A) an accumulation of dirt in the interior of rental cars

B) poor engine maintenance in rental cars

C) free gasoline given to people as an incentive to a rent a car

D) slow replacement of old rental cars with newer ones

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A tax on buyers shifts the demand curve and the supply curve.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The housing shortages caused by rent control are larger in the long run than in the short run because both the supply of housing and the demand for housing are more elastic in the long run.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In an unregulated labor market, the wage adjusts to balance labor supply and labor demand.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

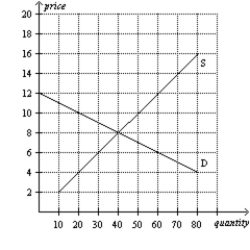

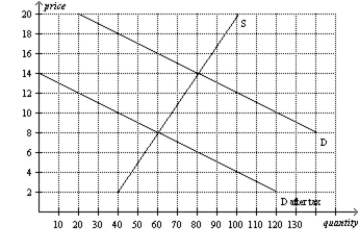

Figure 6-6  -Refer to Figure 6-6. Which of the following statements is not correct?

-Refer to Figure 6-6. Which of the following statements is not correct?

A) A price ceiling set at $6 would be binding, but a price ceiling set at $12 would not be binding.

B) A price floor set at $14 would be binding, but a price floor set at $8 would not be binding.

C) A price ceiling set at $9 would result in a surplus.

D) A price floor set at $6 would result in a shortage.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An alternative to rent-control laws that would not reduce the quantity of housing supplied is

A) the payment by government of a fraction of a poor family's rent.

B) higher taxes on rental income earned by landlords.

C) a policy that prevents landlords from evicting tenants.

D) a policy that allows government to confiscate residential property for the purpose of commercial development.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Lawmakers can decide whether the buyers or the sellers must send a tax to the government, but they cannot legislate the true burden of a tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Price controls

A) always produce a fair outcome.

B) always produce an efficient outcome.

C) can generate inequities of their own.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You receive a paycheck from your employer, and your pay stub indicates that $400 was deducted to pay the FICA (Social Security/Medicare) tax. Which of the following statements is correct?

A) This type of tax is an example of a payback tax.

B) Your employer is required by law to pay $400 to match the $400 deducted from your check.

C) The $400 that you paid is the true burden of the tax that falls on you, the employee.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government has imposed a price floor on cellular phones. Which of the following events could transform the price floor from one that is binding to one that is not binding?

A) Cellular phones become less popular.

B) Traditional land line phones become more expensive.

C) The components used to produce cellular phones become less expensive.

D) Firms expect the price of cellular phones to fall in the future.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the sellers of coffee mugs

A) increases the size of the coffee mug market.

B) decreases the size of the coffee mug market.

C) has no effect on the size of the coffee mug market.

D) may increase, decrease, or have no effect on the size of the coffee mug market.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

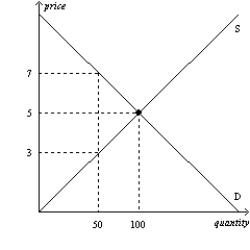

Figure 6-19  -Refer to Figure 6-19. Suppose a tax of $2 per unit is imposed on this market. How much will buyers pay per unit after the tax is imposed?

-Refer to Figure 6-19. Suppose a tax of $2 per unit is imposed on this market. How much will buyers pay per unit after the tax is imposed?

A) $3

B) between $3 and $5

C) between $5 and $7

D) $7

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

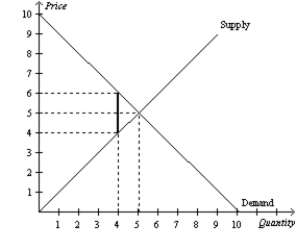

Figure 6-36  -Refer to Figure 6-36. If the government places a $2 tax in the market, the seller receives $6.

-Refer to Figure 6-36. If the government places a $2 tax in the market, the seller receives $6.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The primary effect of rent control in the short run is to reduce rents.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is imposed in a market, it will

A) alter the behavior of buyers.

B) alter the behavior of sellers.

C) have no effect on the behavior or either buyers or sellers.

D) affect the behavior of both buyers and sellers.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the equilibrium price of an airline ticket is $400 and the government imposes a price floor of $500 on airline tickets, then fewer airline tickets will be sold than at the market equilibrium.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the sellers of a product, the

A) size of the market decreases.

B) effective price received by sellers decreases, and the price paid by buyers increases.

C) supply of the product decreases.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

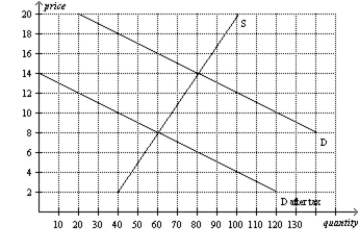

Figure 6-26  -Refer to Figure 6-26. The per-unit burden of the tax is

-Refer to Figure 6-26. The per-unit burden of the tax is

A) $2 for buyers and $6 for sellers.

B) $4 for buyers and $4 for sellers.

C) $6 for buyers and $2 for sellers.

D) $8 for buyers and $0 for sellers.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

To be binding, a price floor must be set above the equilibrium price.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-26  -Refer to Figure 6-26. The amount of the tax per unit is

-Refer to Figure 6-26. The amount of the tax per unit is

A) $4.

B) $8.

C) $14.

D) $10.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 241 - 260 of 668

Related Exams