A) capital flight from the United States

B) the government budget deficit increases

C) the U.S. imposes import quotas

D) None of the above is correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following decreases if the U.S. imposes an import quota on computer components?

A) U.S. imports and U.S. exports.

B) U.S. imports but not U.S. exports.

C) U.S. exports but not U.S. imports.

D) Neither U.S. exports nor U.S. imports.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the real exchange rate for the dollar is above the equilibrium level, the quantity of dollars supplied in the market for foreign-currency exchange is

A) greater than the quantity demanded and the dollar will appreciate.

B) greater than the quantity demanded and the dollar will depreciate.

C) less than the quantity demanded and the dollar will appreciate.

D) less than the quantity demanded and the dollar will depreciate.

F) A) and C)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

An increase in the budget deficit causes domestic interest rates

A) and investment to rise.

B) to rise and investment to fall.

C) to fall and investment to rise.

D) and investment to fall.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

As the interest rate rises, it is possible that net capital outflow could move from a positive to a negative value.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

Capital flight shifts the NCO curve to the left.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In equilibrium a country has a net capital outflow of $200 billion and domestic investment of $150 billion. What is the quantity of loanable funds demanded?

A) $50 billion

B) $150 billion

C) $200 billion

D) $350 billion

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When Mexico suffered from capital flight in 1994, U.S. demand for loanable funds

A) and U.S. net capital outflow rose.

B) and U.S. net capital outflow fell.

C) fell and U.S. net capital outflow rose.

D) rose and U.S. net capital outflow fell.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the U.S. government imposes a quota on toy imports, then

A) net capital outflow rises.

B) net exports rise.

C) the exchange rate rises.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in real interest rates in the United States changes the quantity of loanable funds demanded because

A) U.S. residents will want to buy more foreign assets.

B) Foreign residents will want to buy fewer foreign assets.

C) U.S. firms will want to purchase fewer U.S. capital goods.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Net capital outflow represents the quantity of dollars supplied in the foreign-currency exchange market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the open-economy macroeconomic model, if net capital outflow increases then

A) the demand for dollars in the market for foreign-currency exchange shifts right.

B) the demand for dollars in the market for foreign-currency exchange shifts left.

C) the supply of dollars in the market for foreign-currency exchange shifts right.

D) the supply of dollars in the market for foreign-currency exchange shifts left.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the world thought that many banks in a certain country were at or near the point of bankruptcy, then that country's real exchange rate

A) and net exports would rise.

B) would rise and net exports would fall.

C) would fall and net exports would rise.

D) and net exports would fall.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the U.S. imposes an import quota on lumber. The quota makes the real exchange rate of the U.S. dollar

A) appreciate but does not change the real interest rate in the United States.

B) appreciate and the real interest rate in the United States increase.

C) depreciate and the real interest rate in the United States decrease.

D) depreciate but does not change the real interest rate in the United States.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When a country imposes a trade restriction, the real exchange rate of that country's currency appreciates.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

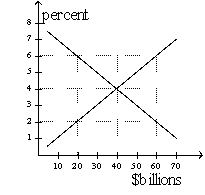

Figure 19-1  -Refer to Figure 19-1. In the Figure shown, if the real interest rate is 6 percent, there will be pressure for

-Refer to Figure 19-1. In the Figure shown, if the real interest rate is 6 percent, there will be pressure for

A) the real interest rate to fall.

B) the demand for loanable funds curve to shift left.

C) the supply for loanable funds curve to shift right.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that Chile has a government budget surplus, and then goes into deficit. This change would

A) increase national saving and shift Chile's supply of loanable funds left.

B) increase national saving and shift Chile's demand for loanable funds right.

C) decrease national saving and shift Chile's supply of loanable funds left.

D) decrease national saving and shift Chile's demand for loanable funds right.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In the long run import quotas do not affect the size of net exports.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When Mexico suffered from capital flight in 1994, Mexico's net exports

A) decreased.

B) did not change.

C) increased.

D) decreased until the peso appreciated, then increased.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government of a country with a zero trade balances increases its budget deficit, then interest rates

A) rise and the trade balance moves to a surplus.

B) rise and the trade balance moves to a deficit.

C) fall and the trade balance moves to a surplus.

D) fall and the trade balance moves to a deficit.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 374

Related Exams