A) 20%

B) 30%

C) 40%

D) 50%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

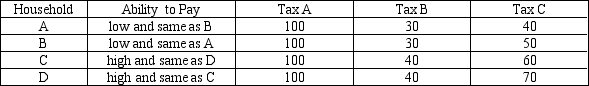

Table 12-16

The table below provides information on the 4 households that make up a small economy and how much they would pay in taxes under 3 types of taxes.

-Refer to Table 12-16.In this economy Tax A exhibits

-Refer to Table 12-16.In this economy Tax A exhibits

A) horizontal and vertical equity.

B) horizontal equity but not vertical equity.

C) vertical equity but not horizontal equity.

D) neither horizontal nor vertical equity.

F) B) and C)

Correct Answer

verified

B

Correct Answer

verified

True/False

One characteristic of an efficient tax system is that it minimizes the costs associated with revenue collection.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

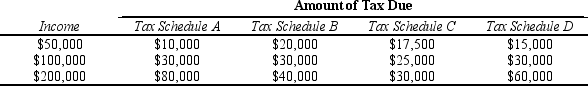

Table 12-11

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-11.Which tax schedules are progressive?

-Refer to Table 12-11.Which tax schedules are progressive?

A) Tax Schedule A only

B) Tax Schedule A and Tax Schedule B

C) Tax Schedule A, Tax Schedule B, and Tax Schedule C

D) All four Tax Schedules are progressive.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The two types of taxes that are most important to state and local governments as sources of revenue are

A) individual income taxes and corporate income taxes.

B) sales taxes and individual income taxes.

C) sales taxes and property taxes.

D) social insurance taxes and property taxes.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In addition to tax payments,the two other primary costs that a tax system inevitably imposes on taxpayers are

A) deadweight losses and administrative burdens.

B) deadweight losses and frustration with the political system.

C) administrative burdens and tax-preparation costs.

D) administrative burdens and the risk of punishment for failure to comply with tax laws.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In choosing the form of a tax,there is often a tradeoff between

A) allocative and productive efficiency.

B) profits and revenues.

C) efficiency and fairness.

D) fairness and profits.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A transfer payment is a government payment

A) to companies that provide goods or services to government agencies.

B) designed to transfer funds from one government agency to another.

C) which transfers revenue from the federal government to state government.

D) not made in exchange for a good or service.

F) C) and D)

Correct Answer

verified

D

Correct Answer

verified

True/False

Horizontal and vertical equity are the two primary measures of efficiency of a tax system.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

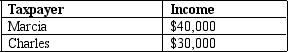

Table 12-8

-Refer to Table 12-8.If the government imposes a $2,000 lump-sum tax,the average tax rate for Marcia and Charles would be

-Refer to Table 12-8.If the government imposes a $2,000 lump-sum tax,the average tax rate for Marcia and Charles would be

A) 5 percent and 6.7 percent, respectively.

B) 8 percent and 6 percent, respectively.

C) 12 percent and 9 percent, respectively.

D) 13 percent and 10 percent, respectively.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

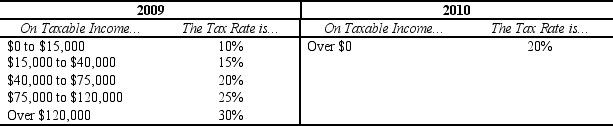

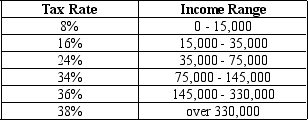

Table 12-10

The following table shows the marginal tax rates for unmarried individuals for two years.

-Refer to Table 12-10.For an individual who earned $80,000 of taxable income in 2009,what was the individual's average tax rate in 2009?

-Refer to Table 12-10.For an individual who earned $80,000 of taxable income in 2009,what was the individual's average tax rate in 2009?

A) 12.7%

B) 15.0%

C) 16.1%

D) 16.9%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The resources that a taxpayer devotes to complying with the tax laws are a type of

A) consumption tax.

B) value-added tax.

C) deadweight loss.

D) producer surplus.

F) None of the above

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

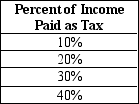

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Noah has taxable income of $43,000,his average tax rate is

-Refer to Table 12-2.If Noah has taxable income of $43,000,his average tax rate is

A) 14.7%.

B) 16.3%.

C) 20.8%.

D) 24.0%.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-15

-Refer to Table 12-15.In this tax system which of the following is possible?

-Refer to Table 12-15.In this tax system which of the following is possible?

A) vertical and horizontal equity

B) vertical but not horizontal equity

C) horizontal but not vertical equity

D) neither horizontal nor vertical equity

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which type of tax is used to finance the Social Security program in the United States?

A) consumption tax

B) income tax

C) payroll tax

D) property tax

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The average tax rate gauges the sacrifice made by a taxpayer, whereas the marginal tax rate gauges the distortion of taxes on consumer decisions.

B) The marginal tax rate gauges the sacrifice made by a taxpayer, whereas the average tax rate gauges the distortion of taxes on consumer decisions.

C) The average tax rate measures how much the tax system discourages people from working.

D) The marginal tax rate measures total taxes paid divided by total income.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a country imposes a lump-sum income tax of $6,000 on each individual in the country.What is the average income tax rate for an individual who earns $60,000 during the year?

A) 0%

B) 10%

C) More than 10%

D) The average tax rate cannot be determined without knowing the entire tax schedule.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

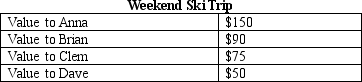

Table 12-3

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $45 and that the price reflects the actual unit cost of providing a weekend of skiing.How much consumer surplus accrues to Anna and Clem individually?

-Refer to Table 12-3.Assume that the price of a weekend ski pass is $45 and that the price reflects the actual unit cost of providing a weekend of skiing.How much consumer surplus accrues to Anna and Clem individually?

A) $125 and $20 respectively

B) $105 and $30 respectively

C) $85 and $40 respectively

D) $65 and $50 respectively

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax levied on the total amount spent in retail stores is called

A) a sales tax.

B) an excise tax.

C) a retail tax.

D) an income tax.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Many health economists believe that it will be very difficult to stem the rise in health care costs because

A) government intervention is unpopular with most citizens, especially the elderly.

B) improvements in medical technology have not kept pace with technological improvements in other sectors of the economy.

C) increased competition will increase rather than reduce costs.

D) medical advances are providing better ways to extend and improve human lives but at high costs.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 478

Related Exams