B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nobel Prize winner Daniel Kahaneman suggests an investment strategy that involves

A) trying to beat the market while not being very concerned about inflation.

B) trying to beat the market while at the same time trying to beat inflation

C) trying not to beat the market and trying to beat inflation.

D) trying not to beat the market and not being very concerned about inflation.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are tearing down a building and find $1 in change that someone lost when working on the building 140 years ago.If instead of being careless with their change,this person had deposited their $1 in a bank and earned 2 percent interest,how much would be in the account today according to the rule of 70?

A) $4

B) $16

C) $32

D) None of the above is correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

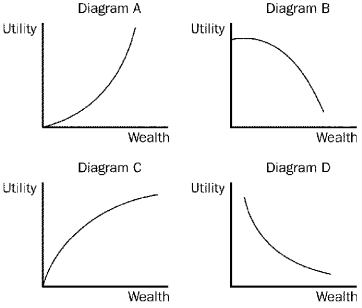

Figure 27-1

-Refer to Figure 27-1.Which of the graphs above is consistent with positive but diminishing marginal utility?

-Refer to Figure 27-1.Which of the graphs above is consistent with positive but diminishing marginal utility?

A) Diagram A

B) Diagram B

C) Diagram C

D) Diagram D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Some people claim that stocks follow a random walk.What does this mean?

A) The price of stock one day is about what it was on the previous day.

B) Changes in stock prices cannot be predicted from available information.

C) Stock prices are not determined by market fundamentals such as supply and demand.

D) Prices of stocks of different firms in the same industry show no or little tendency to move together.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A risk averse person has

A) utility and marginal utility curves that slope upward.

B) utility and marginal utility curves that slope downward.

C) a utility curve that slopes down and a marginal utility curve that slopes upward.

D) a utility curve that slopes upward and a marginal utility curve that slopes downward.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Risk-averse persons will take no risks.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) A risk averse person might be willing to hold stocks.

B) Other things the same, a portfolio with the stocks of a large number of companies has less risk.

C) Other things the same, the larger a portion of savings a person invests in stocks, the greater their expected return.

D) Diversification can eliminate market risk but not firm-specific risk.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the interest rate is 7 percent.Consider four payment options: Option A: $500 today. Option B: $550 one year from today. Option C: $575 two years from today. Option D: $600 three years from today. Which of the payments has the highest present value today?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct concerning diversification?

A) It only reduces firm-specific risk, but most of the reduction comes from increasing the number of stocks in a portfolio to well above 30.

B) It only reduces firm-specific risk; much of the reduction comes from increasing the number of stocks in a portfolio from 1 to 30.

C) It only reduces market risk, but most of the reduction comes from increasing the number of stocks in a portfolio to well above 30.

D) None of the above is correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two years ago Brian put some money into an account.He earned 6 percent interest on this account and now has about $1,000.About how much did he deposit into his account two years ago?

A) about $860

B) about $870

C) about $880

D) about $890

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The future value of a deposit in a savings account will be larger

A) the longer a person waits to withdraw the funds.

B) the higher the interest rate is.

C) the larger the initial deposit is.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fourteen years ago Alfred put money in his account at First National Bank.Alfred decides to cash in his account and is told that his money has quadrupled.According to the rule of 70,what rate of interest did Alfred earn?

A) 5 percent

B) 7 percent

C) 10 percent

D) 14 percent

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Amanda talks with several different brokers at a social gathering.She hears the following advice from brokers A,B,and C.Which broker,if any,gave her incorrect advice?

A) There are risks in holding stocks, even in a highly diversified portfolio.

B) Portfolios with smaller standard deviations have lower risk.

C) Stocks with greater risks offer lower average returns.

D) They all gave her correct advice.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Managed funds typically have a higher return than indexed funds.This tends to refute the efficient market hypothesis.

B) Managed funds typically have a higher return than indexed funds.This tends to support the efficient market hypothesis.

C) Index funds typically have a higher rate of return than managed funds.This tends to refute the efficient market hypothesis.

D) Index funds typically have a higher rate of return than managed funds.This tends to support the efficient market hypothesis.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The K-Nine dog food company is considering the purchase of additional canning equipment.They expect that adding the equipment will yield $200,000 at the end of the first year and $250,000 at the end of the second year and then nothing after that.At which of the following prices and interest rates would K-Nine buy the equipment?

A) $415,000 if the interest rate is 5%

B) $419,000 if the interest rate is 4%

C) K-Nine would buy the equipment in both cases.

D) K-Nine would not buy the equipment in either case.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the future value of $750 one year from today if the interest rate is 3 percent?

A) 772.73

B) 772.50

C) 773.33

D) None of the above are correct to the nearest penny.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fundamental analysis is

A) the study of the relation between risk and return of stock portfolios.

B) the determination of the allocation of savings between stocks and bonds based on a person's degree of risk aversion.

C) the study of a company's accounting statements and future prospects to determine its value.

D) a method used to determine how adding stocks to a portfolio will change the risk of the portfolio.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the interest rate is 5 percent.Consider three payment options: 1.$500 today. 2) $520 one year from today. 3) $550 two years from today. Which of the following is correct?

A) 1 has the lowest present value and 3 has the highest.

B) 2 has the lowest present value and 1 has the highest.

C) 3 has the lowest present value and 2 has the highest.

D) None of the above is correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Diminishing marginal utility of wealth implies that the utility function is

A) upward sloping and has decreasing slope.

B) upward sloping and has increasing slope.

C) downward sloping and has decreasing slope.

D) downward sloping and has increasing slope.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 249

Related Exams