A) -$20,000

B) -$14,000

C) $36,000

D) $60,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Raising the welfare of the worst-off person in society is an important goal of which political philosophy?

A) utilitarianism

B) liberalism

C) libertarianism

D) secularism

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A disadvantage associated with a minimum wage law to reduce poverty is that it

A) encourages illegitimate births because single women with children receive higher payments.

B) rewards laziness because it provides payments to those with low incomes regardless of their work effort.

C) focuses on children and the disabled while neglecting the working poor.

D) may benefit the teenage children of families who are not poor.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Followers of the liberalism political philosophy believe that society should maximize the total of individual utilities.

B) The poverty line is adjusted for regional differences in the costs of raising children.

C) One advantage to the Earned Income Tax Credit (EITC) is that it benefits the working poor.

D) Libertarians pursue policies to redistribute income from the rich to the poor.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

Who said "The inherent vice of capitalism is the unequal sharing of blessings. The inherent virtue of socialism is the equal sharing of miseries"?

Correct Answer

verified

Correct Answer

verified

True/False

According to a study by Michael Cox and Richard Alm, consumption per person in the richest 20% of households was only 2.1 times consumption per person in the poorest 20% of households.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Since 1970 the United States' income distribution has become more equal.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Income mobility studies suggest that poverty

A) cannot be alleviated by privately sponsored anti-poverty programs.

B) cannot be alleviated by government sponsored anti-poverty programs.

C) is a long-term problem for a relatively large number of families.

D) is not a long-term problem for most families.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A utilitarian government has to balance the gains from greater income equality against the losses from distorted work incentives. To maximize total utility, therefore, the government

A) would never tax labor income.

B) must always achieve a fully egalitarian society.

C) enacts policies that only benefit the middle class.

D) stops short of a fully egalitarian society.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-6 Zooey is a single mother of two young children whose husband died in a tragic car accident. She earns $20,000 per year working as a cashier at a grocery store. The government uses a negative income tax system in which Taxes owed = (1/4 of income) - $15,000. -Refer to Scenario 20-6. If Zooey decides to quit her job and earns $0 in income annually, how much more or less money will she have compared to continuing to work as a cashier?

A) If she quits her job, she will have $10,000 less per year.

B) If she quits her job, she will have $15,000 less per year.

C) If she quits her job, she will have $10,000 more per year.

D) If she quits her job, she will have $15,000 more per year.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-3 Suppose that a society is made up of five families whose incomes are as follows: $120,000; $90,000; $30,000; $30,000; and $18,000. The federal government is considering two potential income tax plans: Plan A is a negative income tax plan where the taxes owed equal 1/3 of income minus $20,000. Plan B is a two-tiered plan where families earning less than $35,000 pay no income tax and families earning more than $35,000 pay 10% of their income in taxes. The income tax revenue collected from those families earning over $35,000 is then redistributed equally to those families earning less than $35,000. -Refer to Scenario 20-3. Assuming that utility is directly proportional to the cash value of after-tax income, which government policy would an advocate of libertarianism prefer?

A) Plan A

B) Plan B

C) either Plan A or Plan B

D) neither Plan A nor Plan B because any plan that forcibly redistributes income is against the philosophy

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the imposition of a binding minimum wage results in much higher unemployment among workers seeking minimum wage jobs,

A) firms will respond by demanding more labor.

B) those workers who are employed will be worse off than before the minimum wage law.

C) labor demand is relatively elastic.

D) labor demand is relatively inelastic.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

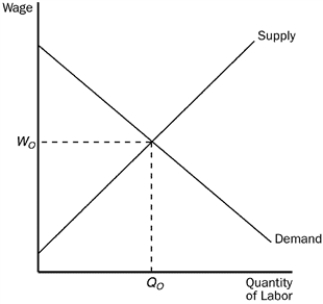

Figure 20-5  -Refer to Figure 20-5. If the government imposes a minimum wage above Wo, it is likely to

-Refer to Figure 20-5. If the government imposes a minimum wage above Wo, it is likely to

A) increase employment to a level above Qo.

B) reduce employment to a level below Qo.

C) provide more income to the working poor than they collectively received before the minimum wage was set.

D) have no effect on employment.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2011, the poverty rate in the United States was 15 percent. This means that 15 percent

A) of the population had a total family income that fell below the poverty line.

B) of the population had a total family income that was above the poverty line.

C) of the population had a total family income below $10,000.

D) of the population had a total family income above $50,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A society consists of three individuals: Larry, Margaret, and Nina. In terms of income and utility, Larry is currently best-off, Margaret ranks in the middle, and Nina is worst-off. Which of the following statements is correct?

A) Utilitarianism suggests that government policies should strive to maximize the sum of all three individuals' utility.

B) Liberalism suggests that government policies should strive to maximize the sum of Larry's utility and Nina's utility.

C) Libertarianism suggests that government policies should strive to make Nina better off at the cost of Larry and Margaret.

D) Utilitarianism suggests that the government policies should strive to make Nina better off than Margaret.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to a utilitarian, total social utility will be maximized when marginal dollars are distributed to the people with the

A) lowest marginal utility of income.

B) highest marginal utility of income.

C) highest total utility from their income.

D) most productive labor resources.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Poverty is found to be correlated with

A) age and race but not family composition.

B) race only.

C) race and family composition but not age.

D) age, race, and family composition.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-5 Suppose the government implemented a negative income tax and used the following formula to compute a family's tax liability: Taxes owed = (1/4 of income) - $10,000 -Refer to Scenario 20-5. A family earning $110,000 before taxes would have how much after-tax income?

A) $82,500

B) $92,500

C) $100,000

D) $127,500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The study by economists Cox and Alm found

A) inequality in consumption is much smaller than inequality in annual income.

B) inequality in consumption is slightly smaller than inequality in annual income.

C) inequality in consumption is slightly larger than inequality in annual income.

D) inequality in consumption is much larger than inequality in annual income.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the doctrine of liberalism, principles of justice are the result of

A) fair agreement and bargain.

B) command-and-control policies.

C) domination of the powerful by the weak.

D) workers owning the factors of production.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 478

Related Exams