Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on U.S. income data from 2011, the top fifth of all families received

A) about 3.8 percent more than the bottom fifth.

B) about 49 percent more than the bottom fifth.

C) approximately 5 times more income than the bottom fifth.

D) more than 12 times more income than the bottom fifth.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

Which philosopher claimed that the government should aim to maximize the well-being of the worst-off person in society?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The philosopher John Rawls argued that

A) people would choose a more equal distribution of income if they had to determine an economic distribution system before knowing their place in it.

B) people would choose income inequality to allow the maximum use of their individual talents.

C) government has a role to ensure income equality to prevent social unrest.

D) people would choose equal opportunity because it is morally right.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

Scenario 20-7 Zooey is a single mother of two young children whose husband died in a tragic car accident. She earns $20,000 per year working as a cashier at a grocery store. The government uses a negative income tax system in which Taxes owed = (1/4 of income) - $15,000. -Refer to Scenario 20-7. Zooey's friend Alfredo owes $0 in taxes. How much does he earn?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) An advantage of the Earned Income Tax Credit (EITC) is that it targets the working poor better than the minimum wage because it does not benefit teenagers from middle-class families who work summer jobs at the minimum wage.

B) A disadvantage of in-kind transfer programs such as food stamps is that they force recipients to purchase from a restricted set of items which may not include things that the poor need the most such as diapers or cleaning supplies.

C) A disadvantage of minimum wage laws is that they are expensive for state and local governments to fund.

D) Effective minimum wage laws create a surplus of labor.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 20-11

Poverty Thresholds in 2011, by Size of Family and Number of Related Children Under 18 Years

[Dollars] ![Table 20-11 Poverty Thresholds in 2011, by Size of Family and Number of Related Children Under 18 Years [Dollars] Source: U. S. Bureau of the Census, Current Population Survey. -Refer to Table 20-11. What is the poverty line for a 75-year-old individual? A) $10,788 B) $11,702 C) $13,596 D) $15,446](https://d2lvgg3v3hfg70.cloudfront.net/TB2269/11eb175c_fc8f_1e9f_931a_bb58b8f16319_TB2269_00.jpg) Source: U. S. Bureau of the Census, Current Population Survey.

-Refer to Table 20-11. What is the poverty line for a 75-year-old individual?

Source: U. S. Bureau of the Census, Current Population Survey.

-Refer to Table 20-11. What is the poverty line for a 75-year-old individual?

A) $10,788

B) $11,702

C) $13,596

D) $15,446

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the government proposes a negative income tax that calculates the taxes owed as follows: taxes owed equal 30% of income less $12,000. A family that earns an income of $40,000 will

A) neither pay taxes nor receive an income subsidy.

B) receive an income subsidy of $3,600.

C) pay $3,600 in taxes.

D) pay $12,000 in taxes.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on U.S. income data from 2011, the bottom fifth of all families received approximately what percent of all income?

A) 48.9 percent

B) 21.3 percent

C) 8.6 percent

D) 3.8 percent

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A follower of liberalism would not support a redistribution of income but rather would focus on equalizing opportunities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the minimum wage is correct?

A) An increase in the minimum wage enhances the well-being of all unskilled workers.

B) An increase in the minimum wage has no effect on the well-being of middle-class families.

C) Advocates of the minimum wage argue that the demand for labor is relatively inelastic.

D) Critics of the minimum wage argue that it is an undesirable way of helping the poor because it is costly to the government.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the United States, long-term poverty affects

A) more families than short-term poverty.

B) an equal number of families as short-term poverty.

C) slightly fewer families than short-term poverty.

D) many fewer families than short-term poverty.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Libertarians believe that in considering economic fairness, one should primarily consider the

A) outcome of the system.

B) process by which outcomes arise.

C) maximin criterion.

D) maximization total social utility.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In the United States in 2011, the bottom fifth of the income distribution had incomes below $27,218.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ms. Spring currently earns $100,000 a year, while her junior partner, Mr. Fall, earns $55,000 a year. From the perspective of a utilitarian, if both of their incomes are subject to diminishing marginal utility, taking a dollar from Ms. Spring and giving it to Mr. Fall will

A) increase society's total utility.

B) lower Ms. Spring's marginal utility of income.

C) increase Mr. Fall's marginal utility of income.

D) lower society's total utility.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over the past 50 years, the U.S. poverty rate was at its lowest level in

A) 1973.

B) 1980.

C) 1990.

D) 2008.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an advantage of an in-kind transfer in comparison to a cash payment?

A) In-kind transfers cost less to administer than cash transfers.

B) In-kind transfers restrict the use of the benefit; thus, recipients receive necessities such as food and health care.

C) In-kind transfers are more efficient than cash transfers.

D) In-kind transfers give the recipient more utility than cash transfers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-2 The government is proposing switching from a progressive tax system, in which families pay 15% of the first $40,000 earned, 30% of the next $40,000 earned, and 45% of any income over $80,000 to a tax system in which every family pays 1/4 of its income regardless of how much they earn and all income redistribution is eliminated. That is, the tax revenue generated is used only for infrastructure, public administration, and national defense. -Refer to Scenario 20-2. Which philosopher would be most in favor of the proposed change in tax policy?

A) Jeremy Bentham

B) John Stuart Mill

C) John Rawls

D) Robert Nozick

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

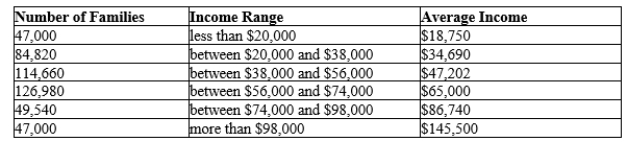

Table 20-5

Distribution of Income in Umakastan  -Refer to Table 20-5. Where would the government of Umakastan have to set the poverty line to have a poverty rate of about 28%?

-Refer to Table 20-5. Where would the government of Umakastan have to set the poverty line to have a poverty rate of about 28%?

A) $20,000

B) $34,690

C) $38,000

D) $56,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The percentage of families with incomes below the poverty line

A) is defined as the 10 percent of U.S.households with the lowest incomes.

B) is known as the poverty rate.

C) is known as the unemployment rate.

D) rises as the general income level rises.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 478

Related Exams