A) supplied to exceed quantity demanded by 45 units.

B) supplied to exceed quantity demanded by 85 units.

C) demanded to exceed quantity supplied by 45 units.

D) demanded to exceed quantity supplied by 85 units.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A binding minimum wage creates a surplus of labor.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The burden that results from a tax on yachts falls more heavily on the buyers of yachts than on the sellers of yachts.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Taxes levied on sellers and taxes levied on buyers are equivalent.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A price ceiling caused the gasoline shortage of 1973 in the United States.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under rent control,landlords cease to be responsive to tenants' concerns about the quality of the housing because

A) with rent control, the government guarantees landlords a minimum level of profit.

B) they become resigned to the fact that many of their apartments are going to be vacant at any given time.

C) with shortages and waiting lists, they have no incentive to maintain and improve their property.

D) with rent control, it becomes the government's responsibility to maintain rental housing.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most labor economists believe that the supply of labor is

A) less elastic than the demand, and, therefore, firms bear most of the burden of the payroll tax.

B) less elastic than the demand, and, therefore, workers bear most of the burden of the payroll tax.

C) more elastic than the demand, and, therefore, workers bear most of the burden of the payroll tax.

D) more elastic than the demand, and, therefore, firms bear most of the burden of the payroll tax.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the sellers of cameras encourages

A) sellers to supply a smaller quantity at every price.

B) buyers to demand a smaller quantity at every price.

C) sellers to supply a larger quantity at every price.

D) Both a) and b) are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

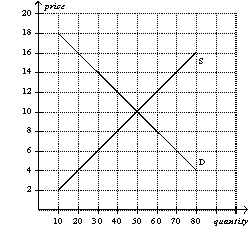

Figure 6-6

-Refer to Figure 6-6.Which of the following statements is correct?

-Refer to Figure 6-6.Which of the following statements is correct?

A) A price ceiling set at $12 would be binding, but a price ceiling set at $8 would not be binding.

B) A price floor set at $8 would be binding, but a price ceiling set at $8 would not be binding.

C) A price ceiling set at $9 would result in a surplus.

D) A price floor set at $11 would result in a surplus.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The tax burden falls more heavily on the side of the market that is more inelastic.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

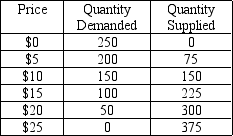

Table 6-2

-Refer to Table 6-2.A price floor set at $5 will

-Refer to Table 6-2.A price floor set at $5 will

A) be binding and will result in a surplus of 50 units.

B) be binding and will result in a surplus of 75 units.

C) be binding and will result in a surplus of 125 units.

D) not be binding.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an example of a public policy?

A) rent-control laws

B) minimum-wage laws

C) taxes

D) equilibrium laws

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A binding minimum wage

A) alters both the quantity demanded and quantity supplied of labor.

B) affects only the quantity of labor demanded; it does not affect the quantity of labor supplied.

C) has no effect on the quantity of labor demanded or the quantity of labor supplied.

D) causes only temporary unemployment because the market will adjust and eliminate any temporary surplus of workers.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a tax on a good,then the price paid by buyers will

A) increase, and the price received by sellers will increase.

B) increase, and the price received by sellers will decrease.

C) decrease, and the price received by sellers will increase.

D) decrease, and the price received by sellers will decrease.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not interfere with market equilibria?

A) a minimum wage

B) a rent control

C) a non-binding price floor

D) a binding price ceiling

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When free markets ration goods with prices,it is both efficient and impersonal.

B) False

Correct Answer

verified

Correct Answer

verified

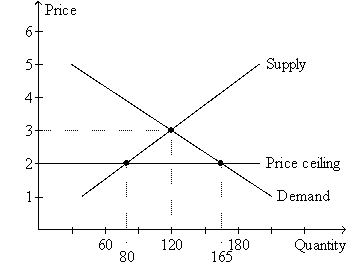

Multiple Choice

Figure 6-2

-Refer to Figure 6-2.The price ceiling causes a

-Refer to Figure 6-2.The price ceiling causes a

A) surplus of 40 units.

B) surplus of 85 units.

C) shortage of 45 units.

D) shortage of 85 units.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A large majority of economists favor eliminating the minimum wage.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A tax of $1 on buyers always decreases the equilibrium price by $1.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the sellers of a product,then the demand curve will

A) shift down.

B) shift up.

C) become flatter.

D) not shift.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 301 - 320 of 557

Related Exams