A) Hunter has a recognized loss of $30,000, and Warren has a recognized gain of $135,000.

B) Neither Hunter nor Warren has any recognized gain or loss.

C) Hunter has no recognized loss, but Warren has a recognized gain of $30,000.

D) Tan Corporation will have a basis in the land of $45,000.

E) None of these.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Robin Corporation, a calendar year C corporation, had taxable income of $700,000, $1.2 million, and $1 million for 2017, 2018, and 2019, respectively.Robin has taxable income of $1.8 million for 2019.The minimum 2020 estimated tax installment payments for Robin are:

A) April 15, 2020, $52,500; June 15, 2020, $52,500�; September 15, 2020, $52,500; December 15, 2020, $52,500.

B) April 15, 2020, $52,500; June 15, 2020, $94,500; September 15, 2020, $94,500; December 15, 2020, $94,500.

C) April 15, 2020, $94,500; June 15, 2020, $94,500; September 15, 2020, $94,500; December 15, 2020, $94,500.

D) April 15, 2020, $52,500; June 15, 2020, $136,500; September 15, 2020, $94,500; December 15, 2020, $94,500.

E) None of these.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Luis is the sole shareholder of a regular C corporation, and Eduardo owns a proprietorship.In the current year, both businesses make a profit of $80,000 and each owner withdraws $50,000 from his business.With respect to this information, which of the following statements is incorrect?

A) Eduardo must report $80,000 of income on his return.

B) Luis must report $80,000 of income on his return.

C) Eduardo's proprietorship is not required to pay income tax on $80,000.

D) Luis's corporation must pay income tax on $80,000.

E) None of these.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A long-term note is treated as "boot." Thus, Eve is taxed on the value of the note received.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carl transfers land to Cardinal Corporation for 90% of the stock in Cardinal Corporation worth $20,000 plus a note payable to Carl in the amount of $40,000 and the assumption by Cardinal Corporation of a mortgage on the land in the amount of $100,000.The land, which has a basis to Carl of $70,000, is worth $160,000.

A) Carl will have a recognized gain on the transfer of $90,000.

B) Carl will have a recognized gain on the transfer of $30,000.

C) Cardinal Corporation will have a basis of $70,000 in the land transferred by Carl.

D) Cardinal Corporation will have a basis of $160,000 in the land transferred by Carl.

E) None of these.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Thrush Corporation files its Form 1120, which reports taxable income of $200,000 in the current year.The corporation's tax is $42,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Because boot is generated under § 357(b) (i.e., the liability is not supported by a bona fide business purpose), the transferor shareholder will always have to recognize gain.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

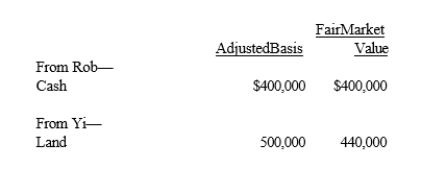

Rob and Yi form Bluebird Corporation with the following investments.  Each receives 50% of Bluebird's stock.In addition, Yi receives cash of $40,000.One result of these transfers is that Yi has a:

Each receives 50% of Bluebird's stock.In addition, Yi receives cash of $40,000.One result of these transfers is that Yi has a:

A) Recognized loss of $60,000.

B) Recognized loss of $20,000.

C) Basis of $460,000 in the Bluebird stock (assuming Bluebird reduces its basis in the land to $440,000) .

D) Basis of $400,000 in the Bluebird stock (assuming Bluebird reduces its basis in the land to $440,000) .

E) None of these.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is incorrect regarding the dividends received deduction?

A) A corporation must hold stock for more than 90 days in order to qualify for a deduction with respect to dividends on such stock.

B) The taxable income limitation does not apply with respect to the 100% deduction available to members of an affiliated group.

C) If a stock purchase is financed 75% by debt, the deduction for dividends on such stock is reduced by 75%.

D) The taxable income limitation does not apply if the normal deduction (i.e., 50% or 65% of dividends) results in a net operating loss for the corporation.

E) None of these.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sarah and Tony (mother and son) form Dove Corporation with the following investments: cash by Sarah of $65,000; land by Tony (basis of $25,000 and fair market value of $35,000) .Dove Corporation issues 400 shares of stock, 200 each to Sarah and Tony.Thus, each receives stock in Dove worth $50,000.

A) Section 351 cannot apply since Sarah should have received 260 shares instead of only 200.

B) Section 351 may apply because stock need not be issued to Sarah and Tony in proportion to the value of the property transferred.

C) Tony's basis in the stock of Dove Corporation is $50,000.

D) As a result of the transfer, Tony recognizes a gain of $10,000.

E) None of these.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Schedule M-2 is used to reconcile unappropriated retained earnings at the beginning of the year with unappropriated retained earnings at the end of the year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer transfers assets and liabilities to a corporation in return for its stock.If the liabilities exceed the basis of the assets transferred, the taxpayer will have a negative basis in the stock.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A corporation with $5 million or more in assets must file Schedule M-3 (instead of Schedule M-1).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Alan, an Owl Corporation shareholder, makes a contribution to capital of equipment to Owl, basis of $40,000 and fair market value of $50,000.Owl's basis of the equipment that Alan contributes is equal to $50,000, the property's fair market value.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Canary Corporation, which sustained a $5,000 net short-term capital loss during the year, will enter $5,000 as an addition on Schedule M-1 of Form 1120.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A corporation's holding period for property received under § 351 includes the holding period of the transferor shareholder.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Tomas owns a sole proprietorship, and Lucy is the sole shareholder of a C corporation.In the current year, both businesses make a net profit of $60,000.Neither business distributes any funds to the owners in the year.For the current year, Tomas must report $60,000 of income on his individual tax return, but Lucy is not required to report any income from the corporation on her individual tax return.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In return for legal services worth $60,000 rendered incident to its formation, Crimson Corporation issues stock to Greta, an attorney.Crimson cannot immediately deduct the value of any of this stock but instead must capitalize it as an organizational expenditure.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under Federal tax law, a bias for corporate issuers exists in favor of debt as compared to equity when financing the operations of a corporation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Similar to like-kind exchanges, the receipt of "boot" under § 351 can cause loss to be recognized.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 136

Related Exams