A) rises because the supply of dollars in the market for foreign-currency exchange falls.

B) falls because the supply of dollars in the market for foreign-currency exchange rises.

C) rises because the demand for dollars in the market for foreign-currency exchange rises.

D) falls because the demand for dollars in the market for foreign-currency exchange falls.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If people decide that some country is now a more risky place to keep their saving, then at the original interest rate in that country there is a

A) surplus of loanable funds, so the interest rate increases.

B) surplus of loanable funds, so the interest rate decreases.

C) shortage of loanable funds, so the interest rate increases.

D) shortage of loanable funds, so the interest rate decreases.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Kenya experienced capital flight, the supply of Kenyan schillings in the market for foreign-currency exchange would shift

A) left, which would make the real exchange rate of the Kenyan schilling appreciate.

B) left, which would make the real exchange rate of the Kenyan schilling depreciate.

C) right, which would make the real exchange rate of the Kenyan schilling appreciate.

D) right, which would make the real exchange rate of the Kenyan schilling depreciate.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a country experiences capital flight, which of the following lists only curves that shift right?

A) the demand for loanable funds and the demand for dollars in the market for foreign-currency exchange

B) the demand for loanable funds and the supply of dollars in the market for foreign-currrency exchange

C) the supply of loanable funds and the demand for dollars in the market for foreign-currency exchange

D) the supply of loanable funds and the supply of dollars in the market for foreign-currency exchange

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the risk of buying U.S. assets rises because it is discovered that lending institutions had not carefully evaluated borrowers prior to lending them funds, then

A) the real exchange rate and the interest rate will rise.

B) the real exchange rate will rise and the interest rate will fall.

C) the real exchange rate will fall and the interest rate will rise.

D) the real exchange rate and the interest rate will fall.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would shift the demand for dollars in the market for foreign currency exchange to the right?

A) foreign citizens want to buy more U.S. goods and services at a given exchange rate

B) foreign citizens want to buy fewer U.S. goods and services at a given exchange rate

C) foreign citizens want to buy more U.S. bonds

D) foreign citizens want to by fewer U.S. bonds

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the real exchange rate is such that the market for foreign-currency exchange has a surplus. This surplus will lead to

A) an appreciation of the dollar, an increase in U.S. net exports, and so an increase in the quantity of dollars demanded in the foreign exchange market.

B) an appreciation of the dollar, a decrease in U.S. net exports, and so a decrease in the quantity of dollars demanded in the foreign exchange market.

C) a depreciation of the dollar, an increase in U.S. net exports, and so an increase in the quantity of dollars demanded in the foreign exchange market.

D) a depreciation of the dollar, a decrease in U.S. net exports, and so a decrease in the quantity of dollars demanded in the foreign exchange market.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would both make a country's real exchange rate rise?

A) its budget deficit increases and bonds issued in the country become riskier

B) bonds issued in that country become riskier and it imposes an import quota

C) it imposes an import quota and the budget deficit increases

D) None of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same, an increase in the U.S. real interest rate induces

A) Americans to buy more foreign assets, which increases U.S. net capital outflow.

B) Americans to buy more foreign assets, which reduces U.S. net capital outflow.

C) foreigners to buy more U.S. assets, which reduces U.S. net capital outflow.

D) foreigners to buy more U.S. assets, which increases U.S. net capital outflow.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In the 1980s, both the U.S. government budget and U.S. trade deficits increased.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would cause the real exchange rate of the U.S. dollar to depreciate?

A) the U.S. government budget deficit increases

B) capital flight from the United States

C) the U.S. imposes import quotas

D) None of the above is correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the quantity of loanable funds supplied is greater than the quantity demanded, then

A) there is a shortage of loanable funds and the interest rate will fall.

B) there is a shortage of loanable funds and the interest rate will rise.

C) there is a surplus of loanable funds and the interest rate will fall.

D) there is a surplus of loanable funds and the interest rate will rise.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the open-economy macroeconomic model, a higher U.S. real exchange rate makes

A) U.S. goods more expensive relative to foreign goods and reduces the quantity of dollars supplied.

B) U.S. goods more expensive relative to foreign goods and reduces the quantity of dollars demanded.

C) foreign goods more expensive relative to U.S. goods and reduces the quantity of dollars supplied.

D) foreign goods more expensive relative to U.S. goods and reduces the quantity of dollars demanded.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

In the open-economy macroeconomic model, at the equilibrium real interest rate, the amount that people (including government) want to save exactly balances desired domestic investment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the open-economy macroeconomic model, the supply of loanable funds equals

A) national saving. The demand for loanable funds comes from domestic investment + net capital outflow.

B) national saving. The demand for loanable funds comes only from domestic investment.

C) private saving. The demand for loanable funds comes from domestic investment + net capital outflow.

D) private saving. The demand for loanable funds comes only from domestic investment.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same, if the expected return on U.S. assets increased, the

A) supply of dollars in the market for foreign-currency exchange shifts right.

B) supply of dollars in the market for foreign-currency exchange shifts left.

C) demand for dollars in the market for foreign-currency exchange shifts right

D) demand for dollars in the market for foreign-currency exchange shifts left.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

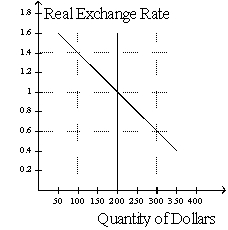

Figure 19-2  -Refer to Figure 19-2. What are the equilibrium values of the real exchange rate and net exports?

-Refer to Figure 19-2. What are the equilibrium values of the real exchange rate and net exports?

A) 1.4, 100

B) 1, 200

C) .6, 300

D) None of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the budget surplus

A) raises net exports and domestic investment.

B) raises net exports and reduces domestic investment.

C) reduces net exports and raises domestic investment.

D) reduces net exports and domestic investment.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In the open-economy macroeconomic model, other things the same, when a U.S. resident imports a foreign good, the demand for dollars in the foreign-currency exchange market decreases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the open-economy macroeconomic model, if the supply of loanable funds shifts right

A) the interest rate rises and the demand for dollars in the market for foreign currency exchange shifts right.

B) the interest rate rises and the demand for dollars in the market for foreign currency exchange shifts left.

C) the interest rate falls and the supply of dollars in the market for foreign-currency exchange shifts right.

D) the interest rate falls and the supply of dollars in the market for foreign currency exchange shifts left.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 374

Related Exams