A) 450 million merits and $150 million merits

B) 410 million merits and $150 million merits

C) 330 million merits and $270 million merits

D) 290 million merits and $270 million merits

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

It is claimed that a secondary advantage of mutual funds is that

A) an investor can avoid investment charges and fees.

B) they give ordinary people access to loanable funds for investing.

C) they usually outperform stock market indexes.

D) they give ordinary people access to the skills of professional money managers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fortunade Corporation stock has a price of $100 per share, a dividend of $1.60 per share, and retained earnings of $2.00 per share. The dividend yield on this stock is

A) 2.8 percent.

B) 2.0 percent.

C) 1.6 percent.

D) 0.4 percent.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

When a firm wants to borrow directly from the public to finance the purchase of new equipment, it does so by selling bonds.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

To state that public saving is equal to investment, for a closed economy, is to state an accounting identity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

By definition, government purchases and taxes are zero for a closed economy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a closed economy, private saving is

A) the amount of income that households have left after paying for their taxes and consumption.

B) the amount of income that businesses have left after paying for the factors of production.

C) the amount of tax revenue that the government has left after paying for its spending.

D) always equal to investment.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The real interest rate is the

A) interest rate corrected for inflation.

B) interest rate as usually reported by banks.

C) difference between the interest rate charged by banks on the loans they make and the interest rate paid by banks to their depositors.

D) difference between the average dividend yield on stocks and the average interest rate on bonds.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Index funds are usually outperformed by mutual funds that are actively managed by professional money managers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the budget deficit increases then

A) saving and the interest rate rise

B) saving rises and the interest rate falls

C) saving falls and the interest rate rises

D) saving and the interest rate falls

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The source of the supply of loanable funds

A) is saving and the source of demand for loanable funds is investment.

B) is investment and the source of demand for loanable funds is saving.

C) and the demand for loanable funds is saving.

D) and the demand for loanable funds is investment.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the quantity of loanable funds demanded exceeds the quantity of loanable funds supplied,

A) there is a surplus so interest rates will rise.

B) there is a surplus so interest rates will fall.

C) there is a shortage so interest rates will rise.

D) there is a shortage so interest rates will fall.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

To state that national saving is equal to investment, for a closed economy, is to state an accounting identity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 13-1. Assume the following information for an imaginary, closed economy. -Refer to Scenario 13-1. For this economy, investment amounts to

A) $4,000.

B) $9,000.

C) $12,000.

D) $16,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The term loanable funds refers to all income that is not used for consumption or government expenditures.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2002 mortgage rates fell and mortgage lending increased. Which of the following could explain both of these changes?

A) The demand for loanable funds shifted rightward.

B) The demand for loanable funds shifted leftward.

C) The supply of loanable funds shifted rightward.

D) The supply of loanable funds shifted leftward.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a large, well-known corporation wishes to borrow directly from the public, it can

A) sell bonds.

B) sell shares of stock.

C) go to a bank for a loan.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a country has only a sales tax. Now suppose it replaces the sales tax with an income tax that includes a tax on interest income. This would make equilibrium

A) interest rates and the equilibrium quantity of loanable funds rise.

B) interest rates rise and the equilibrium quantity of loanable funds fall.

C) interest rates fall and the equilibrium quantity of loanable funds rise.

D) interest rates and the equilibrium quantity of loanable funds fall.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

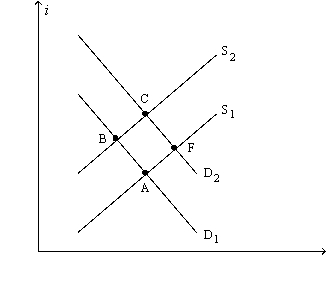

Figure 13-3. The figure shows two demand-for-loanable-funds curves and two supply-of-loanable-funds curves.  -Refer to Figure 13-3. Which of the following movements shows the effects of the government going from a budget deficit to a budget surplus?

-Refer to Figure 13-3. Which of the following movements shows the effects of the government going from a budget deficit to a budget surplus?

A) a movement from Point A to Point B

B) a movement from Point B to Point A

C) a movement from Point A to Point F

D) a movement from Point C to Point B

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A larger budget deficit

A) raises the interest rate and investment.

B) reduces the interest rate and investment.

C) raises the interest rate and reduces investment.

D) reduces the interest rate and raises investment.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 221 - 240 of 473

Related Exams