B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the basic principles of economics is that markets are usually a good way to organize economic activity.This principle is explained by the study of

A) factor markets.

B) energy markets.

C) welfare economics.

D) labor economics.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the market demand curve for a good passes through the point (quantity demanded = 100,price = $25) .If there are five buyers in the market,then

A) the marginal buyer's willingness to pay for the 100th unit of the good is $25.

B) the sum of the five buyers' willingness to pay for the 100th unit of the good is $25.

C) the average of the five buyers' willingness to pay for the 100th unit of the good is $25.

D) all of the five buyers are willing to pay at least $25 for the 100th unit of the good.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Total surplus in a market will increase when the government

A) imposes a tax on that market.

B) imposes a binding price floor on that market.

C) removes a binding price ceiling from that market.

D) None of the above is correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The particular price that results in quantity supplied being equal to quantity demanded is the best price because it

A) maximizes costs of the seller.

B) maximizes tax revenue for the government.

C) maximizes the combined welfare of buyers and sellers.

D) minimizes the expenditure of buyers.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the market price for pizzas increases.The increase in producer surplus comes from the benefit of the higher prices to

A) only existing sellers who now receive higher prices on the pizzas they were already selling.

B) only new sellers who enter the market because of the higher prices.

C) both existing sellers who now receive higher prices on the pizzas they were already selling and new sellers who enter the market because of the higher prices.

D) Producer surplus does not increase; it decreases.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Raisin bran and milk are complementary goods.A decrease in the price of raisins will

A) increase consumer surplus in the market for raisin bran and decrease producer surplus in the market for milk.

B) increase consumer surplus in the market for raisin bran and increase producer surplus in the market for milk.

C) decrease consumer surplus in the market for raisin bran and increase producer surplus in the market for milk.

D) decrease consumer surplus in the market for raisin bran and decrease producer surplus in the market for milk.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a market is allowed to adjust freely to its equilibrium price and quantity,then an increase in demand will

A) increase producer surplus.

B) reduce producer surplus.

C) not affect producer surplus.

D) Any of the above are possible.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) An invisible hand leads buyers and sellers to an equilibrium that maximizes total surplus.

B) Market power can cause markets to be inefficient.

C) Externalities can cause markets to be inefficient.

D) The invisible hand can remedy most if not all types of market failures.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

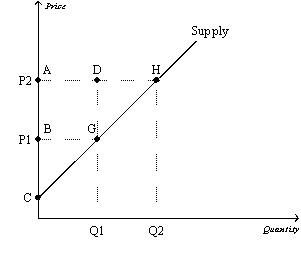

Figure 7-8

-Refer to Figure 7-8.Which area represents producer surplus when the price is P1?

-Refer to Figure 7-8.Which area represents producer surplus when the price is P1?

A) BCG

B) ACH

C) ABGD

D) DGH

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Buyers always want to pay less and sellers always want to be paid more.

B) Buyers always want to pay less and sellers always want to be paid less.

C) Buyers always want to pay more and sellers always want to be paid more.

D) Buyers always want to pay more and sellers always want to be paid less.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Consumer surplus can be measured as the area between the demand curve and the equilibrium price.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Henry is willing to pay 45 cents,and Janine is willing to pay 55 cents,for 1 pound of bananas.When the price of bananas falls from 50 cents a pound to 40 cents a pound,

A) Henry experiences an increase in consumer surplus, but Janine does not.

B) Janine experiences an increase in consumer surplus, but Henry does not.

C) both Janine and Henry experience an increase in consumer surplus.

D) neither Janine nor Henry experiences an increase in consumer surplus.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

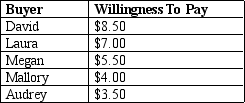

Table 7-2

This table refers to five possible buyers' willingness to pay for a case of Vanilla Coke.

-Refer to Table 7-2.If the market price is $3.80,

-Refer to Table 7-2.If the market price is $3.80,

A) David's consumer surplus is $4.70 and total consumer surplus for the five individuals is $9.50.

B) Megan's consumer surplus is $1.70 and total consumer surplus for the five individuals is $9.80.

C) David, Laura, and Megan will be the only buyers of Vanilla Coke.

D) the demand curve for Vanilla Coke, taking the five individuals into account, is horizontal.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chad is willing to pay $5.00 to get his first cup of morning latté.He buys a cup from a vendor selling latté for $3.75 per cup.Chad's consumer surplus is

A) $8.75.

B) $5.00.

C) $3.75.

D) $1.25.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As a result of a decrease in price,

A) new buyers enter the market, increasing consumer surplus.

B) new buyers enter the market, decreasing consumer surplus.

C) existing buyers exit the market, increasing consumer surplus.

D) existing buyers exit the market, decreasing consumer surplus.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Larry,Moe,and Curly are bidding in an auction for a mint-condition video of Charlie Chaplin's first movie.Each has in mind a maximum amount that he will bid.This maximum is called

A) a resistance price.

B) willingness to pay.

C) consumer surplus.

D) producer surplus.

F) None of the above

Correct Answer

verified

Correct Answer

verified

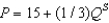

True/False

Let P represent price; let Qˢ represent quantity supplied; and assume the equation of the supply curve is  .If 90 units of the good are produced and sold,then producer surplus amounts to $1,350.

.If 90 units of the good are produced and sold,then producer surplus amounts to $1,350.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) Market power can cause markets to be inefficient.

B) When the decisions of buyers and sellers affect nonparticipants, markets may be inefficient.

C) The tools of welfare economics cannot help economists when markets are inefficient.

D) Externalities can cause markets to be inefficient.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

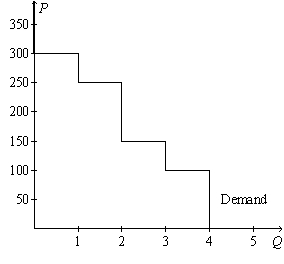

Multiple Choice

Figure 7-1

-Refer to Figure 7-1.If the price of the good is $250,then consumer surplus amounts to

-Refer to Figure 7-1.If the price of the good is $250,then consumer surplus amounts to

A) $50.

B) $100.

C) $150.

D) $200.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 460

Related Exams