A) 17%

B) 27%

C) 37%

D) 47%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On what basis can the benefits principle of taxation be used to argue that wealthy citizens should pay higher taxes than poorer ones

A) Police services are more frequently used in poor neighbourhoods.

B) The wealthy benefit more from services provided by government than the poor.

C) The poor are more active in political processes.

D) The poor places a greater dollar value on public goods than the rich.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

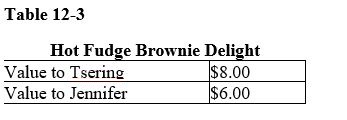

Table 12-3

-Refer to Table 12-3.If the government imposes a $2.00 tax on Delights,causing the price to increase from $5.00 to $7.00,why does a deadweight loss arise

-Refer to Table 12-3.If the government imposes a $2.00 tax on Delights,causing the price to increase from $5.00 to $7.00,why does a deadweight loss arise

A) Jennifer will pay more tax as a percentage of her value of Delights than Tsering.

B) Tsering must pay the $2.00 tax from his consumer surplus.

C) Tsering will have to pay a higher price for Delights.

D) Jennifer will leave the market.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why do taxes create deadweight losses

A) They reduce profits of firms.

B) They distort incentives.

C) They cause prices to rise.

D) They create revenue for the government.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What does the "flypaper theory" of taxation suggest

A) The burden of a tax will seldom fall on its intended target and is, therefore, unfair.

B) The benefits principle of taxation is not a viable option for policymakers.

C) Tax loopholes are available to the wealthiest citizens.

D) The burden of a tax will always fall on its intended target and is, therefore, equitable.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Canadian federal government spends its revenues in a number of ways.What is the rank of the following spending categories from largest to smallest

A) CHST, equalization, national defence, EI

B) CHST, EI, Old Age Security, net interest

C) Old Age Security, CHST, national defence, federal judicial system

D) Old Age Security, EI, national defence, CHST

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-1 Suppose Jeremy and Kelsey receive great satisfaction from their consumption of turkey.Kelsey would be willing to purchase only one slice and would pay up to $5 for it.Jeremy would be willing to pay $8 for his first slice, $6 for his second slice, and $2 for his third slice.The current market price is $2 per slice. -Refer to Scenario 12-1.If a tax of $2 is levied on each slice of turkey,what is the deadweight loss of the tax

A) $0

B) $3

C) $6

D) $8

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is one reason that deadweight losses are so difficult to avoid

A) Taxes distort the decisions that people make.

B) Income taxes are not paid by everyone.

C) Consumption taxes must be universally applied to all commodities.

D) Administrative burden and deadweight loss reflect a clear tradeoff to policymakers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"A $1000 tax paid by a poor person may be a larger sacrifice than a $10,000 tax paid by a wealthy person." What is this argument based on

A) the horizontal equity principle

B) the benefits principle

C) a regressive tax argument

D) the ability-to-pay principle

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Approximately what percentage of the federal government's receipts come from personal income taxes

A) 10

B) 25

C) 35

D) 48

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Tax evasion is legal,but tax avoidance is illegal.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What principle holds that people should pay taxes based on the benefits they receive from government services

A) the welfare principle

B) the tax-benefit principle

C) the government services principle

D) the benefits principle

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the most common explanation for payments to senior citizens accounting for a larger share of federal government expenditures

A) increases in life expectancy

B) people becoming eligible for Old Age Security benefits at an earlier age

C) increases in birth rates among teenagers and the poor

D) falling payroll tax receipts

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2013-2014,what was the total spending per person by the federal government

A) $4750

B) $5445

C) $6410

D) $7644

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is a Children's Fitness Tax Credit considered to be

A) tax evasion

B) a subsidy to the poor

C) a deduction that benefits all members of society equally

D) a tax loophole

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why are lump-sum taxes rarely used in the real world

A) While lump-sum taxes have low administrative burdens, they have high deadweight losses.

B) While lump-sum taxes have low deadweight losses, they have high administrative burdens.

C) Lump-sum taxes take the same amount of money from both poor and rich taxpayers.

D) Lump-sum taxes are very inefficient.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With a lump-sum tax,how is the average tax rate evaluated

A) The average tax rate is always equal to zero.

B) The average tax rate is always less than the marginal tax rate.

C) The average tax rate falls as income rises.

D) The average tax rate rises as income rises.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a poor family has three children in public school and a rich family has two children in private school,what would the benefits principle suggest

A) The poor family should pay more in taxes to pay for public education than the rich family.

B) The rich family should pay more in taxes to pay for public education than the poor family.

C) The benefits of private school exceed those of public school.

D) Public schools should be financed by property taxes.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What do social services primarily consist of

A) welfare programs for low-income people

B) a government health plan for the poor

C) the same services as Old Age Security

D) pensions collected for the infirm

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What does a person's tax liability refer to

A) the percentage of income that a person must pay in taxes

B) the amount of tax a person owes to the government

C) the amount of tax the government is required to refund each person

D) deductions that can be legally subtracted from a person's income each year

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 200

Related Exams