A) encourages a private solution to a particular positive-externality problem.

B) discourages a private solution to a particular positive-externality problem.

C) encourages a private solution to a particular negative-externality problem.

D) discourages a private solution to a particular negative-externality problem.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

University researchers create a positive externality because what they discover in their research labs can easily be learned by others who haven't contributed to the research costs. Suppose that the federal government gives grants to these researchers equal to the their per-unit production externality. What is the relationship between the equilibrium quantity of university research and the socially optimal quantity of university research produced?

A) The equilibrium quantity is greater than the socially optimal quantity.

B) They are equal.

C) The equilibrium quantity is less than the socially optimal quantity.

D) There is not enough information to answer the question.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An externality exists whenever

A) the economy cannot benefit from government intervention.

B) markets are not able to reach equilibrium.

C) a firm sells its product in a foreign market.

D) Bobbi engages in an activity that influences the well-being of Rosa and yet Bobbi neither pays nor receives payment for that influence.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Government can be used to solve externality problems that are too costly for private parties to solve.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming transaction costs are small, the Coase theorem would predict that private parties could arrive at an efficient solution for which of the following problems?

A) One neighbor doesn't mow his lawn.

B) One neighbor doesn't paint her house.

C) One neighbor comes home on his noisy motorcycle late at night.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The business activities of Firm A confer positive externalities on Firm B, and the business activities of Firm B confer positive externalities on Firm A. If the two firms merged, then

A) their respective markets would move closer to the social optimum.

B) their respective markets would move further away from the social optimum.

C) total surplus in their respective markets would decrease.

D) the merger would serve as an example of a misguided public policy toward externalities.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that coal producers create a negative externality equal to $5 per ton of coal. What is the relationship between the equilibrium quantity of coal and the socially optimal quantity of coal?

A) They are equal.

B) The equilibrium quantity is greater than the socially optimal quantity.

C) The equilibrium quantity is less than the socially optimal quantity.

D) There is not enough information to answer the question.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

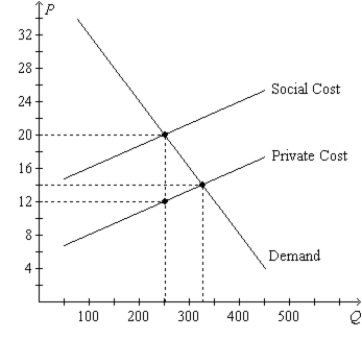

Figure 10-13. On the graph, Q represents the quantity of plastics and P represents the price of plastics.  -Refer to Figure 10-13. Each unit of plastics that is produced results in an external

-Refer to Figure 10-13. Each unit of plastics that is produced results in an external

A) cost of $6.

B) cost of $8.

C) benefit of $6.

D) benefit of $8.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two firms, A and B, each currently dump 50 tons of chemicals into the local river. The government has decided to reduce the pollution and from now on will require a pollution permit for each ton of pollution dumped into the river. The government will sell 40 pollution permits for $75 each. It costs Firm A $100 for each ton of pollution that it eliminates before it reaches the river, and it costs Firm B $50 for each ton of pollution that it eliminates before it reaches the river. Neither firm produces any less output, but they both conform to the law. It is likely that between the cost of permits and the cost of additional pollution abatement,

A) Firm B will spend $3,500.

B) Firm A will spend $4,000.

C) Firm A will spend $4,500.

D) Firm B will spend $3,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A negative externality

A) is a cost to a bystander.

B) is a cost to the buyer.

C) is a cost to the seller.

D) exists with all market transactions.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

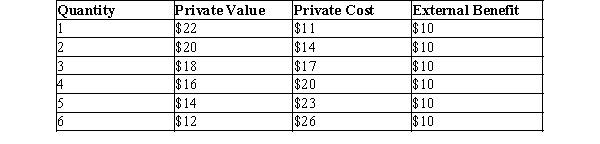

Table 10-3  -Refer to Table 10-3. The table represents a market in which

-Refer to Table 10-3. The table represents a market in which

A) there is no externality.

B) there is a positive externality.

C) there is a negative externality.

D) The answer cannot be determined from inspection of the table.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

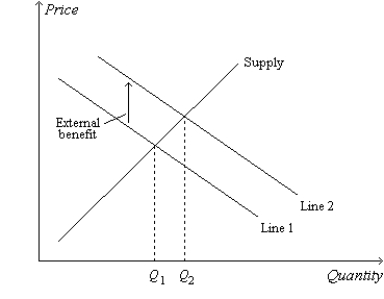

Figure 10-12  -Refer to Figure 10-12. Suppose, on the figure, Q represents the quantity of education and P represents the price of education. Then the quantity

-Refer to Figure 10-12. Suppose, on the figure, Q represents the quantity of education and P represents the price of education. Then the quantity  represents

represents

A) an inefficiency.

B) the extent of the negative externality that pertains to the market for education.

C) the amount of the tax that would be required to correct the negative externality that pertains to the market for education.

D) the amount of the subsidy that would be required to correct the positive externality that pertains to the market for education.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A congestion toll imposed on a highway driver to force the driver to take into account the increase in travel time she imposes on all other drivers is an example of internalizing the externality.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two firms, A and B, each currently emit 100 tons of chemicals into the air. The government has decided to reduce the pollution and from now on will require a pollution permit for each ton of pollution emitted into the air. The government gives each firm 40 pollution permits, which it can either use or sell to the other firm. It costs Firm A $200 for each ton of pollution that it eliminates before it is emitted into the air, and it costs Firm B $100 for each ton of pollution that it eliminates before it is emitted into the air. After the two firms buy or sell pollution permits from each other, we would expect that Firm A will emit

A) 20 fewer tons of pollution into the air, and Firm B will emit 100 fewer tons of pollution into the air.

B) 100 fewer tons of pollution into the air, and Firm B will emit 20 fewer tons of pollution into the air.

C) 50 fewer tons of pollution into the air, and Firm B will emit 50 fewer tons of pollution into the air.

D) 20 more tons of pollution into the air, and Firm B will emit 100 fewer tons of pollution into the air.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When externalities are present in a market, the well-being of market participants

A) and market bystanders are both directly affected.

B) and market bystanders are both indirectly affected.

C) is directly affected, and market bystanders are indirectly affected.

D) is indirectly affected, and market bystanders are directly affected.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Research into new technologies conveys neither negative externalities nor positive externalities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that an MBA degree creates no externality because the benefits of an MBA are internalized by the student in the form of higher wages. If there are no government subsidies for MBAs, then which of the following statements is correct?

A) The equilibrium quantity of MBAs will equal the socially optimal quantity of MBAs.

B) The equilibrium quantity of MBAs will be greater than the socially optimal quantity of MBAs.

C) The equilibrium quantity of MBAs will be less than the socially optimal quantity of MBAs.

D) There is not enough information to answer the question.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

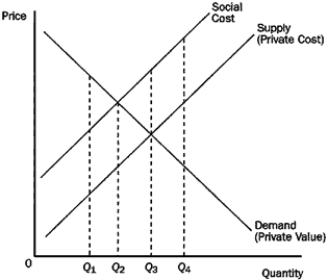

Figure 10-4  -Refer to Figure 10-4. At Q3

-Refer to Figure 10-4. At Q3

A) the marginal consumer values this product less than the social cost of producing it.

B) every consumer values this product less than the social cost of producing it.

C) the cost to society is equal to the value to society.

D) the marginal consumer values this product more than the private cost.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The patent system gives firms greater incentive to engage in research and other activities that advance technology.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corrective taxes are unlike most other taxes because they

A) distort incentives.

B) move the allocation of resources away from the social optimum.

C) raise revenue for the government.

D) move the allocation of resources closer to the social optimum.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 361 - 380 of 543

Related Exams