A) M1 = $830 billion, M2 = $4,370 billion.

B) M1 = $980 billion, M2 = $4,370 billion.

C) M1 = $980 billion, M2 = $3, 390 billion.

D) M1 = $1,020 billion, M2 = $3,390 billion.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

As banks create money, they create wealth.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Marc puts prices on surfboards and skateboards at his sporting goods store. He is using money as a unit of account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The set of items that serve as media of exchange clearly includes

A) balances that lie behind debit cards.

B) demand deposits.

C) other checkable depositis.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If people decide to hold more currency relative to deposits, the money supply

A) falls. The Fed could lessen the impact of this by buying Treasury bonds.

B) falls. The Fed could lessen the impact of this by selling Treasury bonds.

C) rises. The Fed could lessen the impact of this by buying Treasury bonds.

D) rises. The Fed could lessen the impact of the by selling Treasury bonds.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

An increase in the reserve requirement ratio increases reserves and decreases the money supply.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the money multiplier decreased from 20 to 12.5, then

A) the Fed increased the reserve ratio from 5 percent to 8 percent.

B) the Fed increased the fed funds rate from 5 percent to 8 percent..

C) the Fed decreased the reserve ratio from 8 percent to 5 percent.

D) the Fed decreased the fed funds rate from 8 percent to 5 percent.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Soviet government in the 1980's never abandoned the ruble as the official currency. However, the people of Moscow preferred to accept

A) cigarettes in exchange for goods and services, because they were convinced that cigarettes were going to soon become hard to come by.

B) American dollars in exchange for goods and services, because rubles were extremely hard to come by.

C) goods such as cigarettes or American dollars in exchange for goods and services, reminding us of the fact that government decree by itself is not sufficient for the success of a commodity money.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Credit card limits are included in

A) M1 but not M2.

B) M2 but not M1.

C) M1 and M2.

D) neither M1 nor M2.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

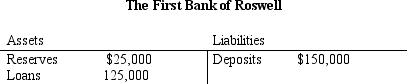

Table 16-4.  -Refer to Table 16-4. Suppose the bank faces a reserve requirement of 10 percent. Starting from the situation as depicted by the T-account, a customer deposits an additional $50,000 into his account at the bank. If the bank takes no other action it will

-Refer to Table 16-4. Suppose the bank faces a reserve requirement of 10 percent. Starting from the situation as depicted by the T-account, a customer deposits an additional $50,000 into his account at the bank. If the bank takes no other action it will

A) have $65,000 in excess reserves.

B) have $55,000 in excess reserves.

C) need to raise an additional $5,000 of reserves to meet the reserve requirement ratio

D) None of the above is correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On a bank's T-account, which are part of the banks liabilities?

A) both deposits made by its customers and reserves

B) deposits made by its customers but not reserves

C) reserves but not deposits made by its customers

D) neither deposits made by its customers nor reserves

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the public decides to hold more currency and fewer deposits in banks, bank reserves

A) decrease and the money supply eventually decreases.

B) decrease but the money supply does not change.

C) increase and the money supply eventually increases.

D) increase but the money supply does not change.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following groups is largely responsible for carrying out the Fed's tasks of regulating banks and ensuring the health of the financial system?

A) FOMC

B) the Board of Governors

C) the New York Fed

D) the regional Federal Reserve Banks

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a system of 100-percent-reserve banking,

A) banks do not accept deposits.

B) banks do not influence the supply of money.

C) loans are the only asset item for banks.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose banks desire to hold no excess reserves and that the Fed has set a reserve requirement of 10 percent. If you deposit $9,000 into First Jayhawk Bank,

A) First Jayhawk's required reserves increase by $900.

B) First Jayhawk will be able to lend out $8,100.

C) First Jayhawk's assets and liabilities both will increase by $9,000.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Just after the terrorist attack on September 11, 2001, the Fed stood ready to lend financial institutions funds. When the Fed did this, it was acting in its role of lender of last resort.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One surprising thing about the U.S. money stock is that

A) banks hold so much currency relative to the public.

B) the public holds so much currency relative to banks.

C) there is so little currency per person.

D) there is so much currency per person.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

U.S. dollars are an example of commodity money and hides used to make trades are an example of fiat money.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When you purchase school supplies at the book store using cash, you are using money as a medium of exchange.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fed's primary tool to change the money supply is

A) changing the interest rate on reserves.

B) changing the reserve requirement.

C) conducting open market operations.

D) redeeming Federal Reserve notes.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 423

Related Exams