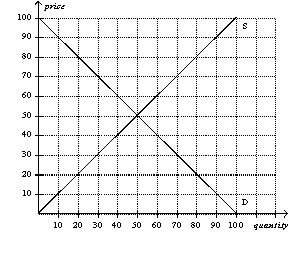

Figure 6-16  -Refer to Figure 6-16.Suppose a tax of $5 per unit is imposed on this market.Which of the following is correct?

-Refer to Figure 6-16.Suppose a tax of $5 per unit is imposed on this market.Which of the following is correct?

A) Buyers and sellers will share the burden of the tax equally.

B) Buyers will bear more of the burden of the tax than sellers will.

C) Sellers will bear more of the burden of the tax than buyers will.

D) Any of the above is possible.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A nonbinding price floor (i) causes a surplus. (ii) causes a shortage. (iii) is set at a price above the equilibrium price. (iv) Is set at a price below the equilibrium price.

A) (iii) only

B) (iv) only

C) (i) and (iii) only

D) (ii) and (iv) only

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A binding price ceiling causes a shortage in the market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other than OPEC,the shortage of gasoline in the U.S.in the 1970s could also be blamed on

A) a sharp increase in the demand for gasoline that was brought on by the Vietnam War.

B) the government's policy of maintaining a price ceiling on gasoline.

C) an indifference among U.S.consumers toward conservation.

D) the lack of substitutes for crude oil.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The true burden of a payroll tax has nothing to do with the percentage of the tax that employers are required to pay.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 6-1

-Refer to Table 6-1.Suppose the government imposes a price ceiling of $1 on this market.What will be the size of the shortage in this market?

-Refer to Table 6-1.Suppose the government imposes a price ceiling of $1 on this market.What will be the size of the shortage in this market?

A) 0 units

B) 2 units

C) 8 units

D) 10 units

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the 1970s,long lines at gas stations in the United States were primarily a result of the fact that

A) OPEC raised the price of crude oil in world markets.

B) U.S.gasoline producers raised the price of gasoline.

C) the U.S.government maintained a price ceiling on gasoline.

D) Americans typically commuted long distances.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A tax on a market with elastic demand and elastic supply will shrink the market more than a tax on a market with inelastic demand and inelastic supply will shrink the market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-20  -Refer to Figure 6-20.What is the amount of the tax per unit?

-Refer to Figure 6-20.What is the amount of the tax per unit?

A) $8

B) $6

C) $4

D) $2

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the buyers of a product,then the supply curve will

A) not shift.

B) shift up.

C) shift down.

D) become flatter.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Figure 6-26  -Refer to Figure 6-26.A price ceiling set at $30 would create a shortage of 20 units.

-Refer to Figure 6-26.A price ceiling set at $30 would create a shortage of 20 units.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 281 - 300 of 553

Related Exams