A) The date the property was acquired by the donor only.

B) The date of gift only.

C) Either the date the property was acquired by the donor or the date of gift.

D) The last day of the tax year in which the property was originally acquired by the donor.

E) None of the above.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If losses are disallowed in a related party transaction, the holding period for the buyer includes the holding period of the seller.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Karen owns City of Richmond bonds with a face value of $10,000.She purchased the bonds on January 1, 2018, for $11,000.The maturity date is December 31, 2027.The annual interest rate is 4%.What is the amount of taxable interest income that Karen should report for 2018, and the adjusted basis for the bonds at the end of 2018, assuming straight-line amortization is appropriate?

A) $0 and $11,000

B) $0 and $10,900

C) $100 and $11,000

D) $100 and $10,900

E) None of the above

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Section 1033 nonrecognition of gain from an involuntary conversion) applies to both gains and losses.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The basis for gain and loss of personal use property converted to business use is the lower of the adjusted basis or the fair market value on the date of conversion.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If property that has been converted from personal use to business use has appreciated in value, its basis for gain will be the same as the basis for loss.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

Gene purchased an SUV for $45,000 which he uses 100% for personal purposes.When the SUV is worth $30,000, he contributes it to his business.The gain basis is $45,000, the loss basis is $30,000, and the basis for cost recovery is $45,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kelly inherits land which had a basis to the decedent of $95,000 and a fair market value of $50,000 on August 4, 2018, the date of the decedent's death.The executor distributes the land to Kelly on November 12, 2018, at which time the fair market value is $49,000.The fair market value on February 4, 2019, is $45,000.In filing the estate tax return, the executor elects the alternate valuation date.Kelly sells the land on June 10, 2019, for $48,000.What is her recognized gain or loss?

A) $1,000)

B) $2,000)

C) $47,000)

D) $1,000

E) None of the above

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Andrew acquires 2,000 shares of Eagle Corporation stock for $100,000 on March 31, 2014.On January 1, 2018, he sells 125 shares for $5,000.On January 22, 2018, he purchases 135 shares of Eagle Corporation stock for $6,075.When does Andrew's holding period begin for the 135 shares?

A) January 22, 2018.

B) January 22, 2018 for 125 shares and March 31, 2014 for 10 shares.

C) March 31, 2014.

D) March 31, 2014, for 125 shares and January 22, 2018, for 10 shares.

E) None of the above.

G) A) and C)

Correct Answer

verified

D

Correct Answer

verified

True/False

Nontaxable stock dividends result in no change to the total basis of the old and new stock, but the basis per share decreases.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the amount of a corporate distribution is less than the amount of the corporate earnings and profits, the return of capital concept does not apply and the shareholders' adjusted basis for the stock remains unchanged.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

To qualify as a like-kind exchange, real property must be exchanged either for other real property or for personal property with a statutory life of at least 39 years.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Ben sells stock adjusted basis of $25,000) to his son, Ray, for its fair market value of $15,000.Ray gives the stock to his daughter, Trish, who subsequently sells it for $26,000.Ben's recognized loss is $0 and Trish's recognized gain is $1,000 $26,000 - $15,000 - $10,000).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The nonrecognition of gains and losses under § 1031 is mandatory for gains and elective for losses.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

To qualify for the § 121 exclusion, the property must have been used by the taxpayer for the 5 years preceding the date of sale and owned by the taxpayer as the principal residence for the last 2 of those years.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If Wal-Mart stock increases in value during the tax year by $6,000, the amount realized is a positive $6,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under the taxpayer-use test for a § 1033 involuntary conversion, the taxpayer has less flexibility in qualifying replacement property than under the functional-use test.

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

The taxpayer must elect to have the exclusion of gain under § 121 sale of principal residence) apply.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

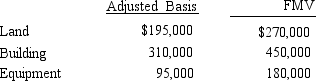

Mona purchased a business from Judah for $1,000,000.Judah's records and an appraiser provided her with the following information regarding the assets purchased:  What is Mona's adjusted basis for the land, building, and equipment?

What is Mona's adjusted basis for the land, building, and equipment?

A) Land $270,000, building $450,000, equipment $180,000.

B) Land $195,000, building $575,000, equipment $230,000.

C) Land $195,000, building $310,000, equipment $95,000.

D) Land $270,000, building $521,429, equipment $208,571.

E) None of the above.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Albert purchased a tract of land for $140,000 in 2015 when he heard that a new highway was going to be constructed through the property and that the land would soon be worth $200,000.Highway engineers surveyed the property and indicated that he would probably get $180,000.The highway project was abandoned in 2018 and the value of the land fell to $100,000.What is the amount of loss Albert can claim in 2018?

A) $40,000

B) $60,000

C) $80,000

D) $100,000

E) None of the above

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 118

Related Exams