A) 8

B) 10

C) 12

D) 14

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Braden says that $400 saved for one year at 4 percent interest has a smaller future value than $400 saved for two years at 2 percent interest. Lefty says that the present value of $400 to be received one year from today if the interest rate is 4 percent exceeds the present value of $400 to be received two years from today if the interest rate is 2 percent.

A) Braden and Lefty are both correct.

B) Braden and Lefty are both incorrect.

C) Only Braden is correct.

D) Only Lefty is correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the 1990s, Fed Chair Alan Greenspan believed that the market was

A) undervalued, and evidence later showed that this was clearly correct.

B) undervalued, but whether it was remains debatable.

C) overvalued, and evidence later showed that this was clearly correct.

D) overvalued, but whether it was remains debatable.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

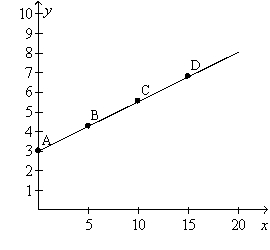

Figure 14-5. On the graph, x represents risk and y represents return.  -Refer to Figure 14-5. Point A represents a situation in which

-Refer to Figure 14-5. Point A represents a situation in which

A) all of a person's savings are allocated to a class of safe assets.

B) the person knows with certainty that his or her return will be 3 percent.

C) the standard deviation of the person's portfolio is zero.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have a contract with someone who has agreed to pay you $20,000 in four years. She offers to pay you now instead. For which of the following interest rates and payments would you take the money today?.

A) 8 percent, $15,000

B) 7 percent, $16,000

C) 6 percent, $17,000

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fundamental analysis is

A) the study of the relation between risk and return of stock portfolios.

B) the determination of the allocation of savings between stocks and bonds based on a person's degree of risk aversion.

C) the study of a company's accounting statements and future prospects to determine its value.

D) a method used to determine how adding stocks to a portfolio will change the risk of the portfolio.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In effect, an annuity provides insurance

A) against the risk of dying and leaving one's family without a regular income.

B) against the risk of living too long.

C) to people who are not risk-averse.

D) to people whose utility functions do not display the usual properties.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the present value of a payment of $200 to be made one year from today if the interest rate is 10 percent?

A) $180

B) $181.82

C) $220

D) $222.22

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At which interest rate is the present value of $35.00 two years from today equal to about $30.00 today?

A) 5 percent

B) 6 percent

C) 7 percent

D) 8 percent

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

ZZL Corporation has the opportunity to undertake an investment project that will cost $20,000 today. If the interest rate is 20 percent and if the project will yield the company $30,000 in 3 years, then ZZL will undertake the project.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you are deciding whether to buy a particular bond. If you buy the bond and hold it for 4 years, then at that time you will receive a payment of $10,000. If the interest rate is 6 percent, you will buy the bond if its price today is no greater than

A) $8,225.06.

B) $7,920.94.

C) $7,672.58.

D) $6,998.98.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) The higher average return on stocks than on bonds comes at the price of higher risk.

B) Risk-averse persons will take the risks involved in holding stocks if the average return is high enough to compensate for the risk.

C) Insurance markets reduce risk, but not by diversification.

D) Risk can be reduced by placing a large number of small bets, rather than a small number of large bets.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A risk-averse person

A) has a utility curve where the slope increases with wealth, and might take a bet with a 70 percent chance of wining $400 and a 30 per chance of losing $400.

B) has a utility curve where the slope increases with wealth, and would never take a bet with a 70 percent chance of wining $400 and a 30 per cent chance of losing $400.

C) has a utility curve where the slope decreases with wealth, and might take a bet with a 70 percent chance of wining $400 and a 30 per chance of losing $400.

D) has a utility curve where the slope decreases with wealth, and would never take a bet with a 70 percent chance of wining $400 and a 30 per cent chance of losing $400.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The possibility of speculative bubbles in the stock market arises in part because

A) stock prices may not depend at all on psychological factors.

B) fundamental analysis may be the correct way to evaluate the value of stocks.

C) future streams of dividend payments are very hard to estimate.

D) the value of shares of stock depends not only on the future stream of dividend payments but also on the price at which the stock will be sold.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the future value of $750 one year from today if the interest rate is 2.5 percent?

A) $766.50

B) $768.75

C) $770.23

D) None of the above are correct to the nearest cent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm has three different investment options, each costing $10 million. Option A will generate $12 million in revenue at the end of one year. Option B will generate $15 million in revenue at the end of two years. Option C will generate $18 million in revenue at the end of three years. Which option should the firm choose?

A) Option A

B) Option B

C) Option C

D) The answer depends on the rate of interest, which is not specified here.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Susan put $375 into an account and one year later had $405. What interest rate was paid on Susan's deposit?

A) 5 percent

B) 7 percent

C) 8 percent

D) 10 percent

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the 1990s, Fed Chairperson Alan Greenspan questioned whether the stock market

A) boom at that time reflected "irrational exuberance."

B) decline at that time reflected "irrational funk."

C) boom at that time reflected "rational exuberance."

D) decline at that time reflected "rational funk."

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kayla faces risks and she pays a fee to ABC Company; in return, ABC Company agrees to accept some or all of Kayla's risks. ABC Company is

A) a mutual fund.

B) an insurance company.

C) a diversified company.

D) an equity-financed company.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the present value of a payment of $150 one year from today if the interest rate is 6 percent?

A) $141.11

B) $141.36

C) $141.75

D) None of the above are correct to the nearest cent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 419

Related Exams