B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Minimum-wage laws dictate the

A) average price employers must pay for labor.

B) highest price employers may pay for labor.

C) lowest price employers may pay for labor.

D) the highest and lowest prices employers may pay for labor.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose there is currently a tax of $50 per ticket on airline tickets. Buyers of airline tickets are required to pay the tax to the government. If the tax is reduced from $50 per ticket to $30 per ticket, then the

A) demand curve will shift upward by $20, and the price paid by buyers will decrease by less than $20.

B) demand curve will shift upward by $20, and the price paid by buyers will decrease by $20.

C) supply curve will shift downward by $20, and the effective price received by sellers will increase by less than $20.

D) supply curve will shift downward by $20, and the effective price received by sellers will increase by $20.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An outcome that can result from either a price ceiling or a price floor is

A) a surplus in the market.

B) a shortage in the market.

C) a nonbinding price control.

D) long lines of frustrated buyers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the buyers of a product, then the demand curve will

A) not shift.

B) shift down.

C) shift up.

D) become flatter.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

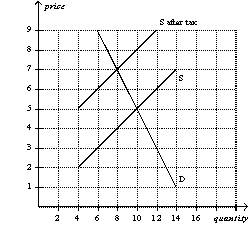

Figure 6-21  -Refer to Figure 6-21. Suppose the same supply and demand curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the sellers of the good, rather than the buyers, are required to pay the tax to the government. After the sellers are required to pay the tax, relative to the case depicted in the graph, the burden on buyers will be

-Refer to Figure 6-21. Suppose the same supply and demand curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the sellers of the good, rather than the buyers, are required to pay the tax to the government. After the sellers are required to pay the tax, relative to the case depicted in the graph, the burden on buyers will be

A) larger, and the burden on sellers will be smaller.

B) smaller, and the burden on sellers will be larger.

C) the same, and the burden on sellers will be the same.

D) The relative burdens in the two cases cannot be determined without further information.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The quantity sold in a market will decrease if the government decreases a

A) binding price floor in that market.

B) binding price ceiling in that market.

C) tax on the good sold in that market.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

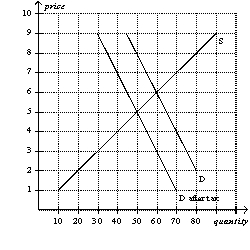

Figure 6-4  -Refer to Figure 6-4. A government-imposed price of $6 in this market could be an example of a (i)

Binding price ceiling.(ii)

Non-binding price ceiling.(iii)

Binding price floor.(iv)

Non-binding price floor.

-Refer to Figure 6-4. A government-imposed price of $6 in this market could be an example of a (i)

Binding price ceiling.(ii)

Non-binding price ceiling.(iii)

Binding price floor.(iv)

Non-binding price floor.

A) (i) only

B) (ii) only

C) (i) and (iv) only

D) (ii) and (iii) only

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The primary effect of rent control in the short run is to reduce rents.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A binding minimum wage creates a shortage of labor.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You receive a paycheck from your employer, and your pay stub indicates that $400 was deducted to pay the FICA (Social Security/Medicare) tax. Which of the following statements is correct?

A) This type of tax is an example of a payback tax.

B) Your employer is required by law to pay $400 to match the $400 deducted from your check.

C) The $400 that you paid is the true burden of the tax that falls on you, the employee.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

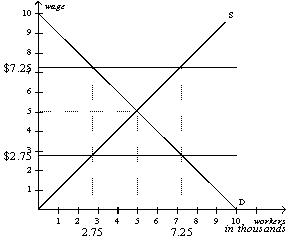

Figure 6-13  -Refer to Figure 6-13. In this market, a minimum wage of $7.25 is

-Refer to Figure 6-13. In this market, a minimum wage of $7.25 is

A) binding and creates a labor shortage.

B) binding and creates unemployment.

C) nonbinding and creates a labor shortage.

D) nonbinding and creates neither a labor shortage nor unemployment.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

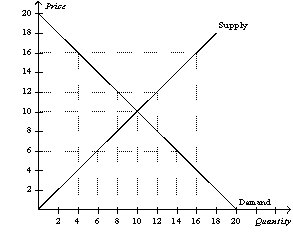

Figure 6-6  -Refer to Figure 6-6. Which of the following price ceilings would be binding in this market?

-Refer to Figure 6-6. Which of the following price ceilings would be binding in this market?

A) $8

B) $10

C) $12

D) $14

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the sellers of coffee mugs

A) increases the size of the coffee mug market.

B) decreases the size of the coffee mug market.

C) has no effect on the size of the coffee mug market.

D) may increase, decrease, or have no effect on the size of the coffee mug market.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a short-run effect of rent control on the housing market?

A) reduced rents

B) a large shortage

C) a small increase in quantity demanded

D) a small decrease in quantity supplied

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the buyers of dog food, then

A) buyers will bear the entire burden of the tax.

B) sellers will bear the entire burden of the tax.

C) buyers and sellers will share the burden of the tax.

D) the government will bear the entire burden of the tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is the burden of a tax divided? (i) When the tax is levied on the sellers, the sellers bear a higher proportion of the tax burden.(ii) When the tax is levied on the buyers, the buyers bear a higher proportion of the tax burden.(iii) Regardless of whether the tax is levied on the buyers or the sellers, the buyers and sellers bear an equal proportion of the tax burden.(iv) Regardless of whether the tax is levied on the buyers or the sellers, the buyers and sellers bear some proportion of the tax burden.

A) (i) and (ii) only

B) (iv) only

C) (i) , (ii) , and (iii) only

D) (i) , (ii) , and (iv) only

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Since half of the FICA tax is paid by firms and the other half is paid by workers, the burden of the tax must fall equally on firms and workers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Most economists are in favor of price controls as a way of allocating resources in the economy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

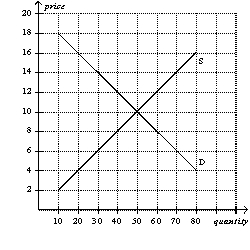

Figure 6-19  -Refer to Figure 6-19. The effective price received by sellers after the tax is imposed is

-Refer to Figure 6-19. The effective price received by sellers after the tax is imposed is

A) $3.

B) $4.

C) $5.

D) $7.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 501 - 520 of 556

Related Exams