A) the profit margin of each concert

B) the cost of spillover effects from the concert (e.g., noise and traffic)

C) the value of concerts to society as a whole

D) the amount by which the city should subsidize the concert organizers

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To enhance the well-being of society,when will a social planner encourage firms to increase production

A) when the firms are producing basic goods

B) when there is a shortage in the market

C) when technology spillovers are associated with production

D) when any negative externalities associated with production are imposed only upon consumers

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

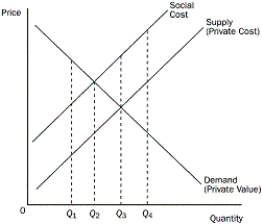

Figure 10-2

-Refer to Figure 10-2.What is the market equilibrium quantity

-Refer to Figure 10-2.What is the market equilibrium quantity

A) Q₁

B) Q₂

C) Q₃

D) Q₄

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What does research into new technologies lead to

A) It provides positive externalities because it creates knowledge others can use.

B) It results in negative externalities because government funding for research leads to cuts in government spending in other areas.

C) It results in negative externalities because too many resources are used for the small benefits received by society.

D) It provides positive externalities because it increases profits for the company that receives government funding for research.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What does internalizing an externality refer to

A) making buyers and sellers take into account the external effects of their actions

B) making certain that all transactions benefit only buyers and sellers

C) making certain government does not disrupt the internal workings of the market

D) making buyers pay the full price for the products they purchase

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When correcting for an externality,command-and-control policies are always preferable to market-based policies.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What are corrective taxes enacted to do

A) give inventors exclusive rights to their inventions

B) correct for the effects of negative externalities

C) discourage production of undesirable products

D) adjust markets with positive externalities

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How do local governments address the problem of barking dogs

A) by imposing leash laws

B) by requiring owners to purchase "bark collars" for their pets

C) by imposing disturbing the peace laws

D) by funding animal control departments

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A technology spillover is a type of negative externality.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hikers frequently claim that livestock grazing in Wilderness Recreation Areas reduces the satisfaction of their recreational hiking experience.What is the economic explanation for this conflict

A) Hikers do not value livestock as much as ranchers.

B) Grazing cows create negative externalities that make hiking less pleasant.

C) Ranchers are insensitive to the recreational use of public lands.

D) Grazing cows is a profit-generating activity, but hiking is not.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Government can be used to solve externality problems that are too costly for private parties to solve.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If only a few people are affected by an externality,what will likely happen

A) Corrective taxes will provide the most efficient solution to the externality.

B) Command-and-control regulation will provide the most efficient solution to the externality.

C) A private solution to the inefficiency will occur.

D) A private solution will be very difficult to negotiate.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the difference between a corrective tax and pollution permits

A) A corrective tax sets the price of pollution, and permits set the quantity of pollution.

B) A corrective tax provides a more efficient outcome than permits.

C) A corrective tax sets the quantity of pollution, and permits set the price of pollution.

D) Permits provide a more efficient outcome than a corrective tax.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why do private markets fail to reach a socially optimal level when negative externalities are present

A) Private benefit exceeds social benefit at the private market solution.

B) Private costs exceed social costs at the private market solution.

C) Social costs exceed private costs at the private market solution.

D) Social benefit exceeds private benefit at the private market solution.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Most economists prefer regulation to taxation because regulation corrects market inefficiencies at a lower cost than taxation does.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What does the Coase theorem suggest about private solutions to the externality problem

A) They will always allocate resources efficiently if private parties can bargain without cost.

B) They are effective under all conditions.

C) They are only efficient when there are negative externalities.

D) They may not be possible because of the distribution of property rights.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What will a positive externality cause a private market to produce

A) less than is socially desirable

B) more than is socially desirable

C) more than market equilibrium

D) less than market equilibrium

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the government chooses an externality policy that aligns private incentives with social efficiency to solve an externality,what does it do

A) It provides incentives for private decision makers to solve the externality problem on their own.

B) It typically uses command-and-control techniques.

C) It follows a rule that the use of taxes is strictly forbidden.

D) It follows a rule that subsidies are always the best policy.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

According to the Coase theorem,the private market will need government intervention in order to reach an efficient outcome.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How have policymakers chosen to solve the problem of too much car exhaust pollution

A) by setting emission standards and limiting driving by commuters

B) by setting emission standards and taxing gasoline

C) by taxing car producers and limiting driving by commuters

D) by taxing gasoline and taxing car producers

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 210

Related Exams