A) the government controls the price of permits.

B) firms that can reduce pollution only at high cost will be willing to pay the most for the pollution permits.

C) the value of pollution-saving technology will be lower than the market value of a pollution permit.

D) the Coase theorem is no longer applicable as a solution to reducing pollution.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With pollution permits,the supply curve for pollution rights is

A) perfectly elastic.

B) perfectly inelastic.

C) upward sloping.

D) downward sloping.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When negative externalities are present in a market,

A) producers will be affected but consumers will not.

B) producers will supply too much of the product.

C) demand will be too high.

D) the market will still maximize total benefits.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dick owns a dog whose barking annoys Dick's neighbor Jane.Dick receives personal benefit from owning the dog,and Jane bears a cost of Dick's ownership of the dog.Assuming Jane has the legal right to peace and quiet,which of the following statements is correct?

A) If Dick's benefit exceeds Jane's cost,government intervention is necessary.

B) Dick will pay to keep his dog if his benefit exceeds Jane's cost.

C) If Jane's cost exceeds Dick's benefit,Dick will pay Jane to keep his dog.

D) If Jane has the legal right to peace and quiet,no further transactions will be mutually beneficial.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An optimal tax on pollution would result in which of the following?

A) Producers will choose not to produce any pollution.

B) Producers will internalize the cost of the pollution.

C) Producers will maximize production.

D) The value to consumers at market equilibrium will exceed the social cost of production.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A negative externality

A) is a cost to a bystander.

B) is a cost to the buyer.

C) is a cost to the seller.

D) exists with all market transactions.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that your roommate is very messy.According to campus policy,you have a right to live in an uncluttered apartment.Suppose she gets a $200 benefit from being messy but imposes a $100 cost on you.The Coase theorem would suggest that an efficient solution would be for your roommate to

A) stop her messy habits or else move out.

B) pay you at least $100 but less than $200 to live with the clutter.

C) continue to be messy and force you to move out.

D) demand payment of at least $100 but no more than $200 to clean up after herself.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dioxin emission that results from the production of paper is a good example of a negative externality because

A) self-interested paper firms are generally unaware of environmental regulations.

B) there are fines for producing too much dioxin.

C) self-interested paper producers will not consider the full cost of the dioxin pollution they create.

D) toxic emissions are the best example of an externality.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that alcohol consumption creates a negative externality.What can the government do to equate the equilibrium quantity of alcohol and the socially optimal quantity of alcohol?

A) impose a tax on alcohol that is equal to the per-unit externality

B) offer a subsidy on alcohol that is equal to the per-unit externality

C) impose a regulation limiting the amount of alcohol that each consumer can purchase

D) nothing

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A positive externality

A) is a benefit to the producer of the good.

B) is a benefit to the consumer of the good.

C) is a benefit to someone other than the producer and consumer of the good.

D) results in an optimal level of output.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that flu shots create a positive externality equal to $12 per shot.Further suppose that the government offers a $15 per-shot subsidy to producers.What is the relationship between the equilibrium quantity and the socially optimal quantity of flu shots produced?

A) They are equal.

B) The equilibrium quantity is greater than the socially optimal quantity.

C) The equilibrium quantity is less than the socially optimal quantity.

D) There is not enough information to answer the question.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most taxes distort incentives and move the allocation of resources away from the social optimum.Why do corrective taxes avoid the disadvantages of most other taxes?

A) Corrective taxes apply only to goods that are bad for people's health,such as cigarettes and alcohol.

B) Because corrective taxes correct for market externalities,they take into consideration the well-being of bystanders.

C) Corrective taxes provide incentives for the conservation of natural resources.

D) Corrective taxes do not affect deadweight loss.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In some cases,tradable pollution permits may be better than a corrective tax because

A) pollution permits allow for a market solution while a corrective tax does not.

B) pollution permits generate more revenue for the government than a corrective tax.

C) pollution permits are never preferred over a corrective tax.

D) the government can set a maximum level of pollution using permits.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

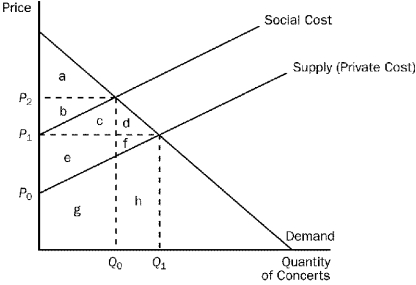

Figure 10-3  -Refer to Figure 10-3.The social cost curve is above the supply curve because

-Refer to Figure 10-3.The social cost curve is above the supply curve because

A) it takes into account the external costs imposed on society by the concert.

B) it takes into account the effect of local noise restrictions on concerts in parks surrounded by residential neighborhoods.

C) concert tickets are likely to cost more than the concert actually costs the organizers.

D) residents in the surrounding neighborhoods get to listen to the concert for free.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The Environmental Protection Agency (EPA)cannot reach a target level of pollution through the use of pollution permits.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dog owners do not bear the full cost of the noise their barking dogs create and often take too few precautions to prevent their dogs from barking.Local governments address this problem by

A) making it illegal to "disturb the peace."

B) having a well-funded animal control department.

C) subsidizing local animal shelters.

D) encouraging people to adopt cats.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Most economists prefer regulation to taxation because regulation corrects market inefficiencies at a lower cost than taxation does.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The term market failure refers to

A) a market that fails to allocate resources efficiently.

B) an unsuccessful advertising campaign which reduces demand.

C) ruthless competition among firms.

D) a firm that is forced out of business because of losses.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) Tradable pollution permits have an advantage over corrective taxes if the government is uncertain as to the optimal size of the tax necessary to reduce pollution to a specific level.

B) Both corrective taxes and tradable pollution permits provide market-based incentives for firms to reduce pollution.

C) Corrective taxes set the maximum quantity of pollution,whereas tradable pollution permits fix the price of pollution.

D) Both corrective taxes and tradable pollution permits reduce the cost of environmental protection and thus should increase the public's demand for a clean environment.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

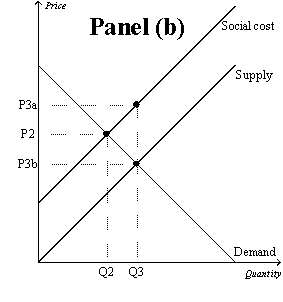

Figure 10-9

-Refer to Figure 10-9,Panel (b) .The market equilibrium quantity is

-Refer to Figure 10-9,Panel (b) .The market equilibrium quantity is

A) Q2,which is the socially optimal quantity.

B) Q3,which is the socially optimal quantity.

C) Q2,and the socially optimal quantity is Q3.

D) Q3,and the socially optimal quantity is Q2.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 352

Related Exams