A) in-kind transfer.

B) minimum wage law.

C) private charity.

D) welfare payment.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Scenario 20-8 Suppose the government implemented a negative income tax and used the following formula to compute a family's tax liability: Taxes owed = (1/4 of income) - $14,000 -Refer to Scenario 20-8. The government does not have to pay a subsidy to any family through this negative income tax if the family with the lowest income earns $50,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

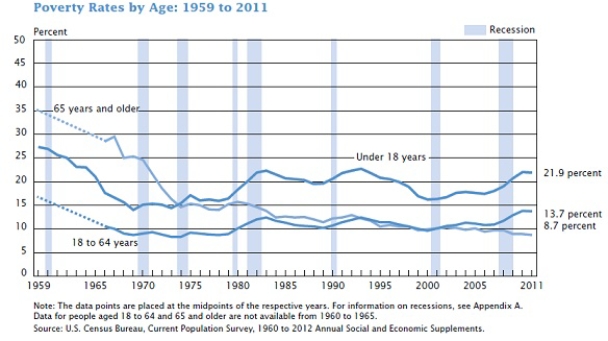

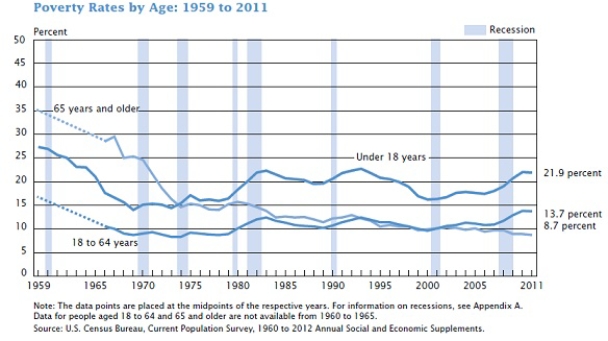

Figure 20-3  -Refer to Figure 20-3. In 1968, the percent of children under age 18 in poverty is

-Refer to Figure 20-3. In 1968, the percent of children under age 18 in poverty is

A) higher than both the percentage of adults aged 18 to 64 and the percentage of elderly aged 65 and over in poverty.

B) higher than the percentage of adults aged 18 to 64 but is lower than the percentage of elderly aged 65 and over in poverty.

C) lower than both the percentage of adults aged 18 to 64 and the percentage of elderly aged 65 and over in poverty.

D) lower than the percentage of adults aged 18 to 64 but is higher than the percentage of elderly aged 65 and over in poverty.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A goal of libertarians is to provide citizens with equal opportunities rather than to ensure equal outcomes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The founders of utilitarianism include

A) A. C. Pigou and John Maynard Keynes.

B) Jeremy Bentham and John Stuart Mill.

C) Augustin Cournot and Jean B. Say.

D) A. Kondratieff and Thomas Malthus.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

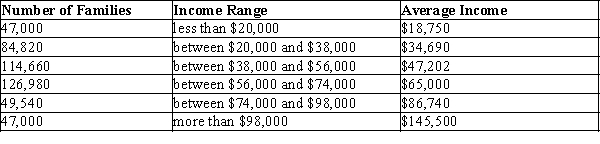

Table 20-5

Distribution of Income in Umakastan  -Refer to Table 20-5. Where would the government of Umakastan have to set the poverty line to have a poverty rate of about 28%?

-Refer to Table 20-5. Where would the government of Umakastan have to set the poverty line to have a poverty rate of about 28%?

A) $20,000

B) $34,690

C) $38,000

D) $56,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 20-3  -Refer to Figure 20-3. In 1968, the percent of elderly aged 65 and over in poverty is

-Refer to Figure 20-3. In 1968, the percent of elderly aged 65 and over in poverty is

A) higher than both the percentage of adults aged 18 to 64 and the percentage of children under age 18 in poverty.

B) higher than the percentage of adults aged 18 to 64 but is lower than the percentage of children under age 18 in poverty.

C) lower than both the percentage of adults aged 18 to 64 and the percentage of children under age 18 in poverty.

D) is lower than the percentage of adults aged 18 to 64 but is higher than the percentage of children under age 18 in poverty.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Critics argue that a disadvantage of minimum-wage laws is that they do not effectively target the working poor because many minimum-wage workers are the teenage children of middle-income families.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

The poverty rate is the percentage of the population whose family income falls below an absolute level called the .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a society consists of only two people, John and Jane. A utilitarian would say that the proper role of government in this society is to

A) equalize the incomes of John and Jane.

B) equalize John's utility and Jane's utility.

C) equalize John's marginal utility and Jane's marginal utility.

D) maximize the sum of John's utility and Jane's utility.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

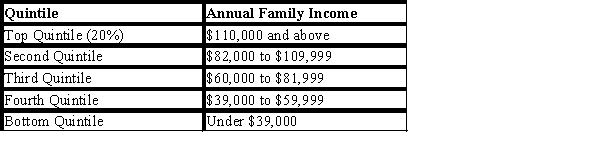

Table 20-13

The following table shows the distribution of income in Widgetapolis.

-Refer to Table 20-13. If the poverty rate is 19%, where is the poverty line in Widgetapolis?

-Refer to Table 20-13. If the poverty rate is 19%, where is the poverty line in Widgetapolis?

A) under $39,000

B) between $39,000 and $59,999

C) between $60,000 and $81,999

D) between $82,000 and $109,999

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The poverty rate for female households with no spouse present is approximately

A) 10 percent.

B) 20 percent.

C) 30 percent.

D) 40 percent.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

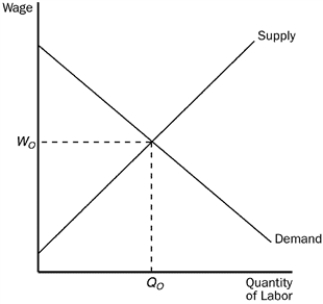

Figure 20-5  -Refer to Figure 20-5. An effective minimum wage would be set at a level

-Refer to Figure 20-5. An effective minimum wage would be set at a level

A) above Wo, and employment would rise above Qo.

B) above Wo, and employment would fall below Qo.

C) below Wo, and employment would rise above Qo.

D) below Wo, and employment would fall below Qo.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In-kind transfers are politically popular because

A) they provide high quality food and shelter.

B) they provide cash.

C) allow resale of food stamps for cash, if needed.

D) the public believes that the aid is not going to support alcohol and drug addiction.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) Welfare is a broad term that includes a variety of government programs designed to help poor people.

B) Since the early 1970s, welfare benefits adjusted for inflation have increased, as has the percentage of children living with only one parent.

C) Critics of welfare programs argue that they can create incentives for unmarried women to have children.

D) Supporters argue that welfare doesn't cause the decline of two-parent families.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The poverty rate is

A) a measure of income inequality across families.

B) the percentage of the population whose family income falls below a specified level.

C) an absolute level of income set by the federal government for each family size.

D) measured by the number of in-kind transfers that a family receives.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Libertarians believe that in considering economic fairness, one should primarily consider the

A) outcome of the system.

B) process by which outcomes arise.

C) maximin criterion.

D) maximization total social utility.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

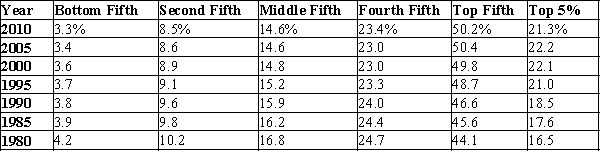

Table 20-9

Income Inequality in the United States

The values in the table reflect the percentages of pre-tax-and transfer income.  Source: US Census Bureau

-Refer to Table 20-9. In 2010, the top fifth of the US population had

Source: US Census Bureau

-Refer to Table 20-9. In 2010, the top fifth of the US population had

A) 50.2% more income than the remainder of the population.

B) a lower share of income than the top fifth in 1980.

C) about 15 times as much income as the bottom fifth.

D) about 6 times as much income as the middle fifth.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When designing public policies, which income group would philosopher John Rawls argue needs the most attention?

A) Individuals located in the bottom fifth of the income distribution.

B) Individuals located at the average income level.

C) Individuals located in the top fifth of the income distribution.

D) Individuals located in the top five percent of the income distribution.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The distribution of annual income accurately reflects the distribution of living standards.

B) Permanent incomes are more equally distributed than annual incomes.

C) Transitory changes in income generally have a significant impact on a family's standard of living.

D) Annual income is more equally distributed than permanent income.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 241 - 260 of 478

Related Exams