A) $0

B) $2,300

C) $3,000

D) $7,100

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A per-day, per-share allocation of flow-through S corporation items must be used.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Several individuals acquire assets on behalf of Skip Corporation on May 28, purchased assets on June 3 and began business on June 11.They subscribe to shares of stock, file articles of incorporation for Skip, and become shareholders on June 21.The S election must be filed no later than 2 1/2 months after:

A) May 28.

B) June 3.

C) June 11.

D) June 21.

E) December 31.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

Separately stated items are listed on Schedule of the Form 1120S.

Correct Answer

verified

Correct Answer

verified

True/False

The termination of an S election occurs on the day after a corporation ceases to be a qualifying S corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kinney, Inc., an electing S corporation, holds $5,000 of AEP and $9,000 in AAA at the beginning of the calendar tax year.Kinney has two shareholders, Eric and Maria, each of whom owns 500 shares of Kinney's stock.Kinney's taxable income is $6,000 for the year.Kinney distributes $6,000 to each shareholder on February 1, and it distributes another $3,000 to each shareholder on September 1.How is Eric taxed on the distribution?

A) $500 dividend income.

B) $1,000 dividend income.

C) $1,500 dividend income.

D) $3,000 dividend income.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mock Corporation converts to S corporation status in 2019.Mock used the LIFO inventory method in 2018 and had a LIFO inventory of $435,000 FIFO value of $550,000) on the date of the S election.How much tax must be added to Mock's 2018 corporate tax liability, assuming that Mock is subject to a 21% tax rate.

A) $0

B) $6,038

C) $24,150

D) $115,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

There are no advantages for an S corporation to issue § 1244 stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which item does not appear on Schedule K of Form 1120S?

A) Intangible drilling costs.

B) Foreign loss.

C) Utilities expense.

D) Recovery of a tax benefit.

E) All of the above items appear on Schedule K.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

An estate may be a shareholder of an S corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

An S corporation's LIFO recapture amount equals the excess of the inventory's value under ____________________ over the value.

Correct Answer

verified

Correct Answer

verified

True/False

A corporation may alternate between S corporation and C corporation status each year, depending on which results in more tax savings.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

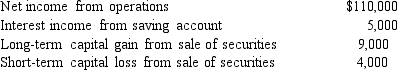

Lemon Corporation incurs the following transactions.  Lemon maintains a valid S election and does not distribute any dividends to its shareholder, Patty.As a result, Patty must recognize ignore the 20% QBI deduction) :

Lemon maintains a valid S election and does not distribute any dividends to its shareholder, Patty.As a result, Patty must recognize ignore the 20% QBI deduction) :

A) Ordinary income of $115,000 and long-term capital gain of $5,000

B) Ordinary income of $115,000, long-term capital gain of $9,000, and $4,000 short-term capital loss.

C) Ordinary income of $120,000.

D) Capital gain of $120,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

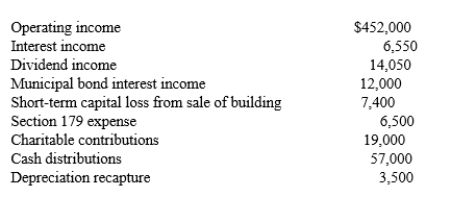

At the beginning of the year, the AAA of Rose, Inc.shows a balance of $682,000.During the year, the following items occur.Compute the end-of-year AAA balance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which item has no effect on an S corporation's AAA?

A) Stock purchase by a shareholder.

B) Interest expense.

C) Cost of goods sold.

D) Capital loss.

E) All have an effect on AAA.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An S corporation must possess which of the following characteristics?

A) Not more than one hundred shareholders.

B) Corporation organized in the U.S.

C) Only one class of stock.

D) All of the above are required of an S corporation.

E) None of the above are required of an S corporation.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

An S election made before becoming a corporation is valid only beginning with the first 12-month tax year.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Since loss property receives a in basis without any loss recognition, S corporation distributions of loss property generally should be .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which, if any, of the following items has no effect on the stock basis of an S corporation shareholder?

A) Operating income.

B) Short-term capital gain.

C) Advertising expenses.

D) Long-term capital loss.

E) The 20% QBI deduction.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

If any entity electing S status is currently a C corporation, NOL carryovers from prior years generally be used in an S corporation year.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 118

Related Exams