A) (i) only

B) (ii) only

C) (i) and (iv) only

D) (ii) and (iii) only

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

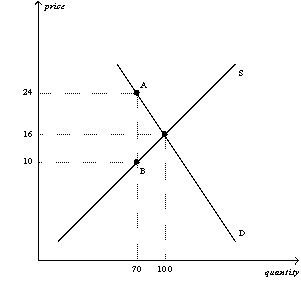

Figure 6-14

The vertical distance between points A and B represents the tax in the market.

-Refer to Figure 6-14.The amount of the tax per unit is

-Refer to Figure 6-14.The amount of the tax per unit is

A) $6.

B) $8.

C) $14.

D) $18.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

All buyers benefit from a binding price ceiling.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the buyers of cereal will increase the price of cereal paid by buyers,

A) decrease the effective price of cereal received by sellers, and decrease the equilibrium quantity of cereal.

B) decrease the effective price of cereal received by sellers, and increase the equilibrium quantity of cereal.

C) increase the effective price of cereal received by sellers, and decrease the equilibrium quantity of cereal.

D) increase the effective price of cereal received by sellers, and increase the equilibrium quantity of cereal.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One disadvantage of government subsidies over price controls is that subsidies

A) prevent the attainment of equilibrium in the markets in which they are imposed.

B) make higher taxes necessary.

C) are always unfair to those with low incomes.

D) cause unemployment.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A tax on a market with elastic demand and elastic supply will shrink the market more than a tax on a market with inelastic demand and inelastic supply will shrink the market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $0.10 tax levied on the sellers of chocolate bars will cause the

A) supply curve for chocolate bars to shift down by $0.10.

B) supply curve for chocolate bars to shift up by $0.10.

C) demand curve for chocolate bars to shift down by $0.10.

D) demand curve for chocolate bars to shift up by $0.10.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

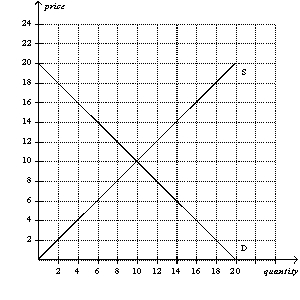

Figure 6-10

-Refer to Figure 6-10.A price floor set at

-Refer to Figure 6-10.A price floor set at

A) $6 will be binding and will result in a surplus of 8 units.

B) $6 will be binding and will result in a surplus of 4 units.

C) $16 will be binding and will result in a surplus of 12 units.

D) $16 will be binding and will result in a surplus of 6 units.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When the government imposes a binding price ceiling on a competitive market,a surplus of the good arises,and sellers must ration the scarce goods among the large number of potential buyers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A tax on buyers decreases the quantity of the good sold in the market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

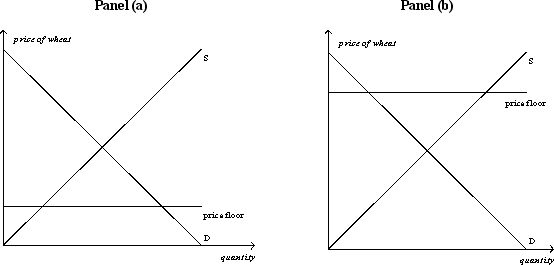

Figure 6-3

-Refer to Figure 6-3.In panel (a) ,there will be

-Refer to Figure 6-3.In panel (a) ,there will be

A) a shortage of wheat.

B) equilibrium in the market.

C) a surplus of wheat.

D) lines of people waiting to buy wheat.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

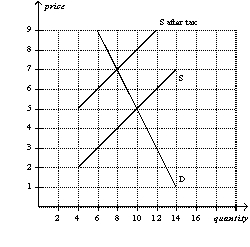

Figure 6-21

-Refer to Figure 6-22.How much tax revenue does this tax generate for the government?

-Refer to Figure 6-22.How much tax revenue does this tax generate for the government?

A) $150

B) $180

C) $250

D) $300

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A minimum wage that is set above a market's equilibrium wage will result in an excess

A) demand for labor, that is, unemployment.

B) demand for labor, that is, a shortage of workers.

C) supply of labor, that is, unemployment.

D) supply of labor, that is, a shortage of workers.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

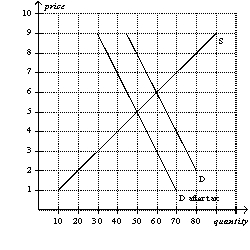

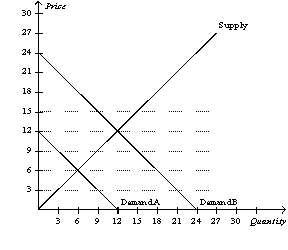

Figure 6-11

-Refer to Figure 6-11.Which of the following statements is not correct?

-Refer to Figure 6-11.Which of the following statements is not correct?

A) A government-imposed price of $9 would be a binding price floor if market demand is Demand A and a binding price ceiling if market demand is Demand B.

B) A government-imposed price of $15 would be a binding price ceiling if market demand is either Demand A or Demand B.

C) A government-imposed price of $3 would be a binding price ceiling if market demand is either Demand A or Demand B.

D) A government-imposed price of $12 would be a binding price floor if market demand is Demand A and a non-binding price ceiling if market demand is Demand B.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

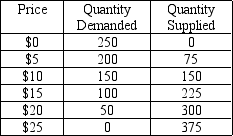

Table 6-2

-Refer to Table 6-2.A price ceiling set at $15 will

-Refer to Table 6-2.A price ceiling set at $15 will

A) be binding and will result in a shortage of 50 units.

B) be binding and will result in a shortage of 100 units.

C) be binding and will result in a shortage of 125 units.

D) not be binding.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A price floor set below the equilibrium price causes a surplus in the market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-19

-Refer to Figure 6-19.For every unit of the good that is sold,sellers are required to send

-Refer to Figure 6-19.For every unit of the good that is sold,sellers are required to send

A) one dollar to the government, and buyers are required to send two dollars to the government.

B) two dollars to the government, and buyers are required to send one dollar to the government.

C) three dollars to the government, and buyers are required to send nothing to the government.

D) nothing to the government, and buyers are required to send two dollars to the government.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a result of rent control?

A) fewer new apartments offered for rent

B) less maintenance provided by landlords

C) bribery

D) higher quality housing

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) A tax levied on buyers will never be partially paid by sellers.

B) Who actually pays a tax depends on the price elasticities of supply and demand.

C) Government can decide who actually pays a tax.

D) A tax levied on sellers always will be passed on completely to buyers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

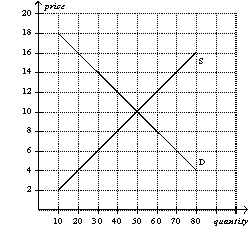

Figure 6-6

-Refer to Figure 6-6.If the government imposes a price floor of $6 on this market,then there will be

-Refer to Figure 6-6.If the government imposes a price floor of $6 on this market,then there will be

A) no surplus.

B) a surplus of 20 units.

C) a surplus of 30 units.

D) a surplus of 40 units.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 557

Related Exams