A) people want to hold more money. This response is shown as a movement along the money demand curve.

B) people want to hold more money. This response is shown as a shift of the money demand curve.

C) people want to hold less money. This response is shown as a movement along the money demand curve.

D) people want to hold less money. This response is shown as a shift of the money demand curve.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In recent years, the Fed has chosen to target interest rates rather than the money supply because

A) Congress passed a law requiring them to do so.

B) the President requested them to do so.

C) the money supply is hard to measure with sufficient precision.

D) changes in the interest rate change aggregate demand, but changes in the money supply do not.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Charisse is of the opinion that the interest rate depends on the economy's saving propensities and investment opportunities. Most economists would say that Charisse's opinion is

A) Keynesian in nature, and that her view is more valid for the long run than for the short run.

B) classical in nature, and that her view is more valid for the long run than for the short run.

C) Keynesian in nature, and that her view is more valid for the short run than for the long run.

D) classical in nature, and that her view is more valid for the short run than for the long run.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Fed increases the money supply, we expect

A) interest rates and stock prices to rise.

B) interest rates and stock prices to fall.

C) interest rates to rise and stock prices to fall.

D) interest rates to fall and stock prices to rise.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the multiplier has a value that exceeds 1, and there are no crowding out or investment accelerator effects. Which of the following would shift aggregate demand to the right by more than the increase in expenditures?

A) an increase in government expenditures

B) an increase in net exports

C) an increase in investment spending

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most economists believe that fiscal policy

A) only affects aggregate demand and not aggregate supply.

B) primarily affects aggregate demand.

C) primarily effects aggregate supply.

D) only affects aggregate supply and not aggregate demand.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to liquidity preference theory, if there were a surplus of money, then

A) the interest rate would be above equilibrium and the quantity of money demanded would be too large for equilibrium.

B) the interest rate would be above equilibrium and the quantity of money demanded would be too small for equilibrium.

C) the interest rate would be below equilibrium and the quantity of money demanded would be too small for equilibrium.

D) the interest rate would be below equilibrium and the quantity of money demanded would be too large for equilibrium.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

Permanent tax changes have a _____ effect on aggregate demand compared to temporary tax changes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) A higher price level shifts money demand rightward.

B) When money demand shifts rightward, the interest rate rises.

C) A higher interest rate reduces the quantity of goods and services demanded.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In liquidity preference theory, an increase in the interest rate, other things the same, decreases the quantity of money demanded, but does not shift the money demand curve.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The idea that expansionary fiscal policy has a positive affect on investment is known as

A) monetary policy.

B) crowding out.

C) the investment accelerator.

D) the multiplier.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same, as the price level rises,

A) the interest rate rises causing aggregate demand to shift.

B) the interest rate rises causing a movement along a given aggregate-demand curve.

C) the interest rate falls causing aggregate demand to shift.

D) the interest rate falls causing a movement along a given aggregate-demand curve.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paul Samuelson, a famous economist, said that

A) "the bond market has predicted zero out of the past nine recessions."

B) "the stock market has predicted zero out of the past nine recessions."

C) "the bond market has predicted nine out of the past five recessions."

D) "the stock market has predicted nine out of the past five recessions."

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

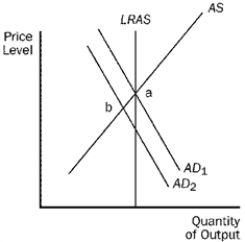

For the following questions, use the diagram below:

Figure 34-7.  -Refer to Figure 34-7. The aggregate-demand curve could shift from AD1 to AD2 as a result of

-Refer to Figure 34-7. The aggregate-demand curve could shift from AD1 to AD2 as a result of

A) an increase in government purchases.

B) a decrease in net exports.

C) households saving a smaller fraction of their income.

D) a decrease in the price level.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The multiplier effect

A) and the crowding-out effect both amplify the effects of an increase in government expenditures.

B) and the crowding-out effect both diminish the effects of an increase in government expenditures.

C) diminishes the effects of an increase in government expenditures, while the crowding-out effect amplifies the effects.

D) amplifies the effects of an increase in government expenditures, while the crowding-out effect diminishes the effects.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the stock market crashes, then

A) aggregate demand increases, which the Fed could offset by increasing the money supply.

B) aggregate demand increases, which the Fed could offset by decreasing the money supply.

C) aggregate demand decreases, which the Fed could offset by increasing the money supply.

D) aggregate demand decreases, which the Fed could offset by decreasing the money supply.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A goal of monetary policy and fiscal policy is to

A) offset the shifts in aggregate demand and thereby eliminate unemployment.

B) offset shifts in aggregate demand and thereby stabilize the economy.

C) enhance the shifts in aggregate demand and thereby create fluctuations in output and employment.

D) enhance the shifts in aggregate demand and thereby increase economic growth

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

For the U.S. economy, the most important reason for the downward slope of the aggregate-demand curve is the interest-rate effect.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The logic of the multiplier effect applies

A) only to changes in government spending.

B) to any change in spending on any component of GDP.

C) only to changes in the money supply.

D) only when the crowding-out effect is sufficiently strong.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the stock market booms, then

A) aggregate demand increases, which the Fed could offset by purchasing bonds.

B) aggregate supply increases, which the Fed could offset by selling bonds.

C) aggregate demand increases, which the Fed could offset by selling bonds.

D) aggregate supply increases, which the Fed could offset by purchasing the money supply.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 523

Related Exams