A) education

B) social services

C) transportation and communication

D) police and protection

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Larry faces a progressive tax structure that has the following marginal tax rates: 0 percent on the first $10,000,10 percent on the next $10,000,15 percent on the next $10,000,25 percent on the next $10,000,and 40 percent on all additional income.If Larry earns $75,000,what is his average tax rate

A) 20 percent

B) 25.33 percent

C) 30 percent

D) 36.67 percent

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the most meaningful measure if we are trying to gauge how much the income tax system distorts incentives

A) the average tax rate

B) the deadweight loss

C) total tax revenue collected

D) the marginal tax rate

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the marginal tax rate equals the average tax rate,what is the tax called

A) proportional

B) progressive

C) regressive

D) egalitarian

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is a payroll tax

A) a tax on the wages that a firm pays its workers

B) a tax on each additional dollar of income earned by a worker

C) a tax on specific goods like gasoline and cigarettes

D) a tax on a firm based on the number of workers it has on its payroll

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An efficient tax system is one that imposes small deadweight losses and small administrative burdens.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

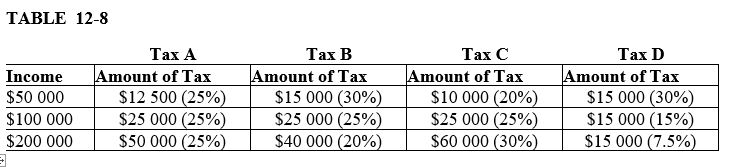

-Refer to Table 12-8.Which tax illustrates a lump-sum tax

-Refer to Table 12-8.Which tax illustrates a lump-sum tax

A) tax A

B) tax B

C) tax C

D) tax D

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the single largest expenditure by provincial governments

A) social services

B) debt service

C) health

D) education

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

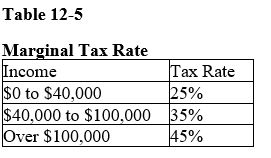

Table 12-5  -Refer to Table 12-5.What is the approximate average tax rate for a person who makes $130,000

-Refer to Table 12-5.What is the approximate average tax rate for a person who makes $130,000

A) 30%

B) 40%

C) 50%

D) 60%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How do provincial governments receive revenue from within the tax system

A) They are funded entirely by their own tax base.

B) They receive the majority of their tax revenues from corporate income tax.

C) They are generally not responsible for collecting sales tax.

D) They receive some of their funds from the federal government.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What determines the deadweight loss of an income tax

A) the amount of total tax revenue to the government

B) the marginal tax rate

C) the average tax rate

D) the loss in consumer surplus when the tax is imposed

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

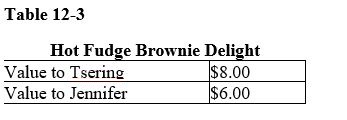

Table 12-3

-Refer to Table 12-3.If the government imposes a $2.00 tax on Delights,causing the price to increase from $5.00 to $7.00,what happens to total consumer surplus

-Refer to Table 12-3.If the government imposes a $2.00 tax on Delights,causing the price to increase from $5.00 to $7.00,what happens to total consumer surplus

A) It falls by less than the tax revenue generated.

B) It falls by more than the tax revenue generated.

C) It falls by the same amount as the tax revenue generated.

D) It will not fall since Jennifer will no longer be in the market.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

According to the ability-to-pay principle,it is fair for people to pay taxes based on their ability to handle the financial burden.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is an advantage of a consumption tax over the present tax system

A) A consumption tax is much harder for taxpayers to cheat.

B) A consumption tax would save the government millions in administrative costs.

C) A consumption tax places more of the tax burden on the wealthy.

D) A consumption tax does not discourage saving.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

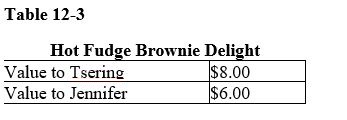

Table 12-3

-Refer to Table 12-3.If the government imposes a $2.00 tax on Delights,causing the price to increase from $5.00 to $7.00,what happens to total consumer surplus

-Refer to Table 12-3.If the government imposes a $2.00 tax on Delights,causing the price to increase from $5.00 to $7.00,what happens to total consumer surplus

A) It will fall from $3 to $1.

B) It will fall from $4 to $1.

C) It will fall from $7 to $3.

D) It will fall from $7 to $4.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement best describes the flypaper theory of tax incidence

A) It ignores the indirect effects of taxes.

B) It assumes that most taxes should be "stuck on" the rich.

C) It says that once a tax has been imposed, there is little chance of it changing, so in essence people are stuck with it.

D) It is how taxes are described: like flies, they are everywhere and they will never go away.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-1 Suppose Jeremy and Kelsey receive great satisfaction from their consumption of turkey.Kelsey would be willing to purchase only one slice and would pay up to $5 for it.Jeremy would be willing to pay $8 for his first slice, $6 for his second slice, and $2 for his third slice.The current market price is $2 per slice. -Refer to Scenario 12-1.How much total consumer surplus do Kelsey and Jeremy collectively receive from consuming turkey when it is priced at $2 a slice

A) $3

B) $6

C) $9

D) $12

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is a tax system best defined if it is characterized by small deadweight losses and small administrative burdens

A) equitable

B) communistic

C) capitalistic

D) efficient

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The administrative burden of complying with the tax laws is a cost to the government,but not to taxpayers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is part of the administrative burden of a tax associated with

A) the money people pay to the government in taxes

B) reducing the size of the market because of the tax

C) the time taxpayers spend filling out tax forms

D) the cost of administering programs that use tax revenue

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 200

Related Exams