A) a lump-sum tax.

B) an equitable tax.

C) supported by the poor.

D) a progressive tax.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a country imposes a lump-sum income tax of $5,000 on each individual in the country. What is the marginal income tax rate for an individual who earns $40,000 during the year?

A) 0%

B) 10%

C) More than 10%

D) The marginal tax rate cannot be determined without knowing the entire tax schedule.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose an excise tax is imposed on luxury boats and yachts. Economists argue that such a tax

A) is sure to be vertically equitable, since buyers of luxury boats and yachts are wealthy.

B) entails no deadweight loss as long as buyers of boats and yachts can easily substitute one luxury good for another.

C) violates the benefits principle of taxation.

D) may burden workers in the luxury-boat-and-yacht industry more than it burdens the buyers of luxury boats and yachts.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

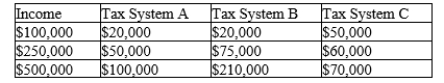

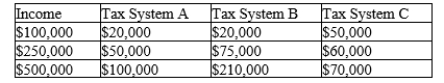

Table 12-23

The dollar amounts in the last three columns are the taxes owed under the three different tax systems.  -Refer to Table 12-23. Which of the three tax systems is progressive?

-Refer to Table 12-23. Which of the three tax systems is progressive?

A) Tax System A

B) Tax System B

C) Tax System C

D) None of the systems are progressive.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-1 Ken places a $20 value on a cigar, and Mark places a $17 value on it. The equilibrium price for this brand of cigar is $15. -Refer to Scenario 12-1. Suppose the government levies a tax of $3 on each cigar, and the equilibrium price of a cigar increases to $18. What is total consumer surplus after the tax is levied?

A) $0

B) $2

C) $5

D) $6

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

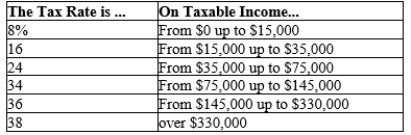

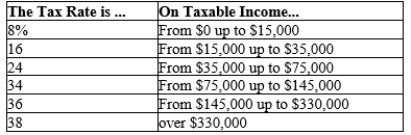

Table 12-11  -Refer to Table 12-11. If Bud has taxable income of $78,000, his marginal tax rate is

-Refer to Table 12-11. If Bud has taxable income of $78,000, his marginal tax rate is

A) 19.3%.

B) 24.0%.

C) 26.8%.

D) 34.0%.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A budget deficit occurs when government receipts fall short of government spending.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The claim that all citizens should make an "equal sacrifice" to support government programs is usually associated with

A) the ability-to-pay principle.

B) the benefits principle.

C) efficiency arguments.

D) regressive tax arguments.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Medicare is the

A) government's health plan for the elderly.

B) government's health plan for the poor.

C) another name for Social Security.

D) Both a and c are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

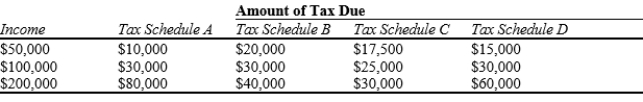

Table 12-20

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.  -Refer to Table 12-20. Which tax schedules are progressive?

-Refer to Table 12-20. Which tax schedules are progressive?

A) Tax Schedule A only

B) Tax Schedule A and Tax Schedule B

C) Tax Schedule A, Tax Schedule B, and Tax Schedule C

D) All four Tax Schedules are progressive.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-11  -Refer to Table 12-11. If Al has taxable income of $165,000, his tax liability is

-Refer to Table 12-11. If Al has taxable income of $165,000, his tax liability is

A) $23,800.

B) $36,000.

C) $45,000.

D) $47,698.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The average tax rate gauges the sacrifice made by a taxpayer, whereas the marginal tax rate gauges the distortion of taxes on consumer decisions.

B) The marginal tax rate gauges the sacrifice made by a taxpayer, whereas the average tax rate gauges the distortion of taxes on consumer decisions.

C) The average tax rate measures how much the tax system discourages people from working.

D) The marginal tax rate measures total taxes paid divided by total income.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A budget surplus occurs when government receipts exceed government spending.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An efficient tax system is one that (i) maximizes tax revenues. (ii) minimizes deadweight losses from taxes. (iii) minimizes administrative burdens from taxes. (iv) promotes equity across taxpayers.

A) (i) only

B) (ii) and (iii) only

C) (i) , (ii) , and (iii) only

D) (i) , (ii) , (iii) , and (iv)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Deadweight losses and administrative burdens are key factors considered when determining the efficiency of the tax system.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Many economists believe that

A) the corporate income tax satisfies the goal of horizontal equity.

B) the corporate income tax does not distort the incentives of customers.

C) the corporate income tax is more efficient than the personal income tax.

D) workers and customers bear much of the burden of the corporate income tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-23

The dollar amounts in the last three columns are the taxes owed under the three different tax systems.  -Refer to Table 12-23. Which of the three tax systems is proportional?

-Refer to Table 12-23. Which of the three tax systems is proportional?

A) Tax System A

B) Tax System B

C) Tax System C

D) None of the systems are proportional.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The benefits principle of taxation can be used to argue that wealthy citizens should pay higher taxes than poorer ones on the basis that

A) police services are more frequently used in poor neighborhoods.

B) the wealthy benefit more from services provided by government than the poor.

C) the poor are more active in political processes.

D) the poor receive welfare payments.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Part of the administrative burden of a tax is

A) the money people pay to the government in taxes.

B) reducing the size of the market because of the tax.

C) the hassle of filling out tax forms that is imposed on taxpayers who comply with the tax.

D) the cost of administering programs that use tax revenue.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vertical equity in taxation refers to the idea that people

A) in unequal conditions should be treated differently.

B) in equal conditions should pay equal taxes.

C) should pay taxes based on the benefits they receive from the government.

D) should pay a proportional tax rather than a progressive tax.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 481 - 500 of 664

Related Exams