A) 20%

B) 23%

C) 40%

D) 45%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The two types of taxes that are most important to state and local governments as sources of revenue are

A) individual income taxes and corporate income taxes.

B) sales taxes and individual income taxes.

C) sales taxes and property taxes.

D) social insurance taxes and property taxes.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a tax of 20 percent on the first $50,000 of income and 30 percent on all income above $50,000.What is the marginal tax rate when income is $60,000?

A) 10 percent

B) 20 percent

C) 30 percent

D) 50 percent

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A budget deficit

A) occurs when government receipts are less than spending.

B) occurs when government spending is less than receipts.

C) occurs when government receipts are equal to spending.

D) is the accumulation of years of government overspending.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

State and local governments

A) are funded entirely by their own tax base.

B) receive the majority of their tax revenues from corporate income taxes.

C) are generally not responsible for collecting sales taxes.

D) receive some of their funds from the federal government.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an administrative burden of our tax system?

A) Government resources used to enforce tax laws

B) Keeping tax records throughout the year

C) Paying the taxes owed

D) Time spent in April filling out forms

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

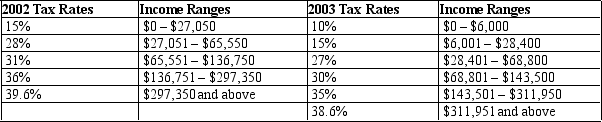

Table 12-12

United States Income Tax Rates for a Single Individual,2002 and 2003.

-Refer to Table 12-12.Charles is a single person whose taxable income is $35,000 a year.What is his average tax rate in 2002?

-Refer to Table 12-12.Charles is a single person whose taxable income is $35,000 a year.What is his average tax rate in 2002?

A) 18%

B) 20.5%

C) 21%

D) 28%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why do some policymakers support a consumption tax rather than an earnings tax?

A) Because the average tax rate would be lower under a consumption tax.

B) Because a consumption tax would encourage people to save earned income.

C) Because a consumption tax would raise more revenues than an income tax.

D) Because the marginal tax rate would be higher under an earnings tax.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

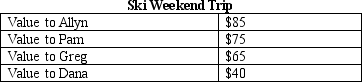

Table 12-3

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $38 and that the price reflects the actual unit cost of providing a weekend of skiing.How much consumer surplus accrues to Allyn and Greg individually?

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $38 and that the price reflects the actual unit cost of providing a weekend of skiing.How much consumer surplus accrues to Allyn and Greg individually?

A) $37 and $17 respectively

B) $47 and $27 respectively

C) $49 and $35 respectively

D) $85 and $65 respectively

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes create deadweight losses because they

A) reduce profits of firms.

B) distort incentives.

C) cause prices to rise.

D) create revenue for the government.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a tax generates a reduction in surplus that is exactly offset by the tax revenue collected by the government,the tax does not have a deadweight loss.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-2 Suppose that Bob places a value of $10 on a movie ticket and that Lisa places a value of $7 on a movie ticket.In addition,suppose the price of a movie ticket is $5. -Refer to Scenario 12-2.Suppose the government levies a tax of $3 on a movie ticket and that,as a result,the price of a movie ticket increases to $8.What is the deadweight loss from the tax?

A) $0

B) $1

C) $2

D) $3

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a country imposes a lump-sum income tax of $5,000 on each individual in the country.What is the average income tax rate for an individual who earns $40,000 during the year?

A) 0%

B) 10%

C) More than 10%

D) The average tax rate cannot be determined without knowing the entire tax schedule.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stacy places a $20 value on a bottle of wine,and Andrea places a $17 value on it.The equilibrium price for a bottle of wine is $15.Suppose the government levies a tax of $3 on each bottle of wine,and the equilibrium price of a bottle of wine increases to $18.How much tax revenue is collected?

A) $0

B) $2

C) $3

D) $6

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Horizontal equity refers to a tax system in which individuals with higher incomes pay more in taxes than individuals with lower incomes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an advantage of a lump-sum tax in comparison to other types of taxes?

A) It would not cause deadweight loss.

B) It imposes a minimal administrative burden on taxpayers.

C) It is more equitable.

D) It is more efficient.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which tax system requires higher-income taxpayers to have lower tax rates,even though they pay a larger amount of tax when compared to lower-income taxpayers?

A) A proportional tax

B) A progressive tax

C) A regressive tax

D) A lump-sum tax

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

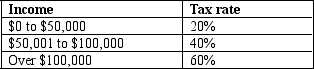

Table 12-7

-Refer to Table 12-7.What is the marginal tax rate for a person who makes $37,000?

-Refer to Table 12-7.What is the marginal tax rate for a person who makes $37,000?

A) 9.25%

B) 20%

C) 25%

D) 40%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A person's marginal tax rate equals

A) her tax obligation divided by her average tax rate.

B) the increase in taxes she would pay as a percentage of the rise in her income.

C) her tax obligation divided by her income.

D) the increase in taxes if her average tax rate were to rise by 1%.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sue earns income of $80,000 per year.Her average tax rate is 50 percent.Sue paid $5,000 in taxes on the first $30,000 she earned.What was the marginal tax rate on the first $30,000 she earned,and what was the marginal tax rate on the remaining $50,000?

A) 6.25 percent and 50.00 percent,respectively

B) 10.00 percent and 70.00 percent,respectively

C) 16.67 percent and 60.00 percent,respectively

D) 16.67 percent and 70.00 percent,respectively

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 301 - 320 of 397

Related Exams