A) multiplier effect.

B) crowding-out effect.

C) accelerator effect.

D) Ricardian equivalence effect.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following shifts aggregate demand to the right?

A) an increase in the price level

B) an increase in the money supply

C) a decrease in the price level

D) a decrease in the money supply

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For the U.S. economy, money holdings are a

A) large part of household wealth, and so the interest-rate effect is large.

B) large part of household wealth, and so the wealth effect is large.

C) small part of household wealth, and so the interest-rate effect is small.

D) small part of household wealth, and so the wealth effect is small.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

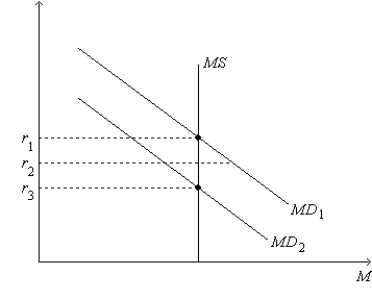

Figure 34-4. On the figure, MS represents money supply and MD represents money demand.  -Refer to Figure 34-4. Suppose the money-demand curve is currently MD1. If the current interest rate is r2, then

-Refer to Figure 34-4. Suppose the money-demand curve is currently MD1. If the current interest rate is r2, then

A) the quantity of money that people want to hold is less than the quantity of money that the Federal Reserve has supplied.

B) people will respond by selling interest-bearing bonds or by withdrawing money from interest-bearing bank accounts.

C) bond issuers and banks will respond by lowering the interest rates they offer.

D) in response, the money-demand curve will shift rightward from its current position to establish equilibrium in the money market.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liquidity preference refers directly to Keynes' theory concerning

A) the effects of changes in money demand and supply on interest rates.

B) the effects of changes in money demand and supply on exchange rates.

C) the effects of wealth on expenditures.

D) the difference between temporary and permanent changes in income.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of President Obama's first fiscal policy initiatives was

A) ARRA.

B) TARP.

C) QE1.

D) QE2.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

The government's choices regarding the overall level of government purchases and taxes is known as _____.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to liquidity preference theory, a decrease in the price level causes the interest rate to

A) increase, which increases the quantity of goods and services demanded.

B) increase, which decreases the quantity of goods and services demanded.

C) decrease, which increases the quantity of goods and services demanded.

D) decrease, which decreases the quantity of goods and services demanded.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in government spending initially and primarily shifts

A) aggregate demand to the right.

B) aggregate demand to the left.

C) aggregate supply to the right.

D) neither aggregate demand nor aggregate supply in either direction.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fiscal policy is determined by

A) the president and Congress and involves changing government spending and taxation.

B) the president and Congress and involves changing the money supply.

C) the Federal Reserve and involves changing government spending and taxation.

D) the Federal Reserve and involves changing the money supply.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

The _____ is the most important automatic stabilizer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

People hold money primarily because it

A) increases in value when there is inflation.

B) serves as a store of value.

C) serves as a medium of exchange.

D) functions as a unit of account.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Kennedy tax cut of 1964 was

A) successful in stimulating the economy.

B) designed to shift the aggregate demand curve to the right.

C) designed to shift the aggregate supply curve to the right.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

During recessions, unemployment insurance payments tend to rise.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A severe problem that many economists have with the active use of monetary policy and fiscal policy to stabilize the economy is that, while those policies obviously work well in practice, they are not well understood on a theoretical level.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Monetary policy

A) can be implemented quickly and most of its impact on aggregate demand occurs very soon after policy is implemented.

B) can be implemented quickly, but most of its impact on aggregate demand occurs months after policy is implemented.

C) cannot be implemented quickly, but once implemented most of its impact on aggregate demand occurs very soon afterward.

D) cannot be implemented quickly and most of its impact on aggregate demand occurs months after policy is implemented.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the interest rate is above the equilibrium level,

A) the quantity of money that people want to hold is less than the quantity of money that the Federal Reserve has supplied.

B) people respond by buying interest-bearing bonds or by depositing money in interest-bearing bank accounts.

C) bond issuers and banks respond by lowering the interest rates they offer.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Sometimes, changes in monetary policy and/or fiscal policy are intended to offset changes to aggregate demand over which policymakers have little or no control.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose aggregate demand shifts to the left and policymakers want to stabilize output. What can they do?

A) repeal an investment tax credit or increase the money supply

B) repeal an investment tax credit or decrease the money supply

C) institute an investment tax credit or increase the money supply

D) institute an investment tax credit or decrease the money supply

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following events would shift money demand to the right?

A) an increase in the price level

B) a decrease in the price level

C) an increase in the interest rate

D) a decrease in the interest rate

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 301 - 320 of 523

Related Exams