A) a price ceiling set at $8

B) a price ceiling set at $12

C) a price floor set at $8

D) a price floor set at $12

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price floor is not binding,then

A) there will be a surplus in the market.

B) there will be a shortage in the market.

C) there will be no effect on the market price or quantity sold.

D) the market will be less efficient than it would be without the price floor.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

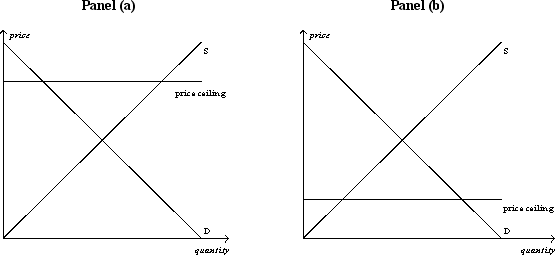

Figure 6-19

-Refer to Figure 6-19.The effective price received by sellers after the tax is imposed is

-Refer to Figure 6-19.The effective price received by sellers after the tax is imposed is

A) $3.

B) $4.

C) $5.

D) $7.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The impact of the minimum wage depends on the skill and experience of the worker.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A minimum wage that is set below a market's equilibrium wage will result in an excess

A) demand for labor, that is, unemployment.

B) demand for labor, that is, a shortage of workers.

C) supply of labor, that is, unemployment.

D) None of the above is correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The minimum wage,if it is binding,raises the incomes of

A) no workers.

B) only those workers who cannot find jobs.

C) only those workers whose jobs would pay less than the minimum wage if it didn't exist.

D) all workers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following observations would be consistent with the imposition of a binding price ceiling on a market? After the price ceiling becomes effective,

A) a smaller quantity of the good is bought and sold.

B) a smaller quantity of the good is demanded.

C) a larger quantity of the good is supplied.

D) the price rises above the previous equilibrium.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government levies a $2 tax per DVD on buyers of DVDs,then the price received by sellers of DVDs would

A) decrease by more than $2.

B) decrease by exactly $2.

C) decrease by less than $2.

D) increase by an indeterminate amount.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price received by sellers in a market will increase if the government decreases a

A) binding price floor in that market.

B) binding price ceiling in that market.

C) tax on the good sold in that market.

D) None of the above is correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The proportion of minimum-wage earners who are in families with incomes below the poverty line is

A) less than one-third.

B) between one-third and one-half.

C) between one-half and two-thirds.

D) greater than two-thirds.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The burden of a luxury tax most likely falls more heavily on sellers because demand is more elastic and supply is more inelastic.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Price is the rationing mechanism in a free,competitive market.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Studies by economists have found that a 10 percent increase in the minimum wage decreases teenage employment 10 percent.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Buyers and sellers always share the burden of a tax equally.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

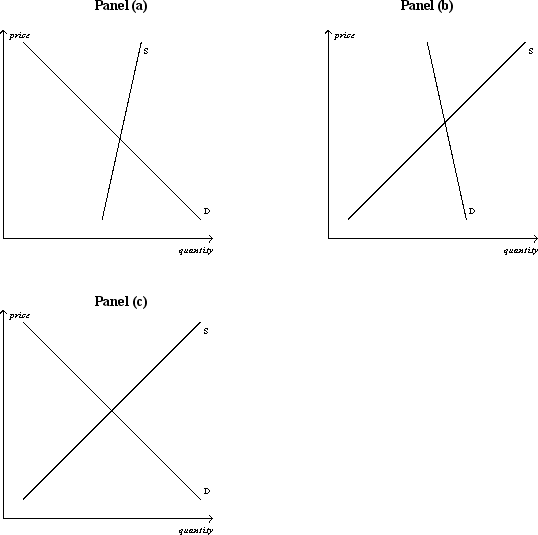

Figure 6-25

-Refer to Figure 6-25.In which market will the majority of the tax burden fall on buyers?

-Refer to Figure 6-25.In which market will the majority of the tax burden fall on buyers?

A) market (a)

B) market (b)

C) market (c)

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

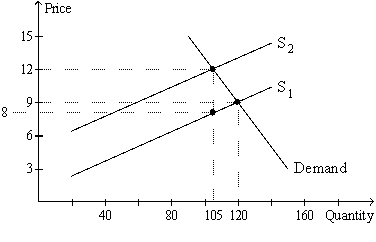

Figure 6-17

-Refer to Figure 6-17.The price that buyers pay after the tax is imposed is

-Refer to Figure 6-17.The price that buyers pay after the tax is imposed is

A) $8.00.

B) $9.00.

C) $10.50.

D) $12.00.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

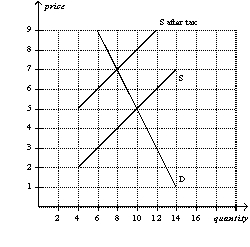

Figure 6-1

-Refer to Figure 6-1.The price ceiling shown in panel (a)

-Refer to Figure 6-1.The price ceiling shown in panel (a)

A) is not binding.

B) creates a surplus.

C) creates a shortage.

D) Both a) and b) are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A tax on sellers increases supply.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The burden of a luxury tax falls

A) more on the rich than on the middle class.

B) more on the poor than on the rich.

C) more on the middle class than on the rich.

D) equally on the rich, the middle class, and the poor.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

At the equilibrium price,the quantity that buyers want to buy exactly equals the quantity that sellers want to sell.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 557

Related Exams