A) Cash and the adjusted basis of property contributed to the activity.

B) Amounts borrowed for use in the activity for which the taxpayer is personally liable or has pledged as security property not used in the activity.

C) Taxpayer's share of amounts borrowed for use in the activity that is qualified nonrecourse financing.

D) Taxpayer's share of the activity's income.

E) None of these.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Kelly, who earns a yearly salary of $120,000, sold an activity with a suspended passive activity loss of $44,000.The activity was sold at a loss and Kelly has no other passive activities.The suspended loss is not deductible.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jed spends 32 hours a week, 50 weeks a year, operating a bicycle rental store that he owns at a resort community. He also owns a music store in another city that is operated by a full-time employee.He elects not to group them together as a single activity under the "appropriate economic unit" standard.Jed spends 40 hours per year working at the music store.

A) Neither store is a passive activity.

B) Both stores are passive activities.

C) Only the bicycle rental store is a passive activity.

D) Only the music store is a passive activity.

E) None of these is correct.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

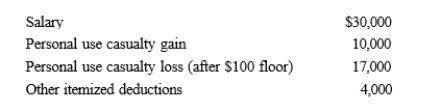

In 2019, Mary had the following items:  Assuming that Mary files as head of household (has one dependent child) , determine her taxable income for 2019.

Assuming that Mary files as head of household (has one dependent child) , determine her taxable income for 2019.

A) $11,650

B) $12,800

C) $13,900

D) $21,900

E) None of these.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Tom participates for 100 hours in Activity A and 450 hours in Activity B, both of which are nonrental businesses. Both activities are active.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Charles owns a business with two separate departments.Department A produces $100,000 of income and Department B incurs a $60,000 loss.Charles participates for 550 hours in Department A and 100 hours in Department B.He has full-time employees in both departments.

A) If Charles elects to treat both departments as a single activity, he cannot offset the $60,000 loss against the $100,000 income.

B) Charles may not treat Department A and Department B as separate activities because they are parts of one business.

C) If Charles elects to treat the two departments as separate activities, he can offset the $60,000 loss against the $100,000 income.

D) If Charles elects to treat both departments as a single activity, he can offset the $60,000 loss against the $100,000 income.

E) None of these is correct.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the current year, Juan's home was burglarized.He had the following items stolen: ∙ Securities worth $25,000.Juan purchased the securities four years ago for $20,000. ∙ New tools that Juan had purchased two weeks earlier for $8,000.He uses the tools in making repairs at an apartment house that he owns and manages. ∙ An antique worth $15,000.Juan inherited the antique (a family keepsake) when the property was worth $11,000. Juan's homeowner's policy had a $50,000 deductible clause for thefts.If his salary for the year is $50,000, determine the amount of his itemized deductions as a result of the theft.

A) $3,100

B) $6,000

C) $26,100

D) $26,500

E) None of these.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If personal casualty gains exceed personal casualty losses (after deducting the $100 floor), there is no itemized deduction.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jon owns an apartment building in which he is a material participant and also owns a computer consulting business. Of the 2,000 hours he spends on these activities during the year, 55% of the time is spent operating the apartment building and 45% of the time is spent in the computer consulting business.

A) The computer consulting business is a passive activity but the apartment building is not.

B) The apartment building is a passive activity but the computer consulting business is not.

C) Both the apartment building and the computer consulting business are passive activities.

D) Neither the apartment building nor the computer consulting business is a passive activity.

E) None of these these applies here.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Aram owns a 20% interest in a partnership (not real estate) in which her at-risk amount was $35,000 at the beginning of the year.The partnership borrowed $50,000 on a recourse note and made a $40,000 profit during the year.Her at-risk amount at the end of the year is $43,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Five years ago, Tom loaned his son John $20,000 to start a business.A note was executed with an interest rate of 8%, which is the Federal rate.The note required monthly payments of the interest with the $20,000 due at the end of 10 years.John always made the interest payments until last year.During the current year, John notified his father that he was bankrupt and would not be able to repay the $20,000 or the accrued interest of $1,800.Tom is an accrual basis taxpayer whose only income is salary and interest income.The proper treatment for the nonpayment of the note is:

A) No deduction.

B) $3,000 deduction.

C) $20,000 deduction.

D) $21,800 deduction.

E) None of these.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vic's at-risk amount in a passive activity is $200,000 at the beginning of the current year.His current loss from the activity is $80,000.Vic had no passive activity income during the year.At the end of the current year:

A) Vic has an at-risk amount in the activity of $120,000 and a suspended passive activity loss of $80,000.

B) Vic has an at-risk amount in the activity of $200,000 and a suspended passive activity loss of $80,000.

C) Vic has an at-risk amount in the activity of $120,000 and no suspended passive activity loss.

D) Vic has an at-risk amount in the activity of $200,000 and no suspended passive activity loss.

E) None of these is correct.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The amount of partial worthlessness on a nonbusiness bad debt is deducted in the year partial worthlessness is determined.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A loss from a worthless security is always treated as a short-term capital loss.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maria, who owns a 50% interest in a restaurant, has been a material participant in the restaurant activity for the last 20 years.She retired from the restaurant at the end of last year and will not participate in the restaurant activity in the future.However, she continues to be a material participant in a retail store in which she is a 50% partner.The restaurant operations produce a loss for the current year, and Maria's share of the loss is $80,000.Her share of the income from the retail store is $150,000.She does not own interests in any other activities.

A) Maria cannot deduct the $80,000 loss from the restaurant because she is not a material participant.

B) Maria can offset the $80,000 loss against the $150,000 of income from the retail store.

C) Maria will not be able to deduct any losses from the restaurant until she has been retired for at least three years.

D) Assuming Maria continues to hold the interest in the restaurant, she will always treat the losses as active.

E) None of these applies here.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On February 20, 2018, Bill purchased stock in Pink Corporation (the stock is not small business stock) for $1,000.On May 1, 2019, the stock became worthless.During 2019, Bill also had an $8,000 loss on § 1244 small business stock purchased two years ago, a $9,000 loss on a nonbusiness bad debt, and a $5,000 long-term capital gain.How should Bill treat these items on his 2019 tax return?

A) $4,000 long-term capital loss and $9,000 short-term capital loss.

B) $4,000 long-term capital loss and $3,000 short-term capital loss.

C) $8,000 ordinary loss and $3,000 short-term capital loss.

D) $8,000 ordinary loss and $5,000 short-term capital loss.

E) $8,000 long-term capital loss and $6,000 short-term capital loss.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Tonya owns an interest in an activity (not real estate) that converted recourse financing to nonrecourse financing. Recapture of previously allowed losses is required if Tonya's at-risk amount is reduced below zero as a result of the debt restructuring.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The purpose of the excess business loss rules is to limit the amount of nonbusiness income (e.g., salaries, interest, dividends) that can be sheltered from tax as a result of business losses.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two years ago, Gina loaned Tom $50,000.Tom signed a note the terms of which called for monthly payments of $2,000 plus 6% interest on the outstanding balance.Last year, when the balance owing on the loan was $18,000, Tom defaulted on the note.As of the end of last year, there appeared to be no reasonable prospect of Gina recovering the $18,000.As a consequence, Gina claimed the $18,000 as a nonbusiness bad debt.Last year, Gina had AGI of $50,000, which included $16,000 of net long-term capital gains.Gina did not itemize her deductions.During the current year, Tom paid Gina $13,000 in final settlement of the loan.How should Gina account for the payment in the current year?

A) File an amended tax return for last year.

B) Report no income for the current year.

C) Report $2,000 of income for the current year.

D) Report $5,000 of income for the current year.

E) None of these.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Gloria owns and works full-time at a shop that rents watercraft of various types to tourists who are vacationing at the beach.If she generates a loss from that activity, the loss is subject to the passive activity loss rules because it is rental property.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 147

Related Exams